Receiving a penalty notice from the Australian Taxation Office (ATO) for a late tax return can be a daunting experience. It may help to understand that these penalties are part of a formal system called 'Failure to Lodge' (FTL), which is the ATO’s way of encouraging everyone to get their paperwork in on time.

Think of it like an overdue library book—the longer it takes to return it, the more the amount owed can increase.

What Happens When Your Tax Return Is Late

So, the deadline has come and gone, and a tax return is still on the to-do list. What might happen now? The ATO's system will likely flag the account and may issue an FTL penalty automatically. The intention isn't just to penalise; it's about maintaining a tax system that is fair for everyone who does lodge on time.

The FTL penalty system is based on something called a penalty unit. The government regularly sets the value of one unit, and the total fine is calculated based on how many units are charged. This helps make the process consistent and predictable.

Understanding the Penalty Structure

The penalty for being late isn’t a one-size-fits-all fee. It’s designed to escalate the longer a return is outstanding, creating a sense of urgency. The ATO's goal is for taxpayers to lodge, and this increasing scale is a way of encouraging it.

For individuals and small businesses, the ATO has set clear penalty tiers based on how late the lodgement is. A return that’s just 1 to 28 days late will typically attract a penalty. If it stretches to between 29 and 56 days, that amount can double. The fine may keep climbing in increments for every 28-day block it is late, up to a specified maximum. To dig deeper, you can find more detail on these ATO penalty tiers and their application.

This guide provides general information for educational purposes and should not be considered financial or tax advice. Always consult with a qualified professional for guidance specific to your circumstances.

How the ATO Calculates Your Penalty Amount

It’s one thing to know the ATO can apply a penalty for lodging late, but it’s another to understand exactly how they land on that final number. It’s not a figure pulled out of thin air. The calculation is surprisingly straightforward, based on a clear formula that combines a set value, called a penalty unit, with how overdue the lodgement is.

Essentially, the Failure to Lodge (FTL) penalty is calculated by applying one penalty unit for every 28-day period—or even part of a period—that a tax return or other document is late. This means the penalty can grow in predictable steps the longer you wait.

The Penalty Unit System Explained

So, what is a penalty unit? It can be thought of as the basic building block for many government fines. The value is set by the Australian Government and gets updated periodically to keep pace with inflation. As of early 2024, one penalty unit is worth $313.

For every 28-day block a return is overdue, another $313 can be added to the penalty. It's a system designed for consistency, ensuring everyone is treated in the same way.

The crucial thing to remember is that the penalty isn't a one-off flat fee. It can stack up over time, which makes dealing with overdue lodgements quickly very important.

Seeing the Numbers in Action

Let's look at how this plays out for an individual or a small business. The penalty doesn't climb forever; it's capped at a maximum of five penalty units.

Here’s a quick breakdown of how the penalty can grow.

ATO Failure to Lodge Penalty Amounts for Individuals & Small Entities

This table illustrates how the penalty for a late tax return may increase based on the number of days it is overdue. Note: These figures are based on the standard penalty unit and are for illustrative purposes.

| Days Overdue | Penalty Amount |

|---|---|

| 1 – 28 days | $313 |

| 29 – 56 days | $626 |

| 57 – 84 days | $939 |

| 85 – 112 days | $1,252 |

| 113+ days | $1,565 |

As you can see, the cost of procrastination can add up fast. Being just one day late can push you into the first penalty bracket, costing the same as being four weeks late. For anyone juggling multiple obligations, keeping on top of tax and compliance is non-negotiable to avoid these escalating costs.

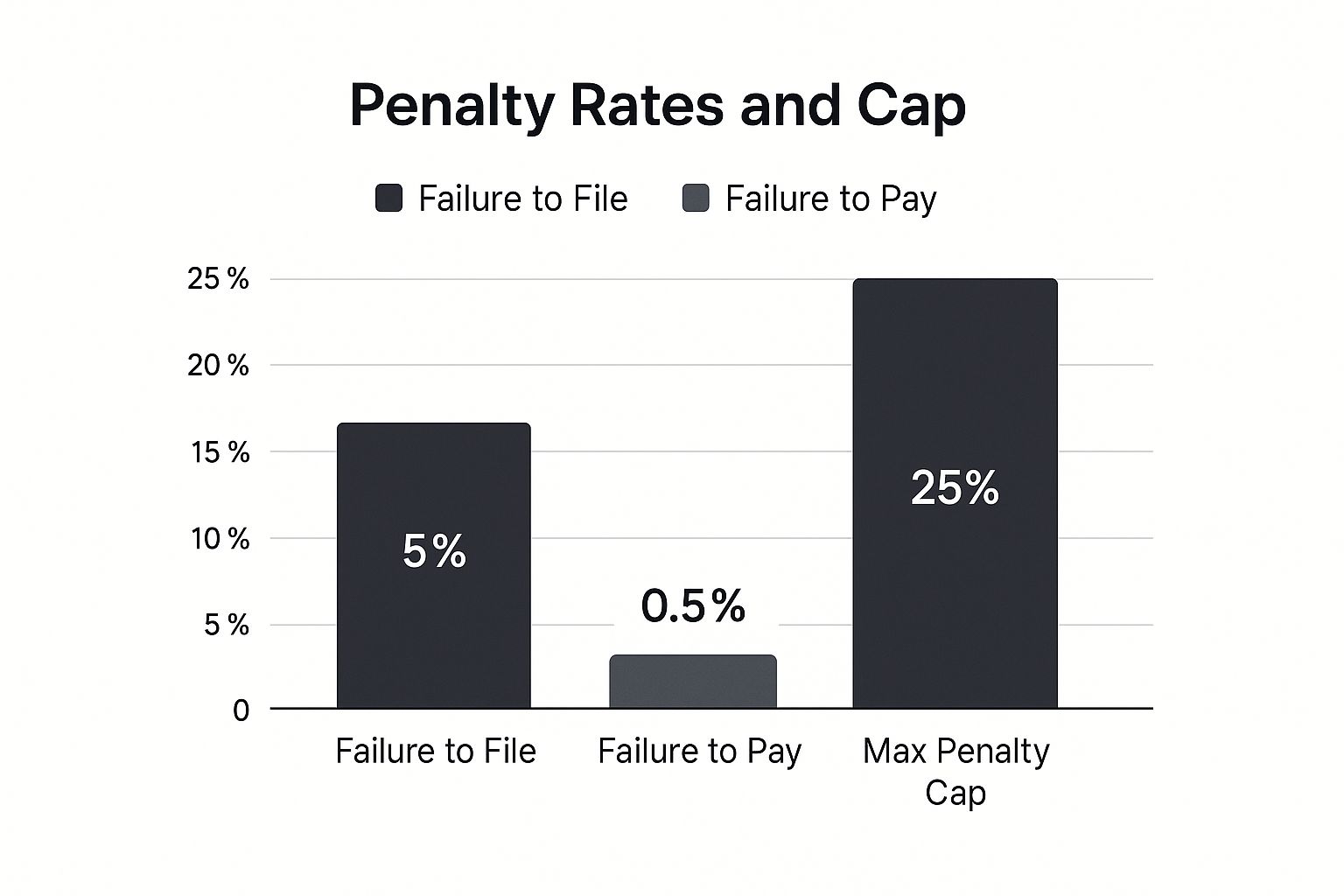

This chart shows the different types of penalties you might face, highlighting the difference between failing to lodge and failing to pay.

What stands out here is that the penalty for simply not filing documents can often be much steeper than the penalty for not paying on time. The ATO’s message is clear: lodging paperwork is a priority.

What Kinds of Documents Can Get You a Late Penalty?

When you hear "late tax penalty," your mind probably jumps straight to your annual income tax return. That's definitely the big one, but it's not the only deadline on the ATO's calendar. The Failure to Lodge (FTL) penalty system is much broader than most people realise, covering a whole host of documents that keep Australia's tax system ticking.

Thinking penalties are just for an end-of-year return is a classic mistake, and one that can catch business owners out with some nasty, unexpected fines. If a document has a due date with the ATO, it's on their radar.

It's More Than Just Your Annual Tax Return

For businesses or even individuals with more going on financially, a whole range of other documents can land you a late lodgement penalty. Getting your head around these obligations is crucial for staying in the ATO’s good books and keeping your money where it belongs.

Here are some of the key culprits that often attract an FTL penalty:

- Business Activity Statements (BAS): These are the regular reports—usually lodged monthly or quarterly—that businesses use to handle their GST, PAYG withholding tax, and other tax matters.

- PAYG Withholding Annual Reports: Employers generally have to send in this annual summary of all the tax they've withheld from their team's pay throughout the year.

- Fringe Benefits Tax (FBT) Returns: Providing perks to staff, like a company car they can use on weekends? You'll likely need to lodge an FBT return for that.

- Taxable Payments Annual Reports (TPAR): This one's for businesses in specific industries, like construction, cleaning, or courier services. It's a report detailing payments made to contractors.

The ATO’s system is set up to automatically flag a wide range of overdue documents, not just tax returns. As tax professionals will tell you, this includes everything from activity statements and FBT returns to PAYG reports and annual GST returns. Juggling these deadlines is just part of running a tight ship. You can dig deeper into the policies on late tax filing in Australia to get the full picture.

One Very Important Exception

Now for a bit of good news. The ATO generally won't apply a late lodgement penalty if your tardiness doesn't actually cost the government any money. This is a really important safety net for a lot of taxpayers.

For the most part, if your late lodgement results in a tax refund or a 'nil' liability (meaning you owe nothing and get nothing back), you're unlikely to receive a penalty. The system is really designed to chase up tax that is owed, not to penalise paperwork for its own sake.

But this isn't a free pass to ignore deadlines. It is always a good practice to lodge on time to get any refund sooner and keep your compliance record looking squeaky clean. Plus, this goodwill might not extend to larger companies or if the ATO has already issued a penalty before you finally get around to lodging.

Navigating a Penalty Notice from the ATO

Let's be honest, seeing an official envelope from the Australian Taxation Office in your letterbox can make your heart skip a beat. Before panic sets in, it helps to see it for what it is: a piece of communication that needs a calm, methodical response, not a final judgement.

A penalty notice is simply the ATO’s formal way of letting you know a lodgement is overdue and a fine has been applied. One of the worst things you can do is put it in the "too-hard basket." Taking a deep breath, opening it, and understanding what it says is your first, most important step toward getting it sorted.

Decoding Your Penalty Notice

An ATO notice might look intimidating, but it's a structured document designed to give you all the key information. When you’re stressed, it can seem more complicated than it really is.

Take a moment to scan the document for these key details, which should be clearly laid out:

- The Penalty Amount: This is the dollar figure the ATO has fined you.

- The Relevant Lodgement: It will pinpoint exactly which document is overdue, like your 2023 Income Tax Return or a specific Business Activity Statement (BAS).

- The Due Date: This is your deadline for paying the penalty.

- Payment Details: The notice will include clear instructions on how to pay.

Breaking it down like this turns a scary-looking letter into a simple, manageable to-do list. It helps you shift from the shock of getting the notice to the practical steps needed to address it.

Your First Step Towards a Solution

Once you've got the facts straight, it's crucial to know this isn't necessarily the end of the story. The ATO has a formal process for reviewing penalties, which is known as penalty remission. This is just the official term for requesting the ATO to reduce or cancel the penalty entirely.

A penalty notice isn't a dead end. Think of it as the start of a conversation, and remission is your opportunity to explain your side of things.

This is a really important point. Many people may assume the fine is final and pay it without question. But the tax system has built-in flexibility for situations where a late lodgement was caused by circumstances beyond your control.

Knowing this path exists is the most powerful piece of information you can have when you first open that envelope. It empowers you to start thinking about solutions, not just dwelling on the problem.

How to Request a Penalty Remission

Getting hit with a penalty notice from the Australian Taxation Office (ATO) can be a gut-wrenching moment, but it doesn't have to be the end of the story. The ATO has a formal process called penalty remission, which is just their way of saying you can ask for the penalty to be reduced or even wiped completely.

This isn’t some secret loophole. It’s a system designed for fairness, acknowledging that sometimes, life throws you a curveball that makes meeting tax deadlines impossible. If you have a legitimate reason for lodging late, the ATO is generally willing to listen.

What Counts as a Valid Reason?

The whole point of a remission request is to show the ATO that the delay was caused by circumstances genuinely outside your control. They look at every case individually, but some situations are consistently seen as valid grounds for a second chance.

Think along these lines:

- Serious illness or injury: If you or a close family member were dealing with a significant medical issue that prevented you from handling your tax affairs.

- Natural disaster: This is a big one. Being impacted by a bushfire, flood, or cyclone that damaged your home, business, or records is a very understandable reason.

- Loss of a key person: For a small business, the unexpected death or departure of the one person who handled the books can be crippling.

- Major personal hardship: Events like a death in the family or other serious personal crises that understandably pushed tax obligations to the back of your mind.

Honesty is key here. Just being a bit disorganised or forgetting the due date probably won't cut it. You need to provide a clear, honest account of what happened.

Get Your Ducks in a Row First

Before you even draft your request, there are two non-negotiables that should be taken care of. Doing this first shows the ATO you’re serious about making things right.

A request for remission has a much stronger chance of success if all outstanding lodgements are brought up to date first. The ATO needs to see the initial problem has been fixed.

Here’s what is generally required:

- Lodge everything that's overdue: The very first step is to file that late tax return, BAS, or whatever document the penalty was for. Asking for a penalty to be waived on a form that’s still outstanding is a surefire way to get a rejection.

- Check your compliance history: The ATO is far more likely to be lenient with someone who usually does the right thing. If you have a clean record of lodging and paying on time, it strengthens your case immensely.

How to Officially Make the Request

Once all your paperwork is in, you're ready to submit your remission request. This can be done yourself or with the help of a tax agent.

The most common ways to get it done are:

- ATO online services: Individuals can log in to their myGov account, while businesses can use Online services for business.

- Through your registered tax agent: An accountant can submit the request for you using their professional online portal, which is often the most efficient route.

- In writing: You can also send a formal letter to the ATO. It is important that it clearly explains the circumstances and includes any supporting evidence.

Whichever method you choose, be clear and concise. If you have proof—like a doctor's certificate, insurance claim, or a statutory declaration—make sure you include it. It can make all the difference.

Simple Habits to Avoid Future Penalties

Getting a penalty waived is a great feeling, but the real win is making sure you never have to deal with late tax return penalties again. It all comes down to building a few simple, repeatable habits that turn tax time from a mad dash into just another task on your calendar.

This isn’t about becoming a financial guru overnight. It’s about putting small, practical systems in place that keep you organised and on top of your obligations. Think of that penalty as an expensive lesson—now it's time to use what you've learned.

Systemise Your Record Keeping

Let’s be honest, the biggest reason people lodge late is because they’re staring at a chaotic shoebox full of receipts. A digital system is so much easier and far less stressful. You could start today by creating a few dedicated folders on your computer or in the cloud.

Your phone can be your best friend here. Snap a photo of every receipt the second you get it and file it away in Google Drive or Dropbox. This one tiny action means nothing gets lost, and when it’s time to do your tax, everything is already in one place.

Organising your finances is like tidying a room. A little effort each day prevents a massive clean-up job later. By keeping your records in order throughout the year, you eliminate that frantic search for documents when the deadline looms.

Master Your Deadlines

You can't hit a target you can't see. Take five minutes right now to find all your key lodgement dates for the year and plug them into the digital calendar you check every day.

But don't just mark the final due date. That’s a recipe for last-minute panic. Instead, set a series of alarms that give you a proper runway.

- Four weeks out: A reminder to start gathering all your documents.

- Two weeks out: Block out time in your calendar to prepare your return or touch base with your tax agent.

- One week out: A final nudge to lodge or to confirm your agent has everything they need from you.

Consider Professional Help

Sometimes, the smartest move is to hand the job over to an expert. Partnering with a registered tax agent is one of the most reliable ways to sidestep future penalties. Not only do they handle the accuracy, but they also get access to extended lodgement deadlines that individuals can’t get on their own.

Understanding how small business owners and individuals can navigate tax season with professional support can completely change the game. It’s an investment in your peace of mind, freeing you up to focus on what you actually enjoy doing.

Common Questions We Hear About Late Lodgement Penalties

We’ve walked through the nuts and bolts of late lodgement penalties, but experience tells us a few key questions always come up. Here are the straight-up answers to the most common queries we get from clients day in and day out.

Will the ATO Penalise Me If I’m Owed a Refund?

Generally speaking, no. The ATO typically won't apply a Failure to Lodge penalty if your late tax return ends up in a refund or a 'nil' result (meaning you don't owe anything). Their main focus is, understandably, on collecting tax that is actually owed.

That said, lodging on time is still the best policy. It gets your refund into your bank account sooner and keeps your compliance history with the ATO looking clean. A good track record can be a huge help if you ever need them to show a bit of leniency down the track.

Does Using a Tax Agent Actually Give Me More Time?

Absolutely. This is one of the biggest perks of working with a professional. Registered tax agents have access to a special lodgement program with the ATO, which grants much later deadlines—often months after the standard 31 October cut-off for individuals.

The key is that you must be on their client list before your original individual deadline passes. If you're wondering how to pick the right expert, our guide on how you can find the best tax accountant close to you can point you in the right direction.

What Happens If I Just Ignore a Penalty Notice?

Please don’t do this. Ignoring a penalty notice is one of the worst things you can do. That penalty is a legitimate debt, and the ATO can start adding a General Interest Charge (GIC) to the unpaid amount, making it grow bigger over time. The ATO has significant powers to recover debts, so your only real options are to pay it or formally request to have it waived.

Trying to stay on top of ATO deadlines and penalties can feel overwhelming, but you don't have to tackle it on your own. The team at Genesis Hub is here to provide expert guidance and help you keep your financial affairs in order. Book a free consultation today and find out how we can support you and your business.

Article created using Outrank