If you're a sole trader or run a small business in Australia, you've probably heard the term 'pay as you go (PAYG) income tax instalment'. It's a system for prepaying your income tax throughout the year, rather than facing a large bill after lodging your annual return.

This system breaks down your estimated tax liability into smaller, more manageable quarterly payments, which can be helpful for cash flow.

Understanding PAYG Income Tax Instalments

The PAYG instalment system is essentially a way to prepay your tax. Instead of facing one large tax debt at the end of the financial year, the Australian Taxation Office (ATO) requires you to pay your expected tax in instalments. It’s designed to help you manage your money and prevent a significant end-of-year tax bill.

This system is specifically for anyone earning income where tax isn't automatically taken out at the source. That's common for:

- Sole traders and independent contractors

- Partnerships and trusts

- Companies earning business income

- Individuals with significant income from investments or rental properties

By making these regular prepayments, you’re covering your tax obligations as you go, which keeps your payments aligned with your income.

Why Does This System Exist?

So, why did the ATO create this system? It's all about smoothing out the tax payment process for people who don't have a traditional employer.

When you're an employee, your employer withholds tax from your pay and sends it straight to the ATO. But when you run your own business, that doesn't happen automatically.

Without PAYG instalments, a profitable year could lead to a large tax bill that’s difficult to pay all at once. The system prevents this by ensuring you're consistently putting money aside for your tax obligations. The ATO bases these instalments on your most recently lodged tax return and then adjusts for any expected changes in income.

The Core Benefit for Your Business

A key advantage of the system is predictability, which can make financial management much easier.

When you know you have regular, scheduled tax payments on the horizon, you can budget for them and keep your cash flow healthy. It can stop being a source of stress and become a normal part of doing business.

The PAYG income tax instalment system transforms your annual tax obligation from a large, unpredictable hurdle into a series of smaller, manageable steps, protecting your business's financial stability.

Understanding PAYG and other obligations is a huge part of running a compliant and successful business. For more insights into staying on top of your finances, you can explore our detailed guides on tax and compliance.

How the ATO Ropes You into the PAYG System

Here's something that often surprises business owners: you don't typically sign up for PAYG instalments. There's no form to fill out or button to click. Instead, the ATO automatically enters you into the system.

It all happens when you lodge a tax return. If that return shows you’re earning business or investment income above a certain threshold without any tax being withheld, the ATO's system will identify this. Once your income crosses that threshold, you’re in. It’s not a penalty—it’s just the standard process for anyone earning money outside of a regular job.

Your tax return acts as the trigger. It signals to the ATO that you're earning enough untaxed income to start pre-paying your tax, which helps prevent a large bill at the end of the financial year.

The Income That Triggers Enrolment

So, what kind of income is the ATO looking for? They call it instalment income, and it’s a broad term covering earnings where tax isn't taken out for you.

The ATO lumps several common income streams into this bucket:

- Business Income: This is the primary income for sole traders—the money you make from your day-to-day operations.

- Investment Income: This includes dividends from shares you own, interest from a bank account, or distributions from a trust.

- Rental Property Income: This is the rent you collect from your tenants.

- Royalties: Payments you get for letting someone use your intellectual property or other assets.

If your latest tax return shows your total instalment income is over the ATO’s threshold, you can expect to be brought into the system. This ensures your tax payments are keeping up with all your earnings.

PAYG Instalments vs. PAYG Withholding: A Crucial Distinction

Let’s clear up one of the biggest points of confusion out there. PAYG instalments and PAYG withholding sound similar, but they are two completely different concepts. Mixing them up can lead to compliance headaches.

PAYG instalments are prepayments of your own income tax on business and investment earnings. PAYG withholding is the tax you collect from your employees' wages and send to the ATO for them.

Simply put, PAYG instalments are about your tax bill. PAYG withholding is about handling your obligations as an employer. They are separate responsibilities, and it’s important to treat them that way.

What to Expect After You're Enrolled

The ATO won’t just enrol you and leave you guessing. Your first piece of mail will be a letter confirming you're now in the pay as you go income tax instalment system. Not long after that, you’ll receive your first activity statement.

This document will be one of two types:

- Business Activity Statement (BAS): If you're registered for GST, your PAYG instalment info will be added to the BAS you already lodge.

- Instalment Activity Statement (IAS): If you're not registered for GST, you'll get this simpler form, which is purely for your PAYG obligations.

Receiving that first notice is your cue to start planning. It marks the official start of your quarterly tax payment cycle. This is the moment to get serious about setting aside a portion of your income, so the funds are ready when each due date rolls around.

Choosing Your PAYG Calculation Method

Once you're in the PAYG income tax instalment system, the Australian Taxation Office (ATO) doesn't just lock you into one way of doing things. You have a choice between two main methods for calculating your payments, and this can impact your business's cash flow.

Your decision often comes down to one thing: is your income steady and predictable, or does it fluctuate throughout the year? Aligning your tax payments with your financial reality is key. Let's break down the two approaches: the ATO-calculated ‘Instalment Amount’ and the self-calculated ‘Instalment Rate’.

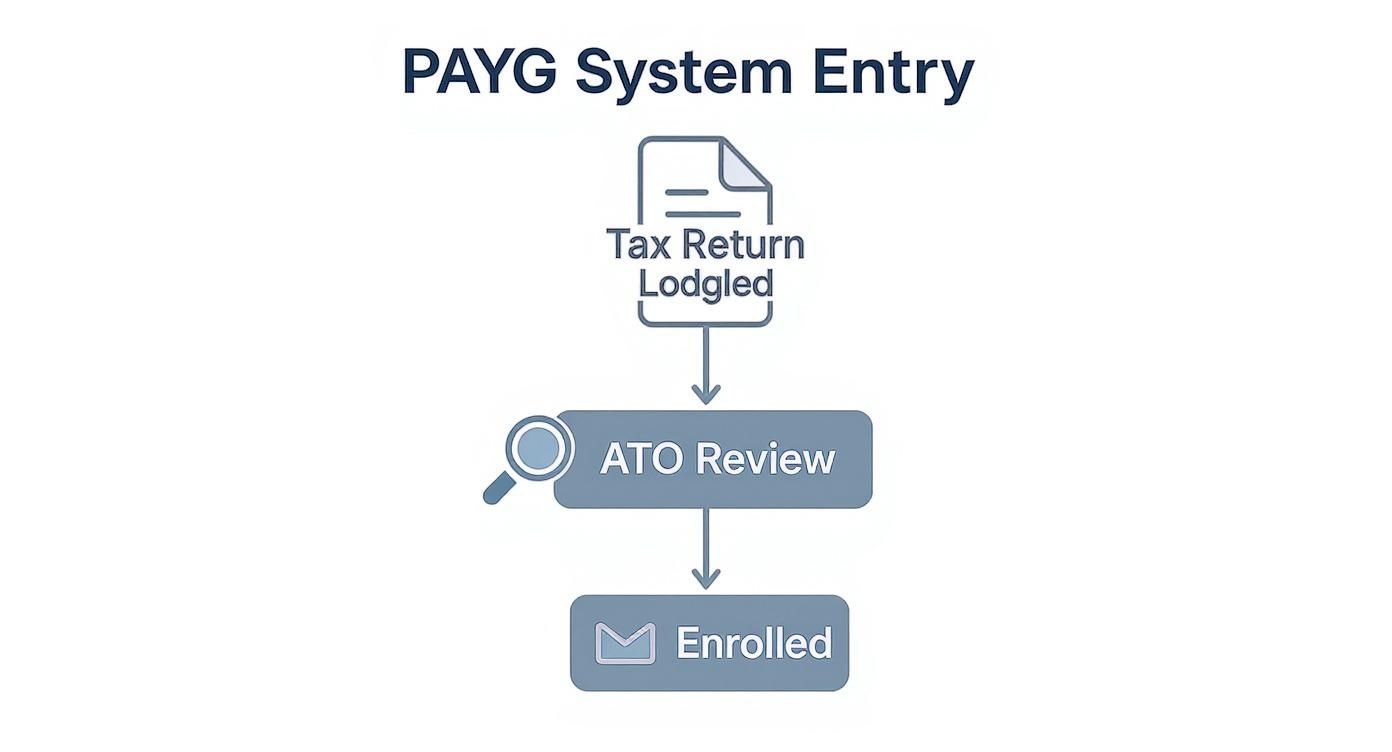

This handy decision tree shows how you automatically get entered into the PAYG system after lodging your tax return.

As the infographic shows, you don't really 'opt-in'. If your income hits a certain threshold, the ATO automatically brings you into the system.

The Instalment Amount Method

The Instalment Amount method can be thought of as the ATO's simplified option. It's built for predictability.

When your activity statement arrives, the ATO has already done the maths for you, pre-filling a fixed dollar amount to pay. This figure is based on the tax from your most recent return, with an adjustment for expected income growth.

This can be a good fit for businesses with stable, consistent earnings. Because the amount is fixed for each quarter of the financial year, you know what’s due and when. It makes budgeting easier.

With the Instalment Amount, you trade flexibility for predictability. Your payments are the same each quarter, regardless of whether you had a booming sales period or a quiet one.

The main benefit here is certainty. You can plan your cash flow with confidence, knowing there won't be any surprises on your quarterly activity statement.

The Instalment Rate Method

On the other hand, the Instalment Rate method is all about flexibility. Instead of a fixed amount, the ATO gives you a percentage.

To figure out what you owe, you apply this rate to your actual business and investment income for that quarter. This approach directly ties your tax instalment to your real-time earnings.

It’s often suitable for businesses with lumpy or seasonal income, like:

- A freelance graphic designer whose project work ebbs and flows.

- A coastal café that makes most of its money during the summer tourist season.

- A consultant who lands big, irregular contracts.

If your income takes a dive in a particular quarter, your payg income tax instalment payment drops right along with it. This can be a powerful way to manage cash flow when your earnings are inconsistent.

The ATO calculates these two main methods, but it's worth noting that once you choose an option, you generally remain on it for the whole financial year. You can usually only switch in the first quarter of the next one. For a deeper dive, you can find more insights on PAYG options from experts like Wolters Kluwer to really get across the rules.

Comparing the Two Methods Head-to-Head

So, which one might be right for you? It all comes down to the financial rhythm of your business. One gives you stability, the other gives you adaptability.

To help you decide, let's look at a direct comparison.

Comparing PAYG Instalment Calculation Methods

This table breaks down the two main methods for calculating PAYG instalments, helping you see which one might be a better fit for your business's income patterns.

| Feature | Instalment Amount (ATO Calculated) | Instalment Rate (Self Calculated) |

|---|---|---|

| Calculation | A fixed dollar amount set by the ATO for each quarter. | A percentage rate you apply to your actual quarterly income. |

| Predictability | High. You know exactly what you owe well in advance. | Low. The payment amount changes with your income. |

| Cash Flow Impact | Can strain cash flow during slow periods if payments remain high. | Aligns payments directly with your current cash flow. |

| Best For | Businesses with stable, predictable, year-round income. | Businesses with seasonal, fluctuating, or irregular income. |

| Administrative Effort | Minimal. The amount is pre-filled on your activity statement. | Requires calculation. You must track and report your income each quarter. |

Ultimately, the goal is to pick the method that causes the least financial stress for your business. For a new business with uncertain income, the Instalment Rate often provides a more manageable start. A more established business with a proven track record of stable earnings might prefer the simplicity of the fixed Instalment Amount. Just remember, this information is for educational purposes and isn't a substitute for professional tax advice.

Navigating Key Dates and Deadlines

Managing your PAYG income tax instalments is all about timing. Hitting your deadlines is crucial to keep your business finances healthy and stay on the right side of the ATO. Missing these key dates can lead to penalties, so it's a good idea to mark them in your calendar.

The whole system is built on a quarterly cycle that follows the financial year. Each quarter, you get a specific window to report your income (if you're using the instalment rate method) and make your payment. It creates a predictable, manageable rhythm for your tax obligations.

Understanding Quarterly Due Dates

For most businesses, PAYG instalments are due every quarter. The deadlines don't change, which makes them easy to plug into a business calendar. Knowing these dates is important if you want to avoid late fees and interest charges.

Here are the standard quarterly deadlines for lodging and paying:

- Quarter 1 (1 July – 30 September): Due 28 October

- Quarter 2 (1 October – 31 December): Due 28 February

- Quarter 3 (1 January – 31 March): Due 28 April

- Quarter 4 (1 April – 30 June): Due 28 July

The key takeaway here is pretty simple: your instalment is usually due on the 28th of the month after the quarter ends. The only exception is the December quarter, where the ATO gives you a bit of extra breathing room until February.

These deadlines are locked in. According to ATO guidelines, payments are typically due 21 or 28 days after the end of each quarter, depending on the type of statement you lodge. For example, your instalment for the quarter ending 30 September is due by 21 October, but the Business Activity Statement (BAS) itself isn't due until 28 October.

BAS vs IAS: How You Lodge Matters

The form you use to report your PAYG instalment comes down to one thing: are you registered for GST? This is an important distinction because it dictates which paperwork the ATO will send your way.

-

Business Activity Statement (BAS): If your business is registered for GST, your PAYG instalment info will be rolled into your BAS. This is convenient because it bundles multiple tax obligations—like GST and PAYG withholding—onto a single form.

-

Instalment Activity Statement (IAS): If you're not registered for GST, you'll get a much simpler form called an IAS. This statement is purely for reporting and paying your PAYG instalment.

While the quarterly due dates are generally the same, knowing which form to look out for can make your life easier. Getting organised is a huge part of how small business owners can navigate tax season without the stress.

Tying It All Together at Year-End

So, what happens to all that money you’ve been paying every quarter? This is where the purpose of the PAYG system becomes clear.

When you lodge your annual income tax return, the ATO works out your total tax bill for the entire financial year. Then, they subtract the total amount of PAYG instalments you’ve already paid.

Your quarterly payments act as credits building up in your ATO account. If your instalments were accurate, you may have nothing more to pay. If you happened to overpay, you may get a refund back. And if you underpaid, you'll have a final amount to settle. This process makes sure your hard work throughout the year pays off by preventing a large tax debt from landing on your plate.

How to Vary Your PAYG Instalments

As a business owner, you know that income rarely follows a perfectly straight line. The good news is that your payg income tax instalment payments don't necessarily have to.

The Australian Taxation Office (ATO) has a process called "varying" your instalments. This allows you to adjust your payments to reflect what you actually expect to earn for the year, rather than being locked into an estimate based on your last tax return.

It's like recalibrating your tax savings plan mid-year. If your business reality changes, you can adjust your instalments to match, which can be a massive help for managing your cash flow. It's a tool designed to stop you from either overpaying and tying up vital cash, or underpaying and facing a large tax debt later on.

When Should You Consider a Variation?

Knowing when to vary your instalments is just as important as knowing how. It’s all about spotting significant changes in your business or investment income that make the ATO's original estimate outdated.

There are a few classic scenarios where a variation might make sense:

- A sudden downturn: Maybe you've lost a major client, or tough economic conditions have slowed your sales. If your expected annual income takes a nosedive, you may want your instalments to do the same.

- An unexpected boom: On the flip side, you might land a massive contract or see a surprise surge in demand that pushes your earnings way beyond last year's figures.

- One-off events: Selling a significant business asset could create a one-time capital gain that throws your original tax estimate out the window.

- Changes in your business structure: Shifting from a sole trader to a company, for example, will almost certainly change your tax obligations.

In any of these situations, the pre-calculated amount on your activity statement may no longer be a good fit for your financial reality.

The Process of Calculating a Variation

When you decide to vary your PAYG instalment, you're essentially telling the ATO that your financial year is looking different and providing a new estimate. This requires a bit of homework to make sure your new calculation is reasonable.

Here's the basic process:

- Estimate your total expected income for the full financial year from all sources (business, investments, etc.).

- Estimate your total tax liability on that income. Remember to factor in any deductions or tax offsets you may be eligible to claim.

- Report this new estimated tax amount on your activity statement for the quarter. The ATO will then use this figure to recalculate what you owe for that period.

Let's imagine a freelance graphic designer who loses their main retainer client halfway through the year. Their income drops sharply, and paying the ATO's original instalment amount becomes a cash flow strain. By varying their instalment, they can reduce their quarterly payments to align with their new, lower projected income, freeing up cash to keep the business afloat while they find new clients.

A variation allows you to proactively manage your tax payments in line with your real-time business performance, transforming your instalments from a fixed obligation into a flexible financial tool.

The Importance of a Reasonable Estimate

While varying your instalments offers fantastic flexibility, it comes with one very important catch: you must make a reasonable estimate. This isn’t an opportunity to lower your payments simply to keep more cash in your pocket.

If you vary your instalment down and it turns out you’ve underpaid your tax by more than 15% of what you actually owe at the end of the year, the ATO may apply interest and penalties. This is why careful, honest forecasting is so crucial.

Getting these calculations right can be tricky, and the consequences of getting it wrong can be significant. This is a classic example of why every business needs an accountant. A good accountant can help you project your income and tax liability with greater accuracy, ensuring your estimates are sound and defensible.

Ultimately, varying your payg income tax instalment is a strategic move for any business owner facing big financial shifts. It puts you back in the driver's seat, helping you maintain a healthy cash flow and stay compliant, no matter which way your business fortunes turn.

Common PAYG Instalment Mistakes to Avoid

Running a business means wearing a lot of hats, and it's easy for tax obligations to slide down the to-do list. But when it comes to PAYG income tax instalments, a few common slip-ups can quickly snowball into a major financial headache.

Knowing the pitfalls is the first step to sidestepping them entirely. Let’s walk through the most frequent mistakes business owners make so you can keep your tax management as smooth as possible.

Forgetting to Set Money Aside

This is a classic issue. Revenue comes in, it goes into the main business account, and suddenly it gets used for operating costs. When the BAS is due, there's a scramble to find the cash.

Treating all your income as usable cash can lead to a cash flow crisis. One simple, effective method is to open a separate bank account just for tax savings.

Every time a customer pays you, you could immediately transfer a percentage of that payment into your dedicated tax account. This turns saving for tax into a habit. Come payment time, it's a simple transfer, not a financial shock to the system.

Ignoring ATO Notices and Deadlines

It can be tempting to put that white envelope from the ATO at the bottom of the "to-do" pile. But ignoring official communication can be a costly mistake.

When you miss a payment deadline, it’s not just about owing the original amount. The ATO can apply a General Interest Charge (GIC), which compounds daily.

If it's ignored for too long, the situation can escalate. The ATO can use any tax refunds you’re due to cover the debt and may take further action if the debt remains unpaid. It's important to stay organised. Putting quarterly due dates in your calendar and opening any ATO mail when it arrives are good habits to adopt.

Proactively managing your PAYG instalments isn't just about ticking a compliance box. It's fundamental to good financial management, protecting the long-term health and stability of your business.

Making Unrealistic Variations

The option to vary your PAYG instalment is a fantastic tool when your income genuinely drops. But using it based on wishful thinking rather than a realistic forecast can get you into trouble.

Here’s the catch: if you vary your payments down and end up underpaying your final tax bill by more than 15%, you can be hit with penalties and interest on the shortfall.

Before you vary, do your homework. Sit down and map out a careful, honest forecast of your expected annual income and expenses. This helps ensure your estimate is reasonable and something you can justify if needed. It’s all about using the system’s flexibility smartly, without falling into a compliance trap.

Got Questions? We've Got Answers

The world of Pay As You Go (PAYG) income tax instalments can definitely throw up a few tricky questions. Let's tackle some of the most common ones that pop up for business owners and sole traders.

What Happens If I Miss a PAYG Instalment Payment?

Falling behind on a PAYG instalment is not something to ignore. The ATO can apply penalties and interest for late payments, and these can add up quickly.

If you know you're not going to make a payment on time, it's best to be proactive. Contact the ATO straight away to discuss your options – you might be able to set up a payment plan. Ignoring it can lead to more serious action down the track.

Important: This content is for general informational purposes only and does not constitute tax advice. Always consult with a qualified tax professional for guidance specific to your individual circumstances.

My Income Has Dropped. Can I Stop Paying Instalments?

Yes, this is possible. If your income has dipped below the threshold that got you into the PAYG system in the first place (and you don't expect it to recover), you can request to be taken out.

You’ll need to formally request an exit from your PAYG income tax instalment obligations, which can be done via the ATO or by asking a registered tax agent. The ATO will then review your recent and expected earnings to decide if you can be removed from the system.

Do My Instalments Cover My HECS-HELP Debt?

Yes, they do. When the ATO works out your PAYG instalment amount, they’re looking at your total estimated tax bill for the entire year.

This calculation doesn't just factor in your income tax. It also includes the Medicare levy and any compulsory repayments for student loans like HECS-HELP. The idea is to have your instalments cover all of these obligations, so you don't get a large bill at the end of the year.

Is GST Included When Calculating My Instalment?

No, GST is kept completely separate. If you're using the 'instalment rate' method, your payment is worked out from your business and investment income, which specifically excludes any GST you've collected.

GST is a tax you collect on behalf of the government, and you report and pay it through your Business Activity Statement (BAS). Your PAYG instalment is about pre-paying your own income tax. The two are handled separately.

Juggling your payg income tax instalment obligations on top of running a business can feel like a lot. At Genesis Hub, our job is to make tax simple so you can get back to doing what you love. Let our team handle the complexities of BAS, GST, and tax compliance for you.

Book your free consultation to see how we can support your business.