If you’ve been paying attention to the Australian Taxation Office (ATO), you’ll know a pretty big rule change kicked in on July 1st. In short, the interest you pay on late or amended tax assessments is no longer a tax-deductible expense.

This change effectively removes what was a small but helpful buffer on the cost of carrying a tax debt.

The End of an Era for ATO Interest Deductions

This policy shift is a significant moment for both Australian businesses and individuals. The interest charges we’re talking about are specifically the General Interest Charge (GIC) and the Shortfall Interest Charge (SIC). In the past, these could be claimed as expenses, which helped to soften the financial blow of a tax liability.

Now, that buffer is gone.

Think about the old system for a moment. If you were charged $100 in GIC, you could claim it as a deduction. At tax time, this might have put around $30 back in your pocket, making the real cost of that interest only $70. From July 1st onwards, that same $100 GIC will cost you the full $100. No discounts.

Why This Change Matters to You

This isn't just a minor tweak to the tax code. It fundamentally changes the financial consequences of paying your tax late or getting an assessment wrong. The need for proactive, timely tax management has never been more critical.

For business owners and individuals, this new landscape demands a closer look at your financial habits and compliance strategies. The key impacts are pretty clear:

- Increased Cost of Debt: Any new or outstanding tax debts will now be more expensive to carry over time. Simple as that.

- Reduced Margin for Error: Small delays or honest mistakes in your tax lodgements that lead to interest charges now come with a much harsher financial sting.

- Greater Need for Planning: Solid cash flow planning and putting funds aside for your tax obligations are now absolutely essential to avoid these non-deductible charges.

In this guide, we'll unpack what this major policy shift means for you. We’ll get into the specifics of the GIC and SIC, explain the ATO's reasoning behind the change, and provide practical insights to help you navigate this new financial environment. Please remember, this content is for informational purposes only and does not constitute tax advice.

So, What Exactly Are GIC and SIC?

To really get a handle on what's changed, you first need to understand the two key acronyms at the centre of it all: the General Interest Charge (GIC) and the Shortfall Interest Charge (SIC). These aren't just bits of tax jargon; they are specific penalties the ATO uses to keep everyone on track.

Think of the GIC like the interest on a credit card you forgot to pay. It’s applied to unpaid tax debts—like an outstanding income tax bill or BAS—to make up for the government being out of pocket. The real kicker is that it compounds daily, which means a small debt can snowball into something much bigger if it is left unpaid.

The SIC, on the other hand, usually pops up after the fact. It applies when the ATO goes back and amends one of your previous tax assessments, often after a review or audit, and finds you’ve underpaid. It's calculated to cover the interest from the day the tax should have been paid right up until they issue the new, corrected assessment.

Why Losing the Deduction Is a Big Deal

For years, the pain of getting hit with GIC or SIC was softened by the fact you could claim the interest as a tax deduction. It was a handy financial buffer that reduced the true cost of the charge. Well, that safety net is officially gone.

As of 1 July 2025, the ATO has removed the tax deductibility of interest charged on its debts, including GIC and SIC. This change hits anyone with an outstanding tax bill or an amended assessment right where it hurts. To give you an idea of the numbers, the GIC rate for the July to September 2025 quarter was a hefty 10.78% per annum, compounding every single day. You can read more about the ATO's debt and interest policies to see how they're pushing for timely payments.

Without the deduction, you now wear the full financial whack of these charges. What used to be a partially offset expense is now a direct blow to your bottom line. Every dollar of interest charged is now a dollar you've truly lost.

The takeaway is simple: GIC and SIC have gone from being a nuisance to a genuine financial threat. The risk is much, much higher now.

This new reality makes avoiding these charges absolutely critical. It pushes the importance of lodging accurately and paying on time from just "good practice" to an essential survival strategy. The focus has to switch from cure to prevention, because the old medicine of claiming a deduction is no longer on the shelf.

Why the ATO Changed the Rules on Interest Deductions

This big shift from the ATO wasn't a random decision pulled out of thin air. It was a deliberate move by the government, aimed squarely at making the Australian tax system fairer for everyone. At the end of the day, it's all about levelling the playing field.

For years, there was a strange imbalance. Taxpayers who did the right thing and paid on time got no extra benefit, but those who delayed could actually claim a deduction on the interest charges, effectively getting a discount on their late payment. This new rule is designed to put a stop to that.

Put simply, the government doesn't want businesses treating the ATO like a cheap bank. By getting rid of the deduction, the real cost of having a tax debt is now front and centre, pushing everyone towards paying their dues on time.

The Legal Foundation for the Change

The power behind this change comes from the Treasury Laws Amendment (Tax Incentives and Integrity) Act 2025. This piece of legislation, first flagged in the 2023–24 Mid-Year Economic and Fiscal Outlook, is what officially slammed the door on interest deductions ato charges for income years starting on or after 1 July 2025.

What this means is that taxpayers can no longer claim an income tax deduction for General Interest Charge (GIC) or Shortfall Interest Charge (SIC) incurred from that date. It doesn't even matter if the tax debt itself is from an earlier year. You can get a deeper dive into the legal nitty-gritty and how the law aims to improve tax system efficiency on dentons.com.

A new term you'll need to know is the crystallisation date. This is just the official date your notice of assessment is issued by the ATO, and it's now the line in the sand.

If your assessment is issued after July 1st, any interest that builds up from then on is not deductible. The timing of the original tax shortfall is irrelevant; what counts is when the interest is officially charged.

Understanding the ATO's Logic

This change really clarifies where the government stands on tax debt. The goals are pretty straightforward and will definitely change how businesses have to think about their finances.

- Promote Timely Payment: By making it more expensive to be late, the ATO is giving businesses a very strong nudge to lodge and pay when they're supposed to.

- Ensure Fairness: It scraps the loophole that gave late payers an unintended advantage over the compliant majority who pay on schedule.

- Improve System Integrity: This stops the tax system from being used as a casual line of credit, which was never what it was designed for.

Once you understand the "why," the rule change makes a lot more sense. It's not about punishing taxpayers; it's about reinforcing a core principle: tax obligations need to be met on time. For every Australian business owner, this shift makes proactive financial planning and keeping the lines of communication open with the ATO more critical than ever.

How These Changes Affect Your Bottom Line

Policy changes can feel a bit abstract, but the real question is always the same: what does this actually mean for my bank account? The short answer is that this rule change has a direct, and for many, significant impact on your finances. The days of treating ATO interest charges as a partially softened blow are officially over.

For small businesses that sometimes lean on ATO payment plans to get through a tight cash flow period, the price of that flexibility just went up. Similarly, if you're an individual who's been hit with an unexpected amended assessment, the financial sting is now much sharper. The bottom line is simple: every dollar of interest the ATO charges is now a dollar straight out of your pocket.

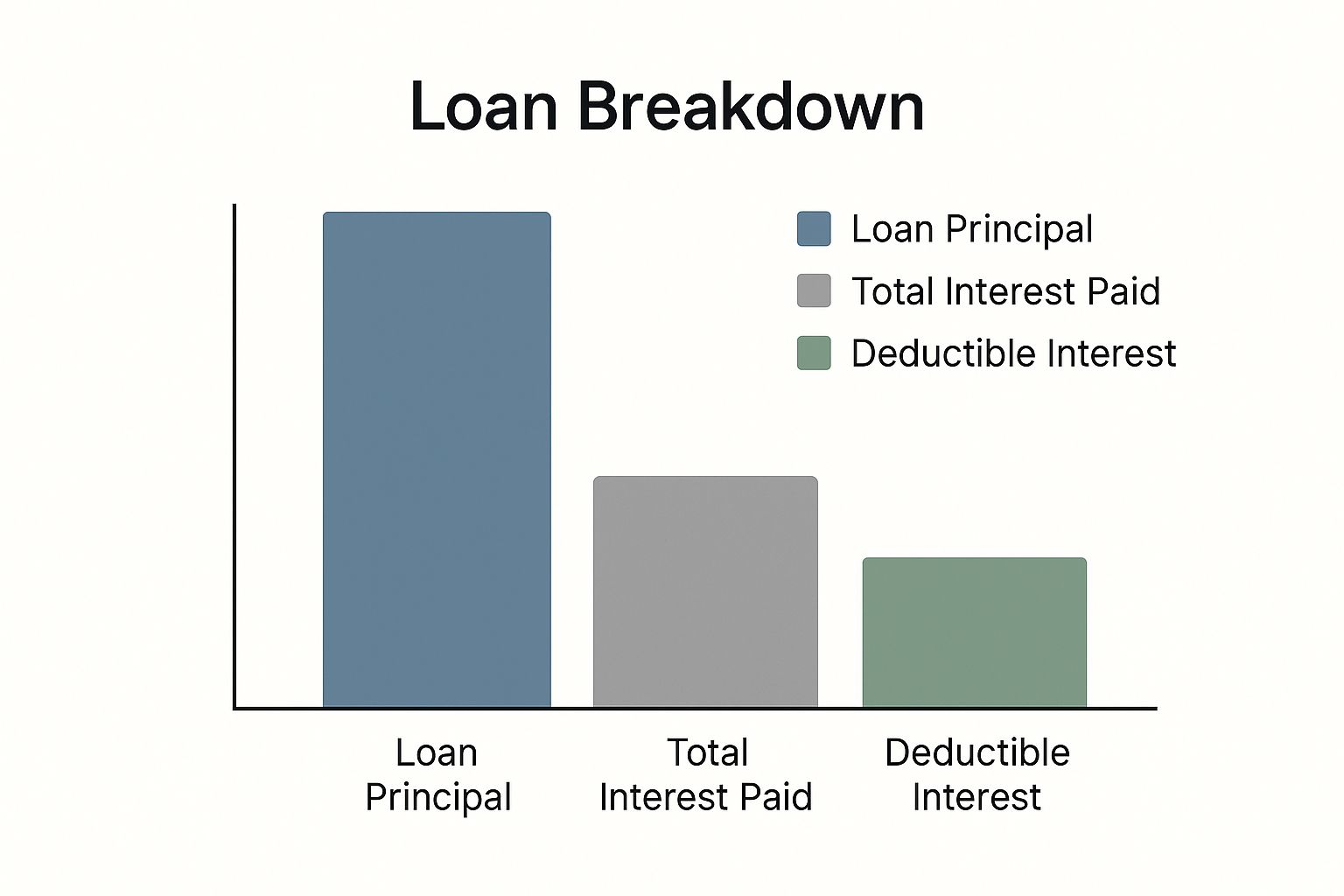

This infographic paints a clear picture. That deductible slice of interest, which used to lessen the overall financial burden, has now been completely removed.

The key takeaway here is that the total interest you pay now hits your net profit directly, with zero tax relief to cushion it.

The Real-World Dollar Difference

Let's put some real numbers to this to make it tangible. Imagine your business has a $20,000 tax debt and you've organised a payment plan.

- Before the Change: Let's say you racked up $2,000 in General Interest Charge (GIC). You could claim that $2,000 as a tax deduction. If your company pays tax at a 25% rate, this would have saved you $500 at tax time. So, the actual cost of that interest was only $1,500.

- After the Change: That same $2,000 in GIC is no longer deductible. You have to wear the full cost. This means your bottom line takes a $2,000 hit, which is a 33% increase in the effective cost of carrying that debt.

This shift means that carrying an ATO debt is now substantially more expensive. The financial incentive to pay on time has never been stronger, making proactive tax management and planning an absolutely crucial business activity.

To illustrate this even further, let's look at how this impacts a hypothetical $10,000 tax debt.

Before vs After: A Look at a Hypothetical ATO Debt

| Metric | Scenario Before the Change | Scenario After the Change |

|---|---|---|

| ATO Tax Debt | $10,000 | $10,000 |

| Annual GIC (at 10%) | $1,000 | $1,000 |

| Tax Deduction on GIC | $1,000 | $0 (No longer deductible) |

| Tax Savings (at 25% rate) | $250 | $0 |

| Effective Cost of Interest | $750 | $1,000 |

As the table shows, the true cost of borrowing from the ATO has jumped significantly. What was once a partially subsidised expense is now a full-cost item on your profit and loss statement.

Broader Impact on Financial Planning

This isn't just a minor tweak; it has a real ripple effect on cash flow and tax planning for Australian businesses. From 1 July 2025, the denial of interest deductions ato charges means an effective price hike on any overdue tax. With GIC rates hovering around 11.17% per annum and compounding daily, businesses now face the full, undiluted interest expense. Given how many small and medium businesses use ATO payment plans as a financial tool, this will force a major rethink of their financial management strategies.

Keeping track of these new financial realities means your reporting needs to be spot on. A robust system for comparing your planned budget against what's actually happening is essential. A fantastic resource for getting this right is A Guide to Budget vs Actual Reporting, which can help you monitor your financial performance with the precision this new environment demands. Getting a firm grip on these figures is the first step toward building a more resilient financial strategy.

Proactive Strategies to Avoid Non-Deductible Interest

Now that the rules on ATO interest charges have completely changed, shifting your mindset from reactive to proactive isn’t just a good idea—it’s essential. Knowledge is power, and this section explores actionable strategies to help you adapt. This is for general information only and is not intended to be financial advice.

The single most effective strategy is almost deceptively simple: lodge and pay on time. Preventing interest from building up in the first place is the only guaranteed way to sidestep the full, non-deductible hit.

Strengthen Your Financial Habits

The bedrock of paying tax on time is solid financial management. It all starts with tightening up your day-to-day bookkeeping and getting a real handle on your cash flow forecasting. Haphazard record-keeping can be a direct line to compliance headaches and unexpected tax bill surprises.

One of the most critical habits you can build is setting aside funds for your tax obligations as you earn the money. This involves not treating GST and PAYG withholding collections as part of your everyday working capital.

- Create a Separate Tax Savings Account: Consider opening a dedicated bank account specifically for tax. Make it a regular habit to transfer estimated GST and PAYG liabilities into it. This simple act quarantines the funds, so they aren't accidentally spent on operational costs.

- Improve Your Invoicing and Collections: The faster you get paid, the healthier your cash flow. It may be time to review your payment terms, chase overdue invoices promptly, and make it as easy as possible for clients to pay you.

- Review Your BAS Cycle: If you consistently feel the squeeze with quarterly BAS payments, it may be worth exploring a switch to a monthly cycle. While it means more frequent reporting, the smaller, more manageable payments can be a much better fit for your cash flow.

The goal is to turn tax from a periodic financial shock into a predictable, manageable business expense. When tax provisioning becomes a non-negotiable weekly or monthly task, you can eliminate that end-of-quarter scramble and reduce the risk of falling behind.

The Importance of Early Communication

Even the best-laid plans can go awry. Businesses can face unexpected cash flow dramas, and if you see a storm brewing and think you’ll struggle to make a tax payment, the absolute worst thing you can do is ignore the problem. The ATO is often more approachable and reasonable with taxpayers who are upfront and honest.

Reaching out to the ATO before a deadline passes shows you're taking responsibility. It can open up options that simply aren't on the table once the debt is officially overdue. This proactive communication is a massive part of managing your relationship with the tax office and minimising potential penalties.

If you find yourself in this position, you can request a payment plan. But it's vital to understand the new reality: while a payment arrangement helps you manage the debt and avoid more severe collection actions, any interest accrued on that plan will be fully non-deductible. It’s a tool to manage the debt, not a way to avoid the new, higher cost of carrying it.

Ultimately, mastering your finances and staying compliant is a complex job. For many business owners, navigating big changes like this is when they truly understand why every business needs an accountant. Getting professional guidance can help ensure you're not just reacting to new rules, but are strategically positioned to thrive within them.

Your Guide to Sound Record-Keeping and Compliance

When it comes to the ATO, the best defence is always a good offence. And that means meticulous preparation. With the ATO removing the buffer for deductible interest, how you keep your records is more critical than ever for managing your interest deductions ato exposure.

Think of robust documentation as your first line of defence. It backs up your tax position and lets you respond quickly to any ATO inquiries. This seriously minimises the risk of those dreaded amendments that can trigger non-deductible interest charges.

Essential Records to Maintain

Keeping organised documentation of all your income, expenses, and key transactions is just fundamental. For businesses looking to really nail their financial operations, a strategic guide to cloud accounting solutions can offer some great insights into modernising these processes.

Your compliance checklist may include:

- Detailed Expense Records: Keep all receipts, invoices, and bank statements that prove what you’re claiming.

- Income Statements: Maintain crystal-clear records of every dollar that comes in, from all sources.

- Asset Registers: You need to accurately document the purchase and sale of any business assets.

- Logbooks: For your car or any other asset that’s used for both business and personal reasons, you must keep a diligent, ATO-compliant logbook.

It's important to remember this article provides general information and isn't a substitute for professional tax advice. In this new tax environment, proactive and professional management is your strongest asset.

We can't stress this enough: it is wise to talk to a registered tax agent or a financial advisor. They're the only ones who can offer guidance that's properly tailored to your unique situation.

For more insights, feel free to explore our other resources on tax and compliance.

Got Questions About ATO Interest Deductions? We've Got Answers

Whenever the ATO changes the rules, it’s natural for questions to pop up. Let's clear up some of the common ones about the new stance on interest deductions.

What Happens to Interest Charged Before July 1st?

Good news here – the new rules don’t work backwards. Any General Interest Charge (GIC) or Shortfall Interest Charge (SIC) that was applied to your account before this new legislation kicked in is still deductible under the old rules, provided you were eligible at the time.

The change only targets interest that accrues from July 1st onwards.

Do These Changes Affect My Type of Business?

Yes, this one applies to everyone across the board. The removal of the tax deduction for GIC and SIC hits all taxpayers—individuals, sole traders, partnerships, trusts, and companies.

The ATO isn't making any exceptions based on your business structure.

Key Takeaway: It doesn't matter if you're a one-person show or a large company. If you are charged GIC or SIC after the changeover, you can't claim it as a tax deduction. This makes paying on time more crucial than ever for absolutely everyone.

What Should I Do if I Can't Pay My Tax on Time?

The best approach is generally to get in touch with the ATO early. Ignoring the issue and waiting for the debt to become overdue just limits your options and may invite tougher collection actions.

It's often a good idea to pick up the phone or have your tax professional reach out to explain your situation. You might be able to set up a payment plan to manage the debt in a structured way. But remember, any interest that racks up under that plan will be 100% non-deductible. Early communication is always your strongest move.

For more tips on staying on top of your obligations, check out our guide on how small business owners and individuals can navigate tax season.

Staying ahead of your tax obligations has never been more important. At Genesis Hub, we partner with businesses to lock down compliance, boost cash flow, and build a more secure financial future. Reach out for a free chat to see how we can help you. https://www.genesishub.com.au