Finding the right accountant in Melbourne is about so much more than just getting your compliance sorted. It’s about finding a genuine partner for your business, someone who can help you map out the future. A great accountant gives you forward-looking advice, helping you get a grip on cash flow, spot real opportunities for growth, and simply make smarter financial decisions.

Why a Great Accountant Is Your Business's Secret Weapon

Let's be honest—most business owners see finding an accountant as a chore. It gets filed away under "things I have to do," right alongside paying bills and renewing permits.

But looking at it that way is missing the bigger picture. The modern accountant isn't just a number-cruncher drowning in receipts. They're a strategic ally who can directly impact your bottom line and how fast you grow.

Beyond Compliance and Lodgements

Thinking an accountant is only there to lodge your Business Activity Statements (BAS) or end-of-year tax return is like owning a smartphone and only using it to make calls. You're missing out on all the best features.

A proactive accountant in Melbourne uses your real-time financial data to offer insights that actually push your business forward. They help you answer the big questions that go way beyond compliance.

- Profitability Check: Which of your services or products are actually making you the most money?

- Cash Flow Strategy: How can you smooth out your cash flow to avoid those nail-biting, low-balance weeks?

- Growth Decisions: Is now the right time to hire that extra person or move into a bigger office?

The difference is night and day. One business owner just gets their compliance work done at the end of the year, no questions asked. Another gets a clear breakdown of their performance, packed with actionable advice on how to boost revenue and trim unnecessary costs next quarter.

A Strategic Partner in Growth

The role of accountants here in Australia has changed dramatically. Industry reports are predicting accounting revenues to climb to AUD 33.4 billion by 2025, and a huge chunk of that growth is coming from advisory services, not just basic compliance. Technology has automated the grunt work, freeing up accountants to focus on what really matters: strategy.

A great accountant doesn't just record the past; they help you shape the future. They translate complex financial data into a clear story, giving you the confidence to make bold decisions backed by solid numbers.

A top-notch accountant is also your first line of defence, playing a crucial role in understanding and mitigating financial risks that could trip up your business. They protect your assets and help ensure you're building something stable for the long term. This mindset shifts the search from a simple running cost into one of the most important investments you'll make. Our other guide on why every business needs an accountant dives even deeper into this crucial relationship.

First, Get a Clear Picture of Your Financial Needs

Before you even think about searching for an accountant in Melbourne, you need to know exactly what you’re looking for. It’s a bit like going to the supermarket without a shopping list – you’ll wander the aisles and probably leave without the one thing you actually went for.

Taking a moment for a quick self-audit gives you a clear brief. This simple exercise is powerful. It helps you zero in on professionals who get your business model and lets you politely sidestep those who don't. Think of it as writing the job description for your perfect financial partner.

Defining Your Core Accounting Needs

Start with the absolute non-negotiables. These are the fundamental jobs you need an accountant to nail to keep your business compliant and ticking along smoothly.

For most businesses in Melbourne, the essentials look something like this:

- Compliance and Lodgements: Getting your Business Activity Statements (BAS), GST, and annual income tax returns lodged accurately and on time, every time.

- Payroll and Superannuation: Making sure your team is paid correctly and your super obligations are handled without a hitch.

- Basic Bookkeeping: Keeping the financial records clean, reconciled, and ready for reporting.

These are just the basics, though. Your specific industry will have its own unique wrinkles. An e-commerce store in Collingwood might be wrestling with complex inventory management, while a construction company out in Richmond has a whole different set of compliance worries around contractor payments.

A clear list of your must-haves acts as an instant filter. It allows you to immediately disqualify accountants who don’t offer the specific services your business depends on, saving you valuable time in your search.

Distinguishing Wants From Needs

Okay, you’ve got your essentials listed. Now, think bigger. What would actually move the needle for your business? These are the "nice-to-have" services that separate a number-cruncher from a true strategic advisor. This is where the real value is hiding.

Maybe you're looking for services like:

- Cash Flow Forecasting: Proactive advice to help you ride the financial peaks and troughs instead of just reacting to them.

- Strategic Growth Planning: Someone who can use your financial data to help you make smart decisions about expansion, hiring, or new investments.

- Performance Reporting: Monthly or quarterly reports that don't just throw numbers at you but actually explain what they mean for your business.

Having a good grasp of your own finances, including concepts like how to handle owner's drawings in a small business, will help you articulate what you’re looking for. By separating your must-haves from your strategic wants, you’re creating a powerful brief that will guide you straight to the perfect accountant in Melbourne.

Decoding Accountant Credentials and Industry Expertise

Let's be honest, all those letters after an accountant's name can be a bit confusing. But they're more than just jargon; they're a quick way to gauge someone's expertise and their commitment to the profession. Understanding what they mean ensures you’re partnering with a professional who is held to high ethical and educational standards.

When you're looking for an accountant in Melbourne, you'll most likely come across CPA and CA.

A Certified Practising Accountant (CPA) has gone through a rigorous program that focuses heavily on strategy, leadership, and global business. On the other hand, a Chartered Accountant (CA) has completed demanding postgraduate training with a strong emphasis on the technical side of accounting, auditing, and financial advice. Both are highly respected and signal a serious level of competence.

Why Do Qualifications Actually Matter?

Choosing a properly qualified professional is a big deal. They are bound by a strict code of conduct and must commit to ongoing professional development to keep their skills sharp. This isn't just a box-ticking exercise; it means they're constantly keeping up with the endless changes in tax laws and business regulations.

Think about it – this ongoing learning, like fulfilling their CPA continuing education requirements, is what separates a good accountant from a great one. You want someone who is actively learning, not someone relying on knowledge from five years ago.

For a clearer picture, here’s a quick breakdown of the key accounting qualifications you'll encounter in Australia.

Comparing Key Accounting Qualifications in Australia

| Qualification | Governing Body | Typical Focus Area |

|---|---|---|

| Certified Practising Accountant (CPA) | CPA Australia | Business strategy, leadership, and finance management. |

| Chartered Accountant (CA) | Chartered Accountants Australia & New Zealand (CA ANZ) | Technical accounting, audit, financial advisory, and assurance. |

| Institute of Public Accountants (IPA) | Institute of Public Accountants | Primarily serves small to medium-sized businesses and individuals. |

Understanding these distinctions helps you match their background to your specific business needs.

Look Beyond Generalists for Industry Specialisation

While qualifications provide a solid foundation, the real magic happens when you find an accountant with deep, industry-specific expertise. A generalist can get the job done, sure. But an expert who genuinely understands your sector? That's a game-changer. They already speak your language and have seen the challenges you're about to face a dozen times before.

Imagine these scenarios:

- You run a hospitality business in Melbourne. An accountant familiar with the cafe scene already knows the ins and outs of managing perishable stock, dealing with complex award wages for casual staff, and squeezing profit from tight margins.

- You're launching a tech startup. A specialist will be all over business structuring for startups, software capitalisation rules, and the right way to build financial models for investor pitches—things a general accountant might completely miss.

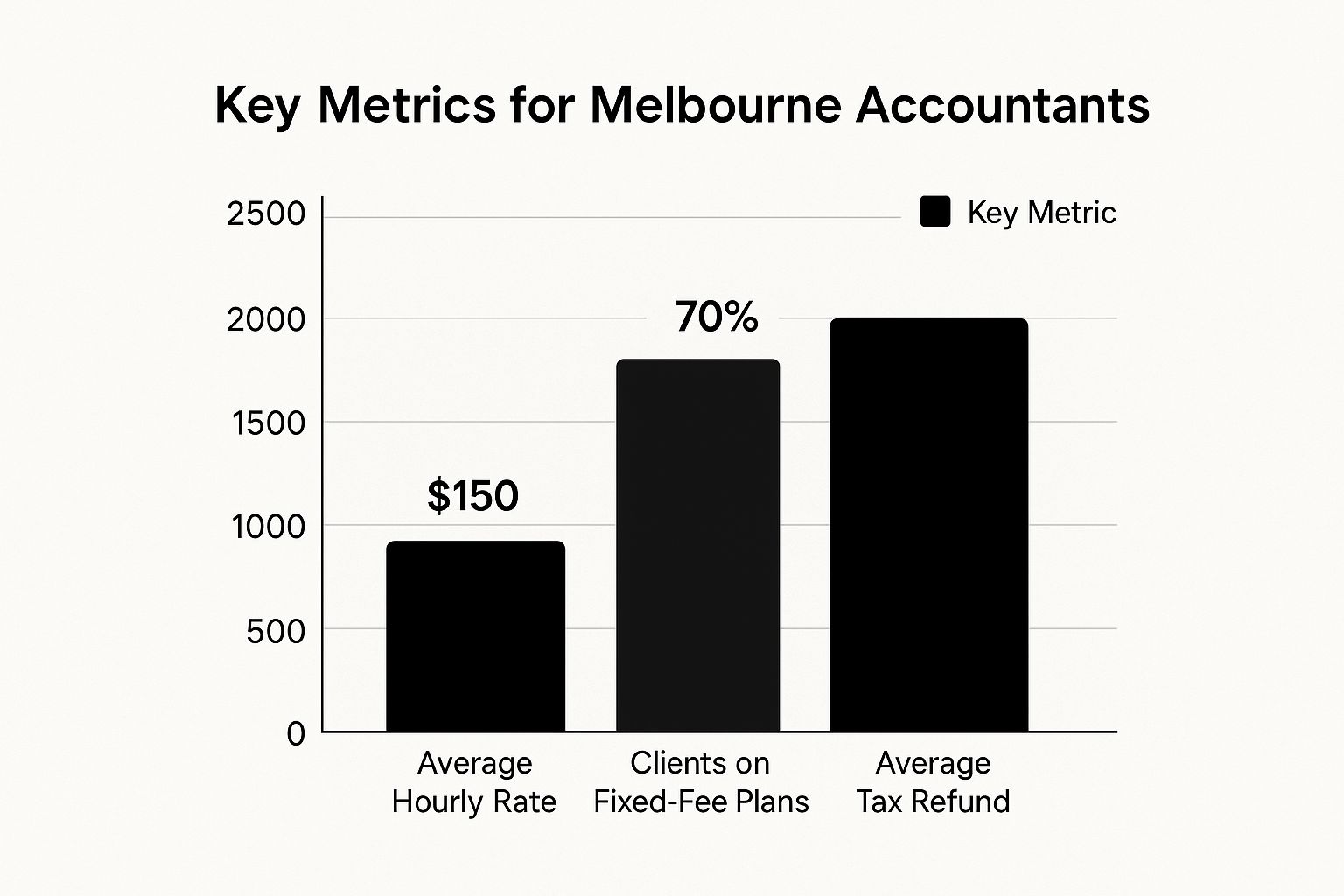

This infographic gives you a snapshot of the kind of financial metrics you might discuss with a potential accountant here in Melbourne.

These numbers show a clear shift towards predictable pricing and highlight the real, tangible value an expert can bring to your bottom line.

Finding an accountant with experience in your industry means you're not paying for their learning curve. They bring ready-made solutions and a network of useful contacts, delivering faster, more impactful results for your business.

The accounting industry in Australia is booming, with projections showing the number of firms will hit 36,717 in 2025. This growth is largely driven by the ever-increasing complexity of financial rules, especially in states like Victoria. In a crowded market, finding a specialist who can cut through the noise is more important than ever. An industry expert doesn't just do your books; they become a true strategic partner.

How to Interview an Accountant Like a Pro

Alright, you've done your homework and have a shortlist of promising accountants. This is where the rubber meets the road. This meeting isn't just about ticking boxes; it's your chance to see if you've found a genuine strategic partner or just another number-cruncher.

Forget treating this like a standard job interview. Think of it more like a first strategy session. You're looking for someone who gets your business, speaks your language, and is genuinely invested in your goals, not just your compliance.

Questions That Uncover a True Partnership

Before you even think about asking, "What are your fees?", you need to dig deeper. The best questions are designed to reveal how they think, operate, and add value beyond just getting your BAS lodged on time. A top-tier accountant in Melbourne will actually appreciate these kinds of questions—it shows you’re serious about growth.

Here are a few conversation starters to get things rolling:

- "Tell me about a time you helped a business like mine overcome a specific financial challenge or improve their bottom line. What was the situation, and what did you do?"

- "What's your preferred way of keeping in touch with clients? Are you a phone person, or do you stick to email and client portals?"

- "Which accounting software, like Xero or MYOB, are you most proficient with? How do you use it to give clients a real-time pulse on their business?"

The real goal here is to get them talking about their process and philosophy. Pay close attention. Are their answers specific, confident, and full of real-world examples, or do they sound like they’re reading from a textbook?

A truly valuable accountant won't just tell you what they do; they'll show you how they think. Their responses should demonstrate a forward-looking mindset focused on problem-solving and opportunity-spotting, not just historical reporting.

Understanding Their Communication and Reporting Style

One of the biggest friction points between business owners and accountants is a mismatch in communication styles. If you're someone who needs proactive updates but they only get in touch when a deadline is breathing down their neck, you're in for a world of frustration.

Get straight to the point and ask about their communication rhythm.

- "How do you keep clients in the loop about important deadlines or even potential opportunities? Should I expect a newsletter, personal emails, or regular check-in calls?"

- "If I have an urgent question, what’s a realistic timeframe for a response?"

- "What kind of reports do you typically provide, and how often? Can you show me a sample of what a monthly or quarterly report looks like?"

A great answer will be clear and manage your expectations from the get-go. They might say, "We guarantee a response to urgent queries within four business hours. As for reporting, you'll get a monthly performance snapshot with a plain-English summary, and we'll schedule a quarterly call to dive into strategy." That shows they have a system built for clarity.

Assessing Their Strategic Value

This is the moment of truth. Is this person a strategic advisor, or are they just a compliance expert? You need an accountant in Melbourne who can see the story your numbers are telling and connect it directly to your business goals.

Here’s how to test their strategic thinking:

- Throw them a scenario: "Imagine my revenue jumps by 20% next quarter, but my profit margin shrinks. Walk me through your process for figuring out what’s going on and how we’d fix it."

- Ask about their network: "Do you have a network of other professionals in Melbourne—say, lawyers or financial planners—that your clients can tap into?"

- Probe for long-term vision: "Looking past compliance matters, how do you help clients with bigger picture stuff like business structuring or cash flow forecasting?"

The right professional will light up when you ask these questions. They’ll likely start firing questions back at you, digging deeper to give you a more thoughtful response. Their ability to think on their feet and apply their expertise to your business is the clearest sign you’ve found a partner.

Checking out a firm's full list of business advisory services can also give you a great feel for their strategic depth before you even meet.

Making Sense of Accounting Fees and Value

Let's talk about the money side of things. When you first start looking for an accountant in Melbourne, the massive range of fees can feel a bit all over the place. It’s really important to get your head around the different pricing models so you can compare apples with apples and find a partner that fits your budget and your business ambitions.

You'll mainly come across two ways accountants charge: hourly rates and fixed-fee packages. Hourly billing is as simple as it sounds—you pay for the time they spend on your file. This can work for a one-off job or a quick consultation, but it can also lead to unpredictable bills, especially if you're someone who likes to pick up the phone and ask questions.

Comparing Pricing Models

These days, fixed-fee packages are becoming the go-to, and for good reason. They give you clarity and predictability. Services like your BAS lodgements, annual tax returns, and even payroll get bundled into one monthly or quarterly payment. This approach is fantastic because it encourages you to actually talk to your accountant without worrying that every phone call is starting a new timer.

When you're looking at a quote, you have to look past the big number at the top. A suspiciously cheap quote might only cover the absolute bare minimum compliance work. That means every email, every question, and every bit of strategic advice costs you extra.

The cheapest accountant is almost never the best value. Focusing only on finding the lowest price often means you miss out on proactive advice that could save you thousands down the track, whether that's through smarter cash flow management or identifying areas for financial improvement.

Understanding the Return on Your Investment

Try to shift your mindset from seeing accounting as a cost to seeing it as an investment in top-tier professional expertise. To put it in perspective, think about what it would cost to hire someone in-house. In Melbourne, a junior financial accountant earns around AUD 98,175 a year, while more senior pros are pulling in AUD 118,125 or more. You can check out local salary benchmarks yourself to get a feel for the market.

When you hire a firm, you get access to that calibre of talent without all the overheads of an employee. The real return on investment (ROI) isn't just in getting your compliance work done on time. It’s in the value they add. A great accountant who helps you get a better interest rate on a loan, improves your profit margins by 5%, or helps you successfully land a government grant is delivering value that absolutely dwarfs their fee.

So when you're weighing up your options, think about the potential ROI. Ask yourself: "What is proactive, expert advice actually worth to my business's health and future growth?" This changes the conversation from just comparing price tags to truly understanding the long-term value a great financial partner brings to the table.

A Few Final Questions About Finding an Accountant

When you're searching for the right financial partner, it’s natural to have a few last-minute questions. We get it. Here are some honest, practical answers to the most common queries we hear from Melbourne business owners on the hunt for the perfect accountant.

How Much Should I Budget for an Accountant?

This is the big question, isn't it? The honest answer is: it really depends on what your business needs. Costs can swing pretty wildly across Melbourne.

A sole trader who just needs straightforward quarterly BAS lodgements and an annual tax return might find some really affordable packages. On the other hand, a growing company that's managing payroll for a team, needs detailed cash flow forecasting, and wants regular strategy meetings will be looking at a more significant monthly investment.

The trick is to shift your focus from just the cost to the value you're getting. A proactive accountant who improves your financial processes or streamlines your finances can easily deliver value far greater than their fee. Always ask for a detailed proposal that spells out exactly what’s included so there are no surprises.

Is a Big City Firm Better Than a Small Boutique Practice?

There’s no single right answer here. It all comes down to your priorities and the kind of relationship you want to build.

Large, CBD-based firms often have a massive range of in-house specialists, which can be a huge plus if you've got really complex or niche requirements. The trade-off? You might find yourself passed between different departments and not always getting that one-on-one personalised attention.

A smaller, local Melbourne firm usually offers a much closer working relationship. You’ll likely have a dedicated contact who really gets to know your business inside and out. This creates consistency and a deeper understanding of your goals. If you value a true partnership and direct access to your advisor, a boutique practice is often the best fit for small business owners.

Does My Accountant Really Need to Be Based in Melbourne?

In today's world of cloud software and Zoom calls, it’s not strictly essential for your accountant to be just down the road. But—and this is a big but—there are powerful, tangible benefits to choosing a local accountant in Melbourne.

A local accountant has an intuitive grasp of the Melbourne business ecosystem. They understand state-specific regulations, know about local grants you might qualify for, and have a network of other local professionals—from lawyers to marketing consultants—that can be incredibly valuable.

For many business owners, nothing beats being able to sit down for a face-to-face meeting to map out a strategy on a whiteboard. That kind of local insight can give you a competitive edge that a remote accountant, no matter how skilled, just can't replicate.

Ready to partner with a proactive Genesis Hub accountant who genuinely understands Melbourne businesses? We offer clear, fixed-fee packages and the strategic advice you need to grow. Book your free consultation today and let's see how we can strengthen your financial position.