Disclaimer: The content provided in this guide is for general informational purposes only. It is not intended to be, and should not be construed as, financial or tax advice. You should always consult with a qualified professional for advice tailored to your specific financial situation.

For any Aussie sole trader, understanding eligible business deductions can be key to managing your taxable income. The Australian Taxation Office (ATO) allows for claims on expenses that are directly tied to earning your income, everything from office stationery to travel costs, which can potentially lower your final tax bill.

For example, a freelance graphic designer who pulls in $120,000 a year but has $15,000 in legitimate business expenses will only be taxed on $105,000. That's a huge difference.

Your Guide to Sole Trader Tax Deductions

Trying to get your head around tax deductions can feel like you're learning a new language. But the main idea is actually quite simple. A deduction is not a direct cash refund. Instead, it can be seen as a discount on your total income before any tax gets calculated.

Why does the ATO allow this? Their goal is to tax your business's profit, not its total revenue. Every dollar you legitimately spend to run your business can eat into your profit, which in turn may reduce the amount of income the ATO can tax. It’s a foundational principle of our entire tax system.

The Three Golden Rules of Claiming

Before considering claiming an expense, you need to understand the three specific conditions set by the ATO. Getting these rules down pat is the first, most crucial step to managing your tax with confidence and making sure every claim you make is supportable.

These rules aren't just suggestions; they apply to absolutely everything, from a $5 box of pens to a $50,000 business vehicle.

"A valid business deduction isn't just an expense; it's a necessary cost incurred in the pursuit of generating income. If you can't connect the cost directly to your business activities, the ATO won't see it as deductible."

Essentially, you have to be able to show the expense was a necessary part of running your business. Before claiming anything, ask yourself if it meets these criteria. We've laid them out in a simple table to make it clear.

The Three Golden Rules of Claiming Deductions

| Rule | What It Means for You | Example |

|---|---|---|

| 1. The Expense Must Be for Your Business | The cost has to be directly linked to earning your income. You generally can't claim personal costs. | A caterer could claim the cost of ingredients for a client's event, but not their weekly family grocery shop. |

| 2. You Must Have Proof of Purchase | You need a record to prove you actually spent the money. No proof, no claim. It's that simple. | This is usually a tax invoice or receipt. A bank statement showing the transaction can also work in some situations. |

| 3. You Must Own the Record | If an expense is for both business and personal use, you can only claim the business portion. | You use your mobile phone 60% for work and 40% for personal calls. You can only claim 60% of your phone bill. |

While these rules provide a solid foundation, things can get complicated fast. For many sole traders, the moment they truly grasp why every business needs an accountant is the moment they feel more confident in managing their tax obligations and achieving peace of mind with the ATO.

Everyday Business Expenses You Can Claim

Knowing the ATO’s rules is one thing, but actually turning that knowledge into practice is where the real work happens. So many sole traders may miss out on potential deductions because they simply overlook the small, day-to-day costs that keep their business ticking over.

Learning to spot these claimable expenses is a skill, and it’s one that can have a direct impact on your bottom line.

Let's break these common costs down into a few simple categories. Think of them like buckets you can toss eligible receipts into all year long. The big ones are your home office costs, general admin expenses, and any money you spend on your own professional growth.

Each bucket holds a ton of potential claims you’re probably already paying for. A good habit is to ask yourself, "Did this expense help me earn my income?" If the answer is yes, you're on the right track.

Unpacking Your Home Office Costs

For the millions of Aussie sole traders working from home, the line between personal and business costs can feel a bit fuzzy. Thankfully, the ATO has clear guidelines on claiming a slice of your household running expenses. It's crucial to understand the two distinct types.

First up, you have running costs. These are the expenses tied to the actual use of your home for business—things like the work-related chunk of your electricity, gas, internet, and phone bills. You may also be able to claim the depreciation of your desk and chair, plus the cost of stationery and printer ink.

Then you have occupancy costs. These are linked to owning or renting your home, such as rent, mortgage interest, council rates, and home insurance. Claiming these can be trickier. It's generally only an option if your home is your main place of business and you have a dedicated area used only for work, like a separate studio or workshop.

Be careful here. Claiming occupancy costs may trigger Capital Gains Tax (CGT) issues when you eventually sell your home. This is a significant consideration, so it's something that often requires professional advice before you proceed.

Here's a quick checklist of common home office running costs that may be claimable:

- Utilities: The business-use percentage of your electricity and gas bills for lighting, heating, and cooling your workspace.

- Connectivity: A portion of your home internet and mobile phone bills, based on a reasonable estimate of your work usage.

- Supplies: The full cost of things like printer paper, ink cartridges, pens, and notebooks that you use for business.

- Equipment Depreciation: The decline in value of office furniture like your desk and chair, and gear like your computer and printer.

Identifying Admin and Operating Expenses

Moving beyond the home office, there's a whole world of other daily costs that are essential to keeping your business running. These are often easier to claim as 100% tax deductible because they rarely have a personal use component. Think of them as the engine oil for your business—without them, things would grind to a halt pretty fast.

These expenses cover everything from the software you rely on to the fees you pay just to keep your business name registered. Keeping tabs on these is usually straightforward, as you can often claim the full amount shown on the invoice.

For instance, a subscription to your accounting software is a clear-cut business expense. The same goes for the annual fee you pay to ASIC for your business name registration – it’s directly linked to your ability to trade.

Here are some common operating expenses to keep an eye out for:

- Software and Subscriptions: Costs for accounting software (like Xero or MYOB), project management tools (like Asana), and industry-specific apps.

- Bank Fees: Any monthly account-keeping fees or transaction charges on your dedicated business bank account.

- Professional Services: Fees paid to your accountant, bookkeeper, or a lawyer for business-related advice.

- Insurance: Premiums for your business insurance policies, like public liability or professional indemnity cover.

Investing in Your Professional Growth

Lastly, don’t forget that any money spent on maintaining or sharpening your professional skills could be another valuable tax deduction. The ATO allows claims for self-education expenses as long as there's a direct link to your current income-earning activities.

This means you may be able to claim a course to upgrade your skills in your existing field, but not a course to retrain for a completely new career. For example, a graphic designer might be able to claim a course on a new animation software, but they likely couldn't claim a course to become a chef.

These investments in yourself are vital for staying sharp and competitive, and thankfully, they're recognised as a legitimate cost of doing business.

Look out for opportunities to claim:

- Training Courses: Fees for workshops, seminars, and courses that build on your professional expertise.

- Memberships and Subscriptions: The cost of joining professional associations or subscribing to trade journals.

- Licensing: Any fees needed to maintain a professional licence or registration that's essential for your work.

- Industry Events: Tickets to conferences and trade shows that are directly relevant to your business.

Navigating Vehicle and Travel Expense Claims

For a huge number of Australian sole traders, the car isn’t just for getting from A to B—it's a fundamental part of the business. It’s no surprise then that vehicle expenses are one of the biggest potential tax deductions you can claim. But be aware, it's also an area the ATO watches closely. Getting your claims right is key to managing your tax position without attracting unwanted attention.

When it comes to your car, the ATO provides two ways to calculate what you can claim. The method you choose will really depend on how much you use your car for work and, frankly, how much paperwork you're prepared to do. Making the right choice here can make a serious difference to your tax bill.

Choosing Your Method for Car Expenses

First up, you have the cents per kilometre method. This one is the simple, no-fuss option. It lets you claim a set rate for every single business-related kilometre you drive, but it's capped at a maximum of 5,000 kilometres per car, each year. For the 2023-24 financial year, that rate is 85 cents per kilometre.

The beauty of this method is its simplicity. You don’t have to hoard receipts for every drop of petrol or every oil change. All you need is a way to justify the business kilometres you’re claiming, like a simple diary logging your work trips. It's a fantastic choice if you only use your car for business now and then.

Your other option is the logbook method. Now, this one is more involved, but it often leads to a larger deduction, especially for those who practically live on the road for their business. The big advantage? There's no 5,000-kilometre limit.

With this approach, you'll need to keep a detailed logbook for a solid 12-week period. This helps you work out the exact percentage of your car's use that is for business. Once you have that magic number, you can claim that percentage of all your car’s actual running costs. We’re talking fuel, insurance, rego, servicing, and even the depreciation in its value.

Think of it this way: The cents per kilometre method is a quick estimate. The logbook method is a precise calculation. If your business has you constantly behind the wheel, the extra effort of the logbook method will almost certainly pay off.

Mastering the ATO-Compliant Logbook

A proper logbook is your golden ticket for claiming a larger chunk of your vehicle expenses. To be ATO-compliant, it needs to run for 12 consecutive weeks and capture some key details for every single business trip. The good news is that one logbook can be valid for up to five years, as long as your driving patterns stay roughly the same.

Here's exactly what you need to record for each entry:

- Dates: The start and end dates of your 12-week logbook period.

- Odometer Readings: The reading on your car’s odometer when you start and finish the logbook period.

- Total Kilometres: The total number of kilometres your car travelled during those 12 weeks.

- Journey Details: For every business trip, you must note the date, the start and end odometer readings, how many kilometres you drove, and a clear reason for the trip (e.g., "Client meeting at XYZ Corp" or "Travel to supplier warehouse").

Claiming Other Business Travel Expenses

Your tax deductions for sole traders in Australia don't stop with your car. Whenever you travel overnight for business, a whole new world of claimable expenses may open up. This can include things like flights, public transport, taxis or ride-sharing, and your accommodation.

The critical rule here is to separate business from pleasure. Let's say you go to Sydney for five days—three for a conference and two for sightseeing. You can only claim the costs that relate to those three business days. This is where meticulous records become your best friend. A travel diary and receipts with notes on them are absolutely non-negotiable if you need to prove the business portion of your trip to the ATO.

Claiming Assets and High-Value Equipment

Not every business purchase is as straightforward as a ream of paper or a box of pens. So, what happens when you invest in something more substantial, like a new laptop, specialised tools for your trade, or a professional camera?

The ATO treats these high-value items differently, and understanding the distinction is crucial for correctly managing your tax deductions for sole traders in Australia.

Instead of claiming the full cost in one hit, these bigger purchases are often seen as business assets. Think of an asset as something with a bit of staying power—it provides a lasting benefit to your business, helping you earn income over several years, not just on the day you buy it. How you claim these items really comes down to their cost and the specific ATO rules for that financial year.

The Power of the Instant Asset Write-Off

One of the best tools in a sole trader's kit can be the instant asset write-off. This scheme is brilliant—it lets you claim an immediate, full deduction for the business portion of an eligible asset in the same year you buy and start using it. It essentially turns a long-term asset into an immediate expense, giving you a healthy tax benefit straight away.

The eligibility threshold for this write-off can change, so it's always smart to check the ATO's current rules. For example, if the threshold is $20,000, and you buy a new work computer for $3,500, you may be able to claim the full $3,500 as a deduction on that year's tax return (as long as it's used 100% for business, of course).

This can be a powerful strategy for managing your cash flow. By bringing the deduction forward, you lower your taxable income for the current year, which may free up funds to pump straight back into your business.

Immediate Expense vs Depreciating Asset

It can be tricky to know which category a purchase falls into. This table breaks down the key differences to help you figure out how to treat your business spending.

| Type of Purchase | What It Is | How You Claim It | Example |

|---|---|---|---|

| Immediate Expense | A day-to-day running cost that gets used up quickly. | Claim the full business-use portion in the same financial year you buy it. | Stationery, software subscriptions, printer ink. |

| Depreciating Asset | A significant item that provides value to your business over multiple years. | Claim a portion of its value (depreciation) each year over its 'effective life'. | A work vehicle, specialised machinery, office furniture. |

Ultimately, immediate expenses are for the "here and now," while depreciating assets are about claiming a long-term investment over its useful lifespan.

Understanding Depreciation for Larger Assets

But what if an asset costs more than the instant asset write-off threshold? You can't just claim the whole lot at once. Instead, you claim its decline in value over time through a process called depreciation.

Think of depreciation like this: a brand-new piece of machinery won't be worth the same amount in five years as it is today. It gets used, suffers a bit of wear and tear, and becomes less valuable over its effective life. Depreciation is simply the ATO's way of letting you claim a portion of that value loss as a tax deduction each year.

The ATO provides detailed guidance on the effective life of thousands of different assets, which helps you calculate your annual claim. For instance, a professional-grade camera might have an effective life of five years. You would then claim a piece of its cost each year for those five years, reflecting its slow decline in value as you use it to earn income.

Making Record-Keeping Work for You

Whether you're writing an asset off instantly or depreciating it over several years, your record-keeping has to be spot on. It's non-negotiable. Solid records are the backbone of every single tax claim, and making the switch from paper to digital can save you a mountain of time, money, and stress.

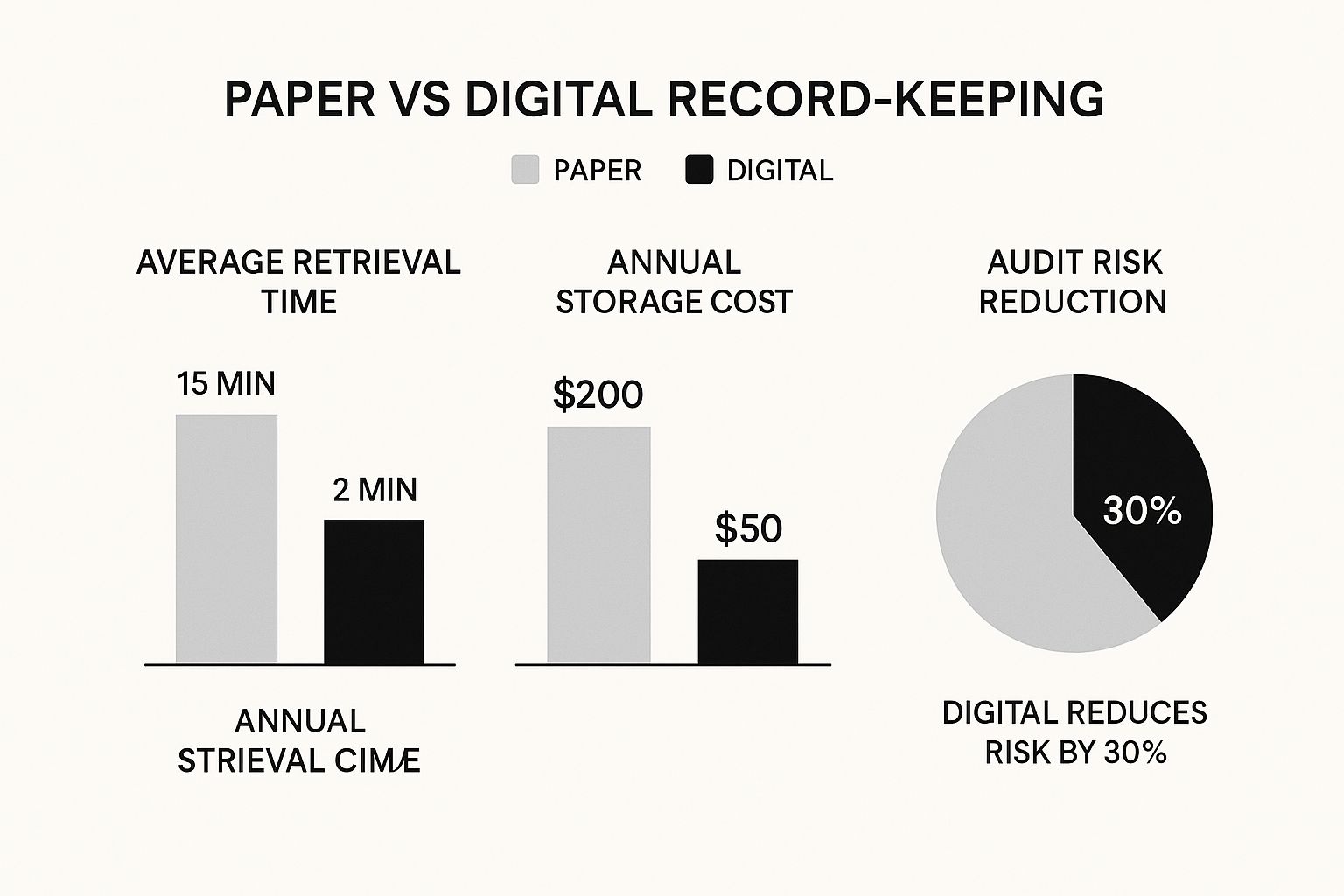

This infographic paints a pretty clear picture when comparing digital versus traditional paper-based methods.

The numbers don't lie. Digital systems can massively cut down the time and cost involved in managing your finances, all while potentially lowering your audit risk. It's a no-brainer.

Mastering Your Record-Keeping Habits

Think of it this way: strong records are the absolute foundation of every single tax claim you make. Without solid proof of purchase, even the most legitimate business expense simply can't be deducted. Your records are the evidence you'd present to the ATO; without them, your case just doesn't hold up.

Building a simple, stress-free record-keeping system is one of the smartest moves you can make as a sole trader. This isn't about getting lost in complex spreadsheets or drowning in paperwork. It’s about building a consistent habit that can save you a massive headache at tax time and gives you total peace of mind if the ATO ever comes knocking.

What the ATO Considers a Valid Record

When the tax office talks about "records," they mean more than just a crumpled receipt you found in your glovebox. For a record to be valid, it needs to have specific details that prove the expense was real and directly related to your business. Getting this right is crucial for ensuring your tax deductions for sole traders in Australia are all above board.

For a record to pass the test, it generally needs to show:

- The name of the supplier (who you paid).

- The amount of the expense (in Aussie dollars, of course).

- The nature of the goods or services (what you actually bought).

- The date the expense was paid (to place it in the right financial year).

- The date of the document (like the invoice date).

While a proper tax invoice is the gold standard, other documents like bank statements showing the transaction details can also work as proof, especially for those smaller, everyday purchases.

The golden rule is simple: if you can't prove you spent the money on a legitimate business cost, you generally can't claim it. Meticulous records aren't just good practice; they're your number one defence in an audit.

Choosing Your Record-Keeping System

How you organise your paperwork is completely up to you, but consistency is the name of the game. The goal is to pick a method you’ll actually stick with, whether that’s digital, physical, or a bit of both. Don’t overcomplicate things—a simple system you use regularly is a million times better than a complex one you barely touch.

Here are a few popular options to consider:

- Digital Accounting Software: Tools like Xero, MYOB, or Rounded are built for this. You can link your business bank account, snap photos of receipts with your phone, and let the software categorise everything. It can make tax time so much easier.

- A Structured Spreadsheet: A well-organised spreadsheet can be surprisingly effective. Create separate tabs for different expense types (like vehicle, office supplies, or subscriptions) and make it a weekly habit to update it with new purchases, making sure to include all the key details the ATO wants.

- Dedicated Digital Folders: If you prefer a more manual digital approach, create folders on your computer or cloud storage for each financial year. Inside, have sub-folders for each month where you can save scanned copies or photos of your receipts and invoices.

The Five-Year Rule is Non-Negotiable

One of the most critical parts of record-keeping is how long you keep everything. The ATO legally requires you to hold onto your business records for five years from the date you lodge your tax return. This isn’t a suggestion; it’s a hard-and-fast rule.

This five-year window gives the ATO time to review past returns if they need to. Having your records neatly organised and easy to find means you can respond to any questions quickly and confidently. For more expert insights into staying on the right side of the tax man, you can explore our resources on tax and compliance for business owners.

Building a simple weekly habit of filing your records now will save you from a world of stress down the track.

Bringing It All Together at Tax Time

After a year of carefully tracking your income and expenses, tax time is where all that hard work really pays off. This is the moment you connect the dots—every receipt you’ve saved, every kilometre you’ve logged—and see it come together on your individual tax return.

As a sole trader, you don’t need to file a separate tax return for your business. Everything gets reported within your personal return, which is a huge reason why this structure is so popular in Australia.

In fact, sole traders are the backbone of our small business community, with recent data showing there are over 822,873 of us operating across the country. The beauty of this setup is its simplicity; you use your personal Tax File Number (TFN) for everything, so there’s no need to juggle a separate business TFN.

Calculating Your Net Business Profit

The whole process really hinges on one simple formula. The Australian Taxation Office (ATO) doesn't tax your total revenue; it’s only interested in your profit. Understanding this is the key to understanding how your tax deductions for sole traders Australia actually work.

Here’s the basic calculation that sits at the heart of it all:

- Start with Your Total Business Income: This is every dollar your business earned during the financial year, before you take out a single expense.

- Subtract Your Accumulated Deductions: Tally up every single eligible business expense you've claimed—from your home office costs and vehicle expenses to the depreciation on your assets.

- The Result is Your Net Business Profit: This final number is what the ATO views as your taxable business income.

This net profit figure then gets added to any other income you’ve earned (like a salary from a part-time job or some investment income) to work out your total taxable income for the year. That’s the amount your final tax bill is calculated on.

From Stress to a Straightforward Process

When you keep clear, organised records throughout the year, lodging your return stops feeling like a dreaded chore and becomes more of a straightforward admin task. You’re no longer frantically digging through shoeboxes for receipts or trying to guess your expenses; you're just confidently transferring well-documented figures into your tax form.

This proactive approach not only helps you claim every deduction you may be entitled to but also gives you a crystal-clear financial snapshot of how your business performed. Consistent preparation is what can turn tax-time anxiety into year-end confidence. If you're looking for more strategies, you might find our guide on how small business owners and individuals can navigate tax season helpful.

Important Disclaimer: The information in this guide is for general guidance only and shouldn’t be taken as financial or tax advice. Tax laws are complex, they change, and your personal circumstances can make a big difference to your obligations.

For guidance that’s tailored to your specific business situation, it is always recommended to chat with a registered tax agent or a qualified accountant. They can give you professional assistance to make sure you’re staying compliant with the ATO while making the most of your financial position.

Got Questions? We've Got Answers

When you're wading through the rules for sole trader tax deductions in Australia, a few common questions always seem to pop up. Let's tackle some of the ones heard most often from business owners.

Think of this as a starting point, not a substitute for professional advice tailored to your specific situation.

Can I Claim Expenses from Before My Business Officially Started?

Yes, in many cases. You can often claim what the tax world calls 'pre-business' or 'black hole' expenses. These are the costs you incurred getting your business off the ground, like paying for professional advice or the government fees to register your business name.

You don't typically claim these initial costs in one go. The ATO generally allows you to spread the claim over five years. The key is to keep flawless records of every single dollar you spent before you even made your first sale.

What Should I Do If I Make a Mistake on My Tax Return?

First off, don't panic. Finding a mistake on a tax return you've already lodged is more common than you think, and it's usually straightforward to fix. The best course of action is to address it straight away and lodge an amendment with the ATO. For returns from the last two years, you can typically do this online.

Being upfront is always the better move than hoping the ATO doesn't spot it. When you correct a mistake yourself, you can often sidestep penalties and interest charges. Honesty is the best policy here.

Are Client Entertainment and Meal Expenses Tax Deductible?

This is a big one, and the ATO's position is firm: client entertainment costs are generally not tax deductible. That means shouting a client a coffee, taking them out for lunch, or tickets to a footy game are likely considered private expenses.

Even if you're talking business the whole time, the tax office sees these as private expenses. A main exception? If you're travelling for work and have to stay away from home overnight. In that specific scenario, your own meals usually count as a claimable travel expense.

How Do I Claim a Deduction for My Mobile Phone Bill?

You can claim the business-use portion of your phone bill, but the trick is figuring out what that percentage is. You need a fair and reasonable way to calculate how much you use your phone for earning your income.

A common method is to go through your phone bills for a typical four-week period. Track your calls, data, and texts to work out the split between business and personal use. You can then apply that percentage to your phone bills for the rest of the financial year.

It's critical to hang on to the records from that four-week analysis. That's your proof, showing the ATO exactly how you landed on your business-use percentage if they ever ask.

Trying to get your head around your tax obligations can feel like a full-time job in itself. You don't have to figure it all out alone. The team at Genesis Hub specialises in helping sole traders stay compliant and make the most of their deductions. Book a free consultation today and see how we can help your business thrive.