Claiming the tax-free threshold is a key concept in the Australian tax system. You're essentially letting your employer know not to tax the first $18,200 you earn in a financial year. Understanding this can help you manage your take-home pay, as it means you may see more of your money in each payslip from the start, rather than waiting for a tax refund at the end of the year. Getting this simple step right is a massive part of managing your take-home pay.

What the Tax-Free Threshold Actually Means for You

At its heart, the Australian tax-free threshold is a powerful but simple concept designed to help every eligible worker. It's the exact amount of income you can earn each year before your employer starts withholding any tax.

Imagine your yearly income is a tall glass of water. The tax-free threshold is like a line drawn near the bottom; everything below that line is yours to keep, completely untouched by income tax. It's only the water you pour above that line that gets taxed.

How It Works in Practice

When you kick off a new job, one of the first things you'll do is fill out a Tax File Number (TFN) Declaration form. On this form, there's a crucial question: do you want to claim the tax-free threshold? Ticking 'Yes' is the signal your employer's payroll system needs to apply this benefit.

This one little tick has a direct impact on your weekly or fortnightly pay by:

- Boosting your take-home amount from each pay cycle.

- Stopping your employer from taking too much tax out too early.

- Making sure your tax is calculated correctly from day one.

Australia’s tax system is set up so you don’t pay a cent of income tax on the first $18,200 you earn. This policy is a huge help for lower-income earners and makes participating in the workforce that much more attractive. Once you earn more than this, our progressive tax system kicks in, and the next slice of your income is taxed at the appropriate rate.

By claiming the threshold, you're taking control of your cash flow. You get access to your money as you earn it, instead of giving the ATO an interest-free loan that you have to ask for back later.

For small business owners and individuals alike, getting this right is a fundamental part of smart financial management. Nailing these basics can make all the difference when you navigate tax season.

Determining if You Are Eligible to Claim the Threshold

So, who actually gets to use this tax-free ‘head start’? For most people working in Australia, the answer is refreshingly simple.

Your eligibility to claim the tax-free threshold really boils down to one key thing: your residency status for tax purposes. If you’re an Australian resident for tax purposes, you’re generally in.

It’s a pretty broad category that covers more than just citizens. Generally, this group includes:

- Australian citizens

- Permanent residents

- Plenty of long-term visa holders who have set up their life in Australia

Basically, if Australia is your primary home base where you live and work, you’ll most likely tick the box. The Australian Taxation Office (ATO) has a few tests to work this out, as it's not always as straightforward as just your visa type.

Understanding Tax Residency

Don't get tax residency mixed up with your immigration residency—they can be two different things. Thankfully, the ATO provides clear guidelines to help you figure out where you stand.

The image below shows the starting point for the ATO's handy residency determination tools.

This tool walks you through a series of questions about your living situation and your connection to Australia to give you a clear answer on your tax status.

Important Note: Non-residents and working holiday makers (like those on visa subclasses 417 or 462) play by different rules. They generally can't claim the tax-free threshold. Instead, they are taxed from the very first dollar they earn, usually at a specific, flat rate.

It’s really important to get your status right before you fill out your TFN Declaration form. While this guide gives you a good starting point, it's always a good idea to confirm your official residency status directly with the ATO if you're unsure.

How to Correctly Claim Your Tax-Free Threshold

Putting your hand up for the tax-free threshold is surprisingly straightforward. It’s usually one of the first things you'll do when starting a new job. The whole process hinges on one key document: the Tax File Number (TFN) Declaration form. Think of it as your direct instruction manual for your employer’s payroll team.

On this form, you'll find what is arguably the most important question for your take-home pay: ‘Do you want to claim the tax-free threshold from this payer?’ Ticking ‘Yes’ is the magic step. This tells your employer not to withhold any tax from your earnings until you’ve passed that $18,200 mark.

Completing the TFN Declaration Form

Whether you’re given a paper form or pointed towards a website, the goal is the same. You’re giving your employer the green light to apply the threshold correctly right from your very first payday.

While the old-school paper form still exists, many businesses now use modern, integrated systems. You might fill out the declaration through your employer’s HR software or directly via ATO online services linked to your myGov account. Going digital is usually faster, cuts down on errors, and gets your details into the payroll system almost instantly.

Regardless of how you do it, the steps are pretty much identical:

- Provide Your Personal Details: Just the basics – full name, address, and date of birth.

- Enter Your TFN: Carefully input your nine-digit Tax File Number. Double-check it!

- Answer the Key Question: Find the question about the tax-free threshold and select 'Yes' (remember, this is for your main or only job).

- Sign and Date: Finalise the declaration with your signature and the date.

Getting this form right from day one ensures your pay is calculated accurately from the get-go. It's a fundamental part of managing your money and crucial for good tax and compliance all year round.

And don't worry, this isn't a "set and forget forever" situation. If your circumstances change—like picking up a second job—you can always fill out a new TFN Declaration to update your employer and adjust how your tax is handled.

Juggling Multiple Jobs Without a Tax Surprise

Working more than one job or kicking off a side hustle is pretty common these days. But it brings a crucial tax rule to the forefront: you can only claim the tax-free threshold from one employer at a time. Understanding this is key to managing your tax when you've got multiple income streams.

Think of the threshold like a single-use discount coupon for your annual tax bill. You get to apply it once, but if you try to use it everywhere, you could be setting yourself up for an issue. If each employer's payroll system acts as if it's your only job, they might not withhold enough tax from your total combined income. This can result in a tax bill when it’s time to lodge your return.

The Smart Strategy for Multiple Incomes

So, how do you decide which job gets the "coupon"? The standard approach is to claim the tax-free threshold from your highest-paying job. This makes sure the $18,200 tax-free amount is applied to the income that would otherwise push you into higher tax brackets the fastest.

For every other job, you would tick ‘No’ on the TFN Declaration form where it asks if you want to claim the threshold. This tells your other employers to withhold tax from the very first dollar you earn, which helps cover your total tax obligation across all your earnings.

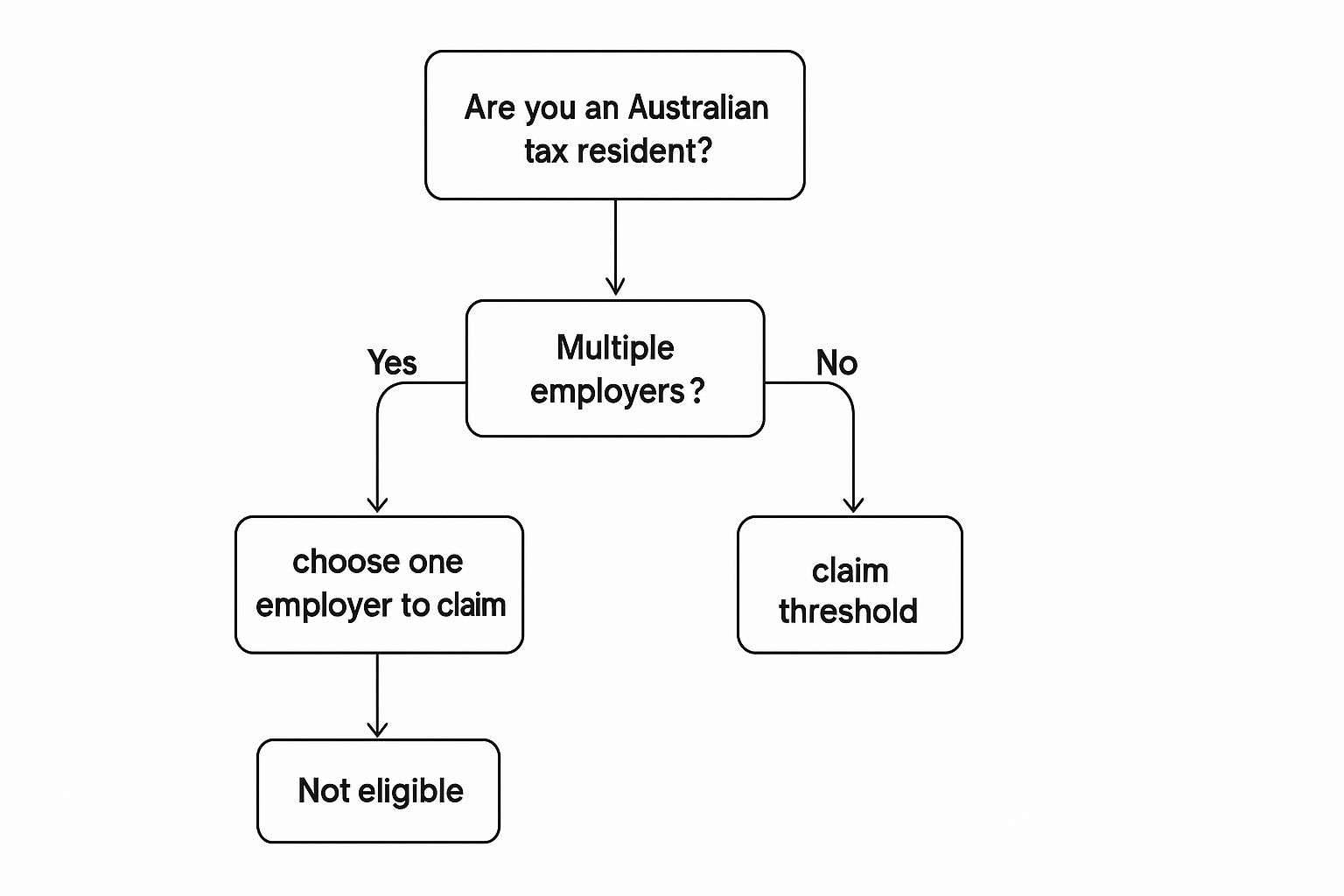

This decision tree gives you a simple visual on how to handle the threshold based on your residency and number of jobs.

As the chart shows, if you’re an Aussie resident for tax purposes with more than one gig, you’ve got to pick just one to claim the threshold from. Simple as that.

To make this even clearer, let's look at a few common situations.

Claiming the Tax-Free Threshold Scenarios

| Scenario | Common Action | Reasoning |

|---|---|---|

| One full-time job | Claim the threshold. | With only one employer, this allows you to use your full tax-free entitlement with them. |

| One full-time and one part-time job | Claim the threshold with the full-time job only. | This applies the tax-free amount to your main source of income, supporting more accurate tax withholding. |

| Two casual jobs with similar hours | Claim the threshold with the job that pays the higher hourly rate. | This can maximise the benefit by applying the threshold to the highest potential earnings. |

| Starting a new job while still at the old one | Do not claim the threshold with the new job. Once you leave the old job, submit a new TFN Declaration to your new employer to start claiming it. | This prevents claiming it twice during an overlap period, which helps avoid an end-of-year tax debt. |

Getting this right means you're proactively staying on top of your tax throughout the year. It's a small step that can help prevent the ATO from notifying you about underpaid tax later on.

Juggling multiple income streams can feel a bit much sometimes. If your pay varies a lot or you're just not sure what the best move is for your situation, you may want to learn more about how to find the best tax accountant near you for personalised information.

When You Might Not Want to Claim the Threshold

While ticking ‘Yes’ to claim the tax-free threshold is the typical choice for most people with a single job, there are a few specific situations where it might be logical to tick ‘No’. The most common reason, besides juggling multiple jobs, is if you’re also receiving certain government payments.

Think about it this way: many Centrelink payments, like JobSeeker or various pensions, already have the tax-free threshold factored in. If you’re getting one of these benefits and then start a new job, claiming the threshold again from your employer is like trying to get the same discount twice on your total income.

This kind of "double-dipping" can mean not enough tax is withheld from your pay throughout the year. The result? You could be left with an unexpected tax bill when you lodge your return. By not claiming it from your employer, tax is taken from the very first dollar you earn, helping to cover your overall tax liability properly.

A Voluntary Strategy for Tax Refunds

Interestingly, some people with just one job deliberately choose not to claim the threshold. Why would they do that? It often comes down to a personal financial strategy.

By telling their employer to withhold more tax from each paycheque, they are effectively having more tax taken out than is likely required. This extra tax paid during the year is then likely to come back to them as a lump-sum refund after they lodge their tax return.

While this approach means less take-home pay each week, some find it a useful budgeting tool for saving towards a specific goal. However, it’s worth noting that this is effectively giving the ATO an interest-free loan of your money.

Getting your head around these less common scenarios gives you a much fuller picture of the claiming tax-free threshold meaning and how it works in the real world. Australia’s Pay-As-You-Go (PAYG) system, introduced way back in 1942, was designed to make tax collection more straightforward. If you're curious, you can find out more about the history of Australia's tax system on the Treasury's website.

Disclaimer: This content is for informational purposes only and does not constitute tax advice. Please consult a qualified tax professional for advice tailored to your specific circumstances.

Your Common Tax-Free Threshold Questions Answered

Even after you get the hang of the basics, a few practical ‘what-if’ questions always seem to pop up. Understanding these common scenarios will help you handle your own situation with confidence.

Just a heads-up, the following is for general guidance only and isn't formal tax advice.

What Happens if I Forget to Claim the Tax-Free Threshold?

It’s an easy mistake to make. If you forget to claim it, your employer has to withhold tax from the very first dollar you earn. This means your take-home pay each week or fortnight will be a bit lower than it would otherwise be.

But the good news is that this money isn't gone for good. When you lodge your tax return, the ATO calculates everything based on your total annual income. Any extra tax that was withheld will simply come back to you as a refund. You can also give your employer an updated TFN Declaration form at any time to fix it for future paydays.

Can I Switch Which Job I Claim the Tax-Free Threshold From?

Yes, you can. In fact, you should update your details if your circumstances change. Let's say your part-time side hustle suddenly takes off and becomes your main source of income—it's logical to make the switch.

To get this done, you just need to give a new TFN Declaration form to both of your employers. You'll hand one to your new main job to start claiming the threshold and another to your old primary job to stop claiming it. It's a simple bit of admin that keeps your tax withholding accurate.

Think of it as redirecting your tax-free "allowance" to where it will be most effective. Keeping your payroll information up to date is key to avoiding an unexpected tax bill.

How Does the Tax-Free Threshold Work for Sole Traders?

For sole traders, things work a little differently. Since you don't have an employer taking tax out of your pay through the PAYG (Pay As You Go) system, the threshold is applied when you lodge your annual income tax return.

This means the first $18,200 of your net business profit for the year is completely tax-free. But because tax isn't taken out automatically, you might need to make quarterly PAYG instalments to the ATO during the year. These instalments are basically a way to pre-pay your expected tax bill so you don't get hit with a huge lump sum at tax time.

What if My Income for the Year Is Less Than $18,200?

If your total income from all your jobs and hustles for the year is under the $18,200 tax-free threshold, you generally won't have to pay any income tax at all.

However, if an employer did withhold some tax during the year (maybe because you didn't claim the threshold at first), you will need to lodge a tax return. It’s the only way to get every dollar of that withheld tax back from the ATO as a full refund.

At Genesis Hub, we know that managing tax can feel complicated. Our team is here to provide clear, practical accounting and advisory support to help small businesses and sole traders in Melbourne stay compliant and confident.

Ready to take control of your finances? Book your free consultation with Genesis Hub today.