For Australian sole traders and small business owners, understanding how to lower taxable income isn't about finding obscure loopholes. It comes down to understanding and applying smart, legal strategies.

This can involve maximising deductions, making savvy super contributions, and being clever about the timing of income and expenses. Taking this kind of proactive approach can help you meet your obligations to the ATO while keeping more of your hard-earned money.

Your Guide to Legally Lowering Taxable Income

Getting a handle on how to lower your taxable income is one of the most powerful financial skills you can build as a business owner. This isn't about tax avoidance. It’s about ensuring you only pay what you're legally required to.

For many sole traders and small business operators, the end of the financial year (EOFY) can feel like a mad scramble. However, it doesn't have to be. A year-round strategy can make a difference, turning tax time from a headache into a planned financial event.

Effective tax planning involves a few core principles, all of which are in line with Australian Taxation Office (ATO) guidelines. By focusing on these areas, you can build a solid framework that genuinely supports your business's financial health.

The Pillars of Smart Tax Reduction

The journey to a smaller tax bill may not be as complex as it sounds. It’s often about being organised and staying informed. The main strategies we'll walk through in this guide are:

- Maximising Deductions: This is a direct route. It means claiming every legitimate business expense, from obvious costs to home office expenses, vehicle mileage, and even professional subscriptions.

- Strategic Super Contributions: Using superannuation can be a way to reduce your taxable income now while building a nest egg for your future.

- Timing Your Income and Expenses: A bit of clever timing can make a significant difference. By deferring some income into the next financial year or bringing forward expenses, you can shift your tax liability for the current year.

- Choosing the Right Business Structure: As your business grows, what worked yesterday might not be the best fit today. Moving from a sole trader to a company structure, for example, can unlock tax efficiencies.

A Quick Heads-Up: The information in this guide is for general educational purposes only and should not be taken as financial or tax advice. Every business situation is different. We always recommend consulting with a qualified tax professional who can provide advice tailored specifically to your circumstances.

To give you a clearer picture, here’s a quick overview of the main methods available for legally minimising your tax.

Key Strategies for Reducing Taxable Income at a Glance

This table breaks down the core strategies available to Australian sole traders and small businesses. It can be a helpful cheat sheet for understanding where potential opportunities lie.

| Strategy | Primary Benefit | Best For |

|---|---|---|

| Maximising Deductions | Immediately reduces your current year's taxable income by offsetting it with legitimate business expenses. | All sole traders and small businesses, especially those with significant operational costs. |

| Super Contributions | Lowers your taxable income by contributing pre-tax dollars to your super, which is taxed at a lower rate (15%). | Individuals looking to boost retirement savings while getting an immediate tax benefit. |

| Timing of Payments | Shifts tax liabilities between financial years, giving you more flexibility and control over your annual tax position. | Businesses with fluctuating income or those that can prepay big expenses before 30 June. |

| Business Structuring | Aligns your business structure with your profit levels to take advantage of more favourable tax rates (e.g., the flat company tax rate). | Growing businesses where personal income is getting pushed into higher marginal tax brackets. |

Each of these pillars offers a powerful way to manage your tax outcome. The key is figuring out which combination makes the most sense for your business, both this year and in the years to come, often with professional guidance.

Maximising Your Business and Personal Deductions

Claiming every dollar you're entitled to is a direct way to shrink your taxable income. For sole traders, this goes beyond just the cost of goods. It's about being thorough with every expense that helps you earn money—from fuel for a work vehicle to software subscriptions.

Many business owners may leave money on the table because they forget about the small, consistent costs that add up. Consider professional association fees, insurance premiums, or even the bank fees on a business account. Each one is a potentially legitimate deduction that can reduce a final tax bill.

The Australian Taxation Office (ATO) is clear: if you spent money to earn your income, you can generally claim it as a deduction. The key is being organised. This is where good record-keeping stops being a chore and becomes a valuable money-saving tool.

Understanding Home Office Expenses

Working from home is common for many people, but are you claiming everything you may be entitled to? The ATO provides two ways to calculate home office deductions, and each has its place.

- Revised Fixed Rate Method: This is a simple option. You can claim a flat rate of 67 cents for every hour you work from home. This is a package rate that covers running costs like power, internet, phone usage, and stationery. All you need is a log of the hours you've worked from home.

- Actual Cost Method: This way requires more record-keeping but can lead to a larger deduction if you have significant expenses. You’ll need to calculate the actual work-related portion of all your home office running costs. That means keeping receipts for everything and working out the business-use percentage, usually based on floor area or a detailed usage log.

Which one is right for you? It really depends on your circumstances. If you have a fully kitted-out, dedicated office and high running costs, the actual cost method may be worth the extra effort. If you value simplicity, the fixed rate is a straightforward alternative.

A common misconception is that you can't claim anything without a dedicated home office room. Even if you’re working from the kitchen bench, you can still claim the running expenses for the hours you put in. The key, as always, is having the records to back it up.

Vehicle Costs and Other Essential Claims

After the home office, a vehicle and the tools of your trade are usually the next biggest source of deductions. It's important to get these claims right to stay on the right side of the ATO.

When it comes to vehicle expenses, sole traders generally have two choices:

- Cents Per Kilometre: This method lets you claim a set rate for every business-related kilometre you drive, up to a cap of 5,000 kilometres per car, each year. It’s straightforward because you don’t need receipts for the individual costs, but you do need to show how you calculated the kilometres (like a diary of your work trips).

- Logbook Method: If your business travel exceeds 5,000 kms, the logbook method is an alternative. You'll need to keep a detailed logbook for 12 continuous weeks to establish your car's business-use percentage. Once you have that figure, you can claim that percentage of all your car's running costs—fuel, insurance, rego, and even depreciation.

The ATO's own data shows just how significant these claims are. According to Taxation Statistics 2022–23, around 40% of individual taxpayers claimed work-related deductions. For home office expenses alone, claims have been hovering between $1,000 to $1,500, which shows what a difference these can make. You can dive into more ATO statistics about individuals to see the trends for yourself.

The Three Golden Rules of Deductions

It doesn't matter if you're claiming a new laptop, a training course, or your work phone bill. The ATO has three golden rules, and for claims to be valid, they must be followed.

- You must have spent the money yourself and not been reimbursed. It has to come out of your own pocket.

- The expense must be directly related to earning your income. There has to be a clear link between the cost and your business activities.

- You must have a record to prove it. This one is non-negotiable. Think receipts, bank statements, and invoices.

Sticking to these principles is everything. Using a receipt-scanning app can make this almost painless, turning that dreaded shoebox of paper into clean, digital records. That simple habit is the foundation for maximising every deduction and legally lowering your tax.

Using Super to Cut Your Tax Bill

Most people see superannuation as a locked-away retirement fund. But that perspective can be a missed opportunity, especially for business owners. It's one of the most powerful and legitimate tools available for reducing taxable income right now, while also building a nest egg for the future. The strategy is simple but can be highly effective.

When you put extra cash into your super from your pre-tax income, it's typically taxed at a flat rate of just 15%. For most business owners, this can be a significant discount compared to their personal marginal tax rate, which can climb as high as 45% (plus the Medicare levy). That immediate tax rate difference is where the savings are made.

You are essentially shifting a chunk of your highest-taxed income into a low-tax environment. This directly cuts down the amount of profit you'll pay your marginal rate on, leading to a smaller tax bill at the end of the financial year.

The Magic of Concessional Contributions

The ATO calls these pre-tax contributions concessional contributions. They get this name because they're taxed at a "concessional" or favourable rate. For business owners, there are a couple of ways to make these contributions.

- Salary Sacrificing: This is an option if you run your business through a company and pay yourself a regular wage. You can set up a formal arrangement with your company (your employer) to divert a portion of your pre-tax salary straight into your super fund.

- Personal Deductible Contributions: If you're a sole trader or contractor, this is your equivalent. You make a contribution to your super fund from your bank account and then claim that amount as a tax deduction on your annual tax return. A key step is to notify your super fund in writing that you intend to claim the deduction.

Both roads lead to the same destination: your taxable income drops by the amount you contribute, and that money is taxed at the friendly 15% rate inside your super fund.

A Real-World Example of Tax Savings

Let's put some numbers to this for illustrative purposes. Picture a sole trader, Chloe, who's had a great year and is looking at a taxable income of $120,000. At this level, every extra dollar she earns is taxed at her marginal rate of 32.5%, plus the 2% Medicare Levy. So, a total of 34.5%.

Chloe decides she wants to reduce her tax bill and boost her super, so she makes a $20,000 personal deductible contribution. Here’s how the situation changes.

- Without the Contribution: The tax on that top $20,000 slice of her income would be $6,900 ($20,000 x 34.5%).

- With the Contribution: That same $20,000 now goes into her super, where it's taxed at only 15%. The tax bill on that amount is just $3,000 ($20,000 x 15%).

By making one smart move, Chloe instantly saves $3,900 in tax for the year. Her taxable income drops to $100,000, and she's $17,000 richer in her retirement savings.

This isn't an obscure loophole; it's a well-known and widely used strategy. Data on Australian income tax progressivity shows that around 30% of taxpayers who contribute to super use these methods, especially those earning over $90,000 where the tax savings really start to accelerate.

Don't Forget the Cap (and the Catch-Up Rule!)

Of course, there are limits. The government caps how much you can contribute at the concessional rate each year. For the 2024-25 financial year, that annual cap is $27,500. This limit includes everything—your mandatory employer contributions (if you're set up that way) plus any extra you put in via salary sacrifice or personal deductions.

Going over the cap can trigger extra tax, so it’s something to monitor.

But there's also a provision called 'catch-up contributions'. If your total super balance was under $500,000 at the end of the last financial year, you may be able to carry forward any unused cap amounts from the previous five years. This can be a game-changer for business owners whose income is lumpy. If you had a few lean years where you couldn't afford to contribute much, you might be able to make a much larger, tax-deductible contribution in a good year to catch up.

Strategic Timing of Income and Expenses

Knowing what to claim is only half the battle. Knowing when to claim it can be just as powerful for lowering your taxable income, especially as the 30 June deadline looms.

For sole traders and small businesses, the lead-up to the end of the financial year presents an opportunity. It’s about strategically managing cash flow to gain more control over your tax position. The approach is simple: bring forward any planned expenses into the current financial year and, where possible, push income into the next one. This combination reduces your profit on paper for this year, which can directly cut your tax bill.

This timeline visualises how strategic contributions and timing can directly lower your tax burden.

The key takeaway? Proactive financial decisions made before the EOFY can have a direct and immediate impact on your final tax assessment.

Bringing Forward Your Business Expenses

One of the most effective EOFY tax planning moves can be to prepay for expenses you know you'll need in the coming months. The Australian Taxation Office (ATO) allows small businesses to claim an immediate deduction for prepaid expenses that cover a period of 12 months or less.

This is a game-changer. It means you can pay for certain costs before 30 June and claim the full deduction in the current financial year, even if the service itself stretches into the next one. It’s a straightforward way to increase your deductions and reduce this year's profit.

Some business owners do this with expenses like:

- Insurance Premiums: Paying for professional indemnity or public liability insurance for the next 12 months in June.

- Subscriptions and Memberships: Renewing industry association memberships or software subscriptions (think Xero, MYOB, or Adobe Creative Suite) for the year ahead.

- Rent or Lease Payments: Prepaying commercial rent or equipment leases for July.

- Maintenance Contracts: Settling contracts for equipment or vehicle servicing that is known to be coming up.

The logic is simple. If you were going to spend that money in July or August anyway, spending it in June could allow you to get the tax benefit a full year earlier.

Deferring Your Business Income

The other side of the timing coin is managing when you actually receive and record income. This strategy is an option for sole traders and small businesses that report tax on a cash basis—meaning income is only counted when it physically lands in your bank account.

Let's say you finish a big project in the last week of June. You have some control over when that income is officially "earned" for tax purposes. By waiting to send the invoice until 1 July, the payment you receive will fall into the next financial year. This simple administrative delay can shift a significant amount of income, and the tax you owe on it, into the future.

This isn't about hiding income; it's purely about timing its recognition according to ATO rules. For businesses on a cash accounting basis, the income isn't legally 'derived' until the cash is in hand, making this a compliant and effective strategy.

Of course, this requires a good handle on your cash flow. You wouldn't want to delay income if you need the funds to cover immediate expenses. But if your cash position is strong, it’s a powerful lever to pull. If you want more insights into managing your finances effectively, check out our guide on how small business owners can navigate tax season.

Your EOFY Tax Timing Checklist

To make this practical, here's a checklist to consider in the weeks before 30 June.

- Review Upcoming Expenses: Look at any subscriptions, insurance, or regular bills due in July or August. Can they be paid now instead?

- Assess Asset Needs: Do you need a new computer, tool, or office chair? Buying it before 30 June allows you to claim depreciation or an immediate write-off for this year.

- Check Your Invoicing Schedule (Cash Basis): For work completed in late June, consider if you can hold off on invoicing until early July to defer the income.

- Stock Up on Supplies: Purchase consumable items you use all the time, like stationery, printing materials, or office supplies, before the deadline.

- Book and Prepay Training: If you're planning on taking a professional development course, paying for it now could lock in the deduction for this year.

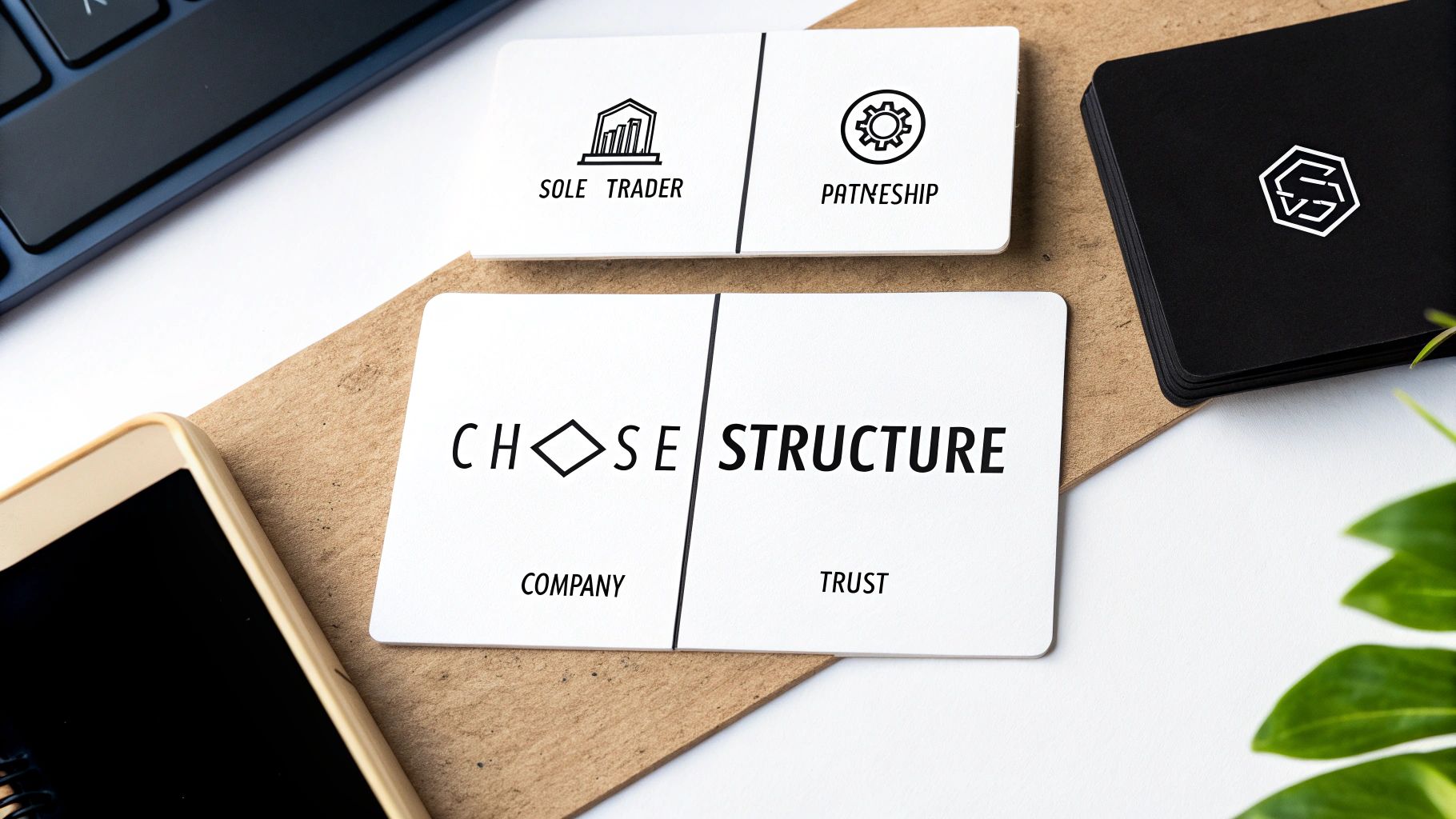

Choosing the Right Business Structure for Tax Efficiency

The structure you pick for your business is more than just a name on a form. It's a fundamental decision that dictates how your profits are taxed. Getting this right is a cornerstone of smart tax planning, as it directly impacts your personal liability, compliance costs, and the end-of-year tax bill.

For most people starting out, being a sole trader is the simplest path. It’s easy to set up and the admin load is light. However, as a business grows and its profits climb, what was once the perfect fit can become less tax-effective.

Understanding the real differences between common Australian business structures is essential for anyone serious about lowering their taxable income for the long haul. This isn't just about this financial year; it's about setting your business up for sustainable, tax-effective growth.

How Different Structures Are Taxed

The main distinction between business structures boils down to how income is taxed. Each model treats profit differently, and this can lead to vastly different outcomes depending on how much you’re earning.

As a sole trader, you and your business are legally the same entity. This means every dollar of profit your business makes is treated as your personal income, taxed at your marginal rate. This can be fine when you're just starting, but once your income climbs into the higher tax brackets, you could be handing over up to 45% (plus the Medicare levy) to the ATO.

A company, on the other hand, is a separate legal entity. It pays its own tax on profits at a flat corporate rate, which currently sits at 25% for eligible small businesses. This creates a wall between your business and personal finances, offering both asset protection and potential tax benefits once your income crosses a certain threshold.

The decision to change your business structure is a significant one with both immediate and long-term consequences for your tax and legal obligations. It’s a classic example of when professional guidance isn’t just helpful—it’s essential.

When to Consider a Change

So, how do you know when it might be time to evolve from a sole trader to something more robust? The biggest trigger is often taxable income. Once your profits are consistently pushing you into the 37% or 45% personal tax brackets, that flat 25% company tax rate starts looking very attractive.

Asset protection is another huge factor. As a sole trader, your personal assets—like your family home—could be on the line if the business gets into financial strife. A company structure contains that risk. The business's debts belong to the company, not you.

Finally, think about your growth plans. If you want to keep profits in the business to reinvest in new gear, hire staff, or expand, a company can be far more tax-effective. You can leave post-tax profits sitting in the business bank account without it bumping up your personal income. Making this kind of strategic shift is complex, which is why it's so important to understand why every business needs an accountant to guide these big decisions.

Comparing Your Options

Choosing the right structure is always a balancing act between tax efficiency, compliance costs, and asset protection. To help make things clearer, let's look at how the main options stack up.

Comparing Australian Business Structures for Tax Implications

This table gives a quick breakdown of how different business structures are taxed and the key things to think about for each one.

| Feature | Sole Trader | Company | Trust |

|---|---|---|---|

| Tax Rate | Your personal marginal tax rate (up to 45% + Medicare Levy). | Flat corporate rate (25% for eligible small businesses). | Beneficiaries pay tax at their marginal rates on distributed income. |

| Asset Protection | None. Your personal assets are at risk. | High. The company is a separate legal entity, protecting personal assets. | High. Assets are held by the trustee, offering protection. |

| Compliance Costs | Low. Minimal setup and reporting requirements. | High. Requires annual returns, ASIC fees, and more complex accounting. | High. Requires a formal trust deed and detailed annual administration. |

| Profit Retention | Inefficient. All profits are taxed as your personal income. | Very efficient. Profits can be retained and taxed at the lower corporate rate. | Inefficient. Profits must generally be distributed to beneficiaries each year to be tax-effective. |

Each structure has its place, and the "best" one for you depends entirely on your income level, risk tolerance, and future ambitions. What works perfectly today might hold you back tomorrow, so it pays to review your setup regularly with a professional.

Common Questions on Lowering Taxable Income

Once you start digging into tax strategies, a few common questions always seem to pop up. It's one thing to know the general rules, but applying them to your specific situation is where the rubber really hits the road. Let's tackle some of the most frequent queries from business owners.

Can I Claim Deductions for Mixed-Use Expenses?

This is a big one, especially for sole traders where business and personal life often blend together. The short answer is yes, you generally can. The longer answer is that you have to be very diligent about it.

When you use something for both business and personal reasons—think your mobile phone, car, or home internet—you can only claim the business-use portion as a deduction. The Australian Taxation Office (ATO) won't accept a rough guess; they expect a logical and consistent method for working out that split.

A classic example is a car. A taxpayer might keep a logbook for a 12-week period and find that 70% of their driving is for business purposes. They can then claim 70% of the fuel, insurance, registration, and other running costs. For a phone bill, they would need to go through an itemised statement and highlight the work-related calls to figure out a reasonable percentage.

The bottom line is this: apportionment is everything. A claim is only as good as the records. If you can't show the ATO how you calculated the business portion, they can and will reject the deduction.

Is There a Limit on Total Deductions?

It’s a common myth that there's some kind of secret cap on how much you can claim in deductions each financial year. The good news is, there is no single cap on the total amount you can deduct.

The real limit is simply whether each expense meets the ATO’s rules. To be claimable, an expense must tick three boxes: it was directly for earning your income, you paid for it yourself (and weren't reimbursed), and you have a record to prove it. As long as every deduction you claim meets this test, it’s legitimate.

That said, some specific types of claims do have their own limits. For instance, if you use the cents per kilometre method for your car, you’re capped at 5,000 business kilometres per year. So, instead of worrying about a total dollar figure, the focus should be on making sure every single claim is justifiable with the paperwork to back it up.

For more deep dives into this and related topics, feel free to explore our other articles on tax and compliance in Australia.

When Should I Switch From Sole Trader to a Company?

Knowing the right time to move from a sole trader to a company structure is a massive decision for any growing business. There’s no magic income figure that works for everyone, but a key trigger is when business profits consistently push your personal income into the higher tax brackets.

Once taxable income starts creeping over $120,000, you begin paying 37 cents or more on every dollar earned above that. At that point, the flat 25% company tax rate can start looking appealing as a way to retain more profit.

But tax isn't the only factor. You should also consider:

- Asset Protection: A company is its own legal entity. This creates a firewall between the business and your personal assets, like your family home. As your business grows and takes on more risk, this protection becomes invaluable.

- Reinvesting Profits: If your game plan is to leave money in the business to fund future growth, it’s far more tax-efficient to do this inside a company structure.

- Professional Image: In some industries, operating as a 'Pty Ltd' company just carries more weight and can open doors that might be closed to a sole trader.

Making the switch isn't a small step. It comes with higher setup fees and more demanding compliance obligations. It's a move that should only be made after getting solid, professional advice from an accountant who can look at your numbers and goals.

Ready to put these strategies into action and feel confident about your tax position? The team at Genesis Hub lives and breathes this stuff. We specialise in helping Australian small businesses and sole traders get on top of their tax and plan for sustainable growth. We offer clear, practical information to help you maximise deductions, stay compliant, and build a stronger financial future.