For most Aussies tackling their own tax return, the big date to remember is 31 October. This is the standard deadline the Australian Taxation Office (ATO) sets after the financial year wraps up on 30 June. Missing this can cause a lot of unnecessary stress and even lead to penalties.

Understanding Australia's Key Tax Deadlines

Getting your head around tax season can feel a bit like learning a new board game, but the main rule is pretty straightforward. Australia's financial year runs from 1 July to 30 June, and this period sets the timeline for all your tax obligations. Once the financial year is over, you have a set amount of time to report your income and claim any deductions.

Officially, the deadline for individuals lodging their own income tax return is 31 October each year. So, for the financial year ending 30 June 2025, you'd need to have your return filed by 31 October 2025 if you're doing it yourself.

But here’s the thing: the tax return deadline in Australia isn't the same for everyone. Your own situation and, more importantly, how you lodge your return can completely change this date.

How Tax Agents Change The Game

One of the biggest factors that can shift your deadline is whether you use a registered tax agent. If you get a professional on board before the 31 October cut-off, you can often get a much later lodgement date, sometimes stretching well into the next year. This is because tax agents have special lodgement programs with the ATO.

This extra time is a major reason why so many people choose to work with a pro. It gives you some breathing room to pull all your documents together and make sure everything is spot-on, without the pressure of that October deadline hanging over you. For more tips on this, check out our guide on how small business owners and individuals can navigate tax season.

The main thing to remember is this: the 31 October deadline is really for people who are preparing and lodging their own tax returns. If you team up with a registered tax agent, your deadline will almost certainly be much later.

To make things clearer, let's look at the most important deadlines you'll come across.

Key Australian Tax Deadlines at a Glance

Here’s a simple table summarising the most common tax deadlines. It's a great quick reference, but remember, everyone's situation is different, so it's always best to confirm the dates that apply to you.

| Filer Type | Key Deadline | Important Notes |

|---|---|---|

| Individuals (Self-Lodging) | 31 October | This is the standard deadline if you are lodging your own tax return. |

| Individuals (Using a Tax Agent) | 15 May (of the following year) | This is the most common extended deadline, but you must be on your agent's list by 31 October. |

| Companies & Trusts (Certain types) | 28 February (of the following year) | Applies to some businesses. Your tax agent will confirm your specific date. |

| Businesses (BAS Lodgements) | Quarterly or Monthly | Business Activity Statements (BAS) have their own separate deadlines throughout the year. |

These dates can shift slightly year to year, especially if they fall on a weekend. The key is to either lodge by 31 October yourself or get in touch with a tax agent before then to lock in an extension. Please keep in mind this is general guidance and does not constitute tax advice for your specific circumstances.

Choosing Your Path: Self-Lodgement Or Tax Agent

When it comes time to file your taxes, you’re at a fork in the road. This first choice you make directly shapes your tax return deadline in Australia. Will you take the wheel and lodge it yourself through myGov, or will you hand the keys to a registered tax agent? This isn't just about convenience—it sets your entire lodgement calendar.

Going the DIY route means you're locked into the firm 31 October deadline. This path gives you full control and is a solid option if your financial affairs are pretty straightforward and you're comfortable managing them yourself. It's the hands-on approach.

But bringing in a professional changes the game completely.

The Tax Agent Advantage

Partnering with a registered tax agent before that 31 October cut-off is your ticket into their special lodgement program with the ATO. This is a huge benefit, as it usually pushes your filing deadline out to 15 May of the following year. That extension gives you some much-needed breathing room to gather every last document, making sure nothing gets missed and your return is spot-on.

This extra time is a lifesaver if your finances are a bit more complex—think investments, a rental property, or business income. A good agent doesn’t just lodge your return; they can identify deductions you might have overlooked, which could improve your tax outcome. Whether you go for a local firm or an online service is really up to you. We break down the pros and cons in our article comparing a tax accountant near you versus an online accountant.

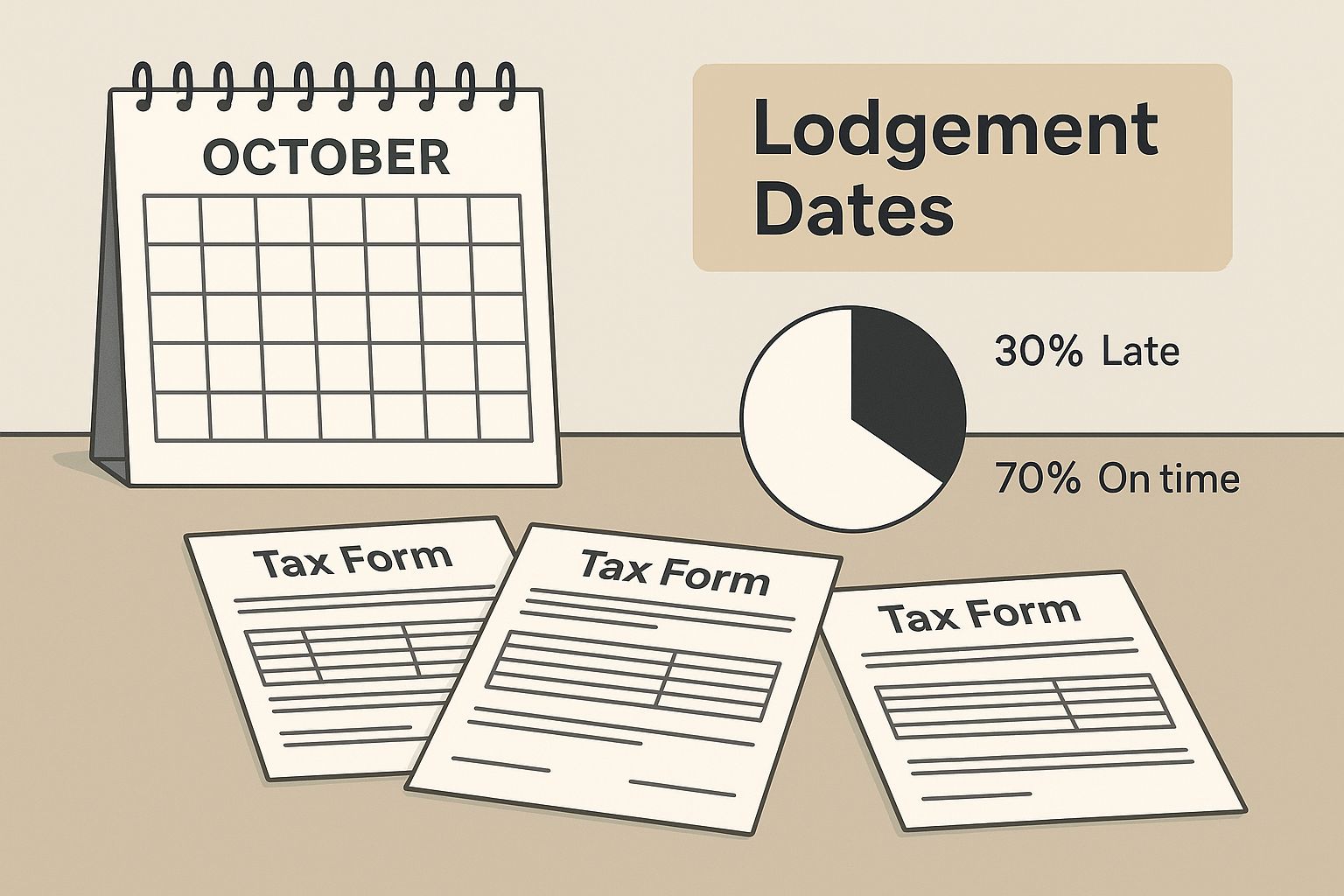

This infographic shows just how different the timelines are depending on your choice.

As you can see, the path you take dramatically shifts the dates on your tax calendar.

To help you decide, let's lay out the key differences side-by-side.

Comparing Self-Lodgement vs. Using a Tax Agent

| Feature | Self-Lodgement (via myGov) | Registered Tax Agent |

|---|---|---|

| Standard Deadline | 31 October (no exceptions) | Usually extended to 15 May the next year |

| Expertise Required | You need to understand your tax obligations and deductions | The agent provides expertise and tax knowledge |

| Time Commitment | You're responsible for all data entry and review | Minimal time needed from you; the agent handles the heavy lifting |

| Cost | Free (besides your time) | Fees apply for their professional service |

| Deduction Maximisation | Relies on your own knowledge of what you can claim | Agents are experts at identifying all eligible deductions |

| Best For | Simple tax affairs (e.g., salary/wages only) | Complex situations, business owners, or anyone wanting peace of mind |

This table makes it clear: the choice isn't just about who clicks the "submit" button. It's about trading control and cost for expertise and a more generous timeline.

Making an Informed Decision

So, what do most Aussies do? Recent stats from the Australian Taxation Office (ATO) show it's a pretty even split. In one tax season, over 3.5 million people lodged their own returns, while more than 2.8 million went with a registered tax agent. It shows that a huge number of taxpayers see the value in getting professional help and securing those later deadlines.

Ultimately, your decision should come down to two things: how complex your finances are and how confident you feel tackling your taxes.

The most critical step is deciding before 31 October. If you miss that date, you're locked out of the agent-lodgement extension. You'll be stuck with the standard deadline and facing any potential late-lodgement penalties all on your own.

Think about which path makes more sense for you. Are you after simplicity and control, or do you prefer professional guidance and a more relaxed timeline? Your answer will map out your next steps as the financial year wraps up.

Why The Financial Year Shapes Your Tax Deadline

To really get your head around the tax return deadline in Australia, you first need to understand the calendar it's built on. Unlike many other countries, Australia’s financial year runs from 1 July to 30 June. This isn't just some random date range; it's the very foundation of our national tax system and directly dictates when your return is due.

This structure gives everyone a clear start and end point for tracking income and expenses. When the clock strikes midnight on 30 June, it signals the End of Financial Year (EOFY). The books are closed on one period, and a new one begins. Think of it like the final whistle in a footy match; once it's over, it's time to tally the score.

This annual cycle is exactly why the standard deadline for lodging your own tax return is 31 October. It provides a neat four-month window—July, August, September, and October—to get your documents in order, finalise your figures, and submit everything to the ATO.

The Historical Roots of Our Tax Calendar

So, why the 1 July to 30 June calendar? It actually has a long history, dating all the way back to the establishment of the Commonwealth in 1901. It was chosen for a very practical reason: to line up with the government's budget planning. This allowed the parliamentary budget cycle, which usually happens in May and June, to work in sync with the national fiscal calendar. You can dive deeper into the history of Australia's financial year on evolvetogrow.com.au.

This century-old decision still shapes our economy today. It’s why we see a mad rush of EOFY sales as businesses try to clear stock before their books close, and it’s why individuals and companies scramble to finalise their accounts around the same time.

Understanding this 'why'—that the tax deadline is directly tied to a century-old government framework—makes the whole process feel more logical. It’s not just an arbitrary date but a key part of Australia’s economic rhythm.

How It Impacts Your Planning

Knowing that the entire tax system revolves around this 1 July to 30 June period can help you plan far more effectively. It really drives home why keeping good records throughout the year is so much better than scrambling in the final weeks before the October deadline.

Here’s a practical way to think about it:

- January to June: This is your prep time. Make sure your records are up-to-date and start thinking about any financial moves before 30 June, such as making extra super contributions or buying work-related assets.

- July to October: This is your lodgement window. It's the time to gather all your necessary paperwork, like income statements from your employer and receipts for any deductions you plan to claim.

Ultimately, this calendar creates a predictable and consistent cycle for millions of Aussie taxpayers. Getting familiar with its structure is the first step toward managing your tax obligations with confidence and staying well ahead of that crucial tax return deadline in Australia.

What Happens If You Miss The Deadline

So, you’ve missed the tax deadline. Before you start to panic, it's important to deal with it quickly. The Australian Taxation Office (ATO) has a process for late lodgements, and understanding how it works will help you get back on track.

The main thing you'll hear about is the Failure to Lodge (FTL) on time penalty. This isn't some random figure plucked out of thin air; it’s calculated based on how late your return actually is. The ATO applies one penalty unit for every 28-day period (or part of a period) your return is overdue, capping it at a maximum of five penalty units.

The dollar value of a penalty unit changes over time, so the final amount can vary. It's a system designed to give everyone a nudge to lodge on time.

Penalties and Interest Charges Explained

When you lodge late, two things can happen, and it all depends on whether you owe the ATO money or if they owe you.

First, there’s the FTL penalty we just mentioned, which is purely for not getting your paperwork in on time. Second is the General Interest Charge (GIC). This charge is applied to any tax you owe and it starts racking up from the original due date until you’ve paid the bill in full.

Here’s a simple way to think about it:

- The FTL penalty is the fine for being late.

- The GIC is the interest you pay on the money you owe.

Now, for a bit of good news. If you’re actually due a refund, you generally won't be hit with an FTL penalty. The ATO's main concern is collecting tax that’s owed to the government. That said, lodging late year after year, even when you're getting money back, can still attract the wrong kind of attention and mess with your compliance history.

The key takeaway is this: A late return with tax to pay will likely cop both a penalty and interest. A late return with a refund coming your way usually avoids these financial hits, but it's still a habit you want to avoid.

The ATO Can Be Understanding

It’s also important to remember the ATO is run by humans. They can be pretty reasonable, especially if you’ve always done the right thing in the past. If you have a solid reason for the delay—like a serious illness, family tragedy, or even a natural disaster—they may agree to remit (which is just a fancy word for cancel) any penalties.

The absolute best thing you can do is talk to the ATO or your tax agent the moment you know you're going to be late. Don’t just bury your head in the sand and hope it goes away. Being proactive shows you’re taking your responsibilities seriously, and that can make all the difference in how they handle your situation. Just remember, this is general information, not financial advice, so you should always consider your own circumstances.

How To Request A Lodgement Extension

While the Australian Taxation Office (ATO) has pretty firm deadlines, they’re not completely inflexible. They understand that life can throw a curveball that makes meeting the standard tax return deadline in Australia feel impossible. For these situations, you can request a lodgement deferral, but it's reserved for specific, serious circumstances.

Don't think of it like asking your teacher for a bit more time on an assignment. It's much more like needing a medical certificate to miss a final exam. The ATO is looking for reasons that are genuinely outside of your control.

They'll typically consider extensions for situations like:

- Serious illness or accident: This applies whether it’s you or a close family member you’re caring for.

- A death in the family: The loss of a loved one understandably disrupts your ability to handle financial matters.

- Impact of a natural disaster: If you've been caught up in events like bushfires or floods, the ATO is generally very understanding.

- Loss of essential documents: This could be due to something like a fire, theft, or another unforeseen event that destroyed your records.

The Right Way To Apply

If there's one golden rule here, it's this: be proactive. You absolutely must contact the ATO before your lodgement deadline passes. Trying to ask for more time after the due date has come and gone really weakens your case and will likely lead to penalties.

To make your request, you’ll generally need to get in touch with the ATO directly. Be ready to explain your circumstances clearly and have evidence on hand in case they ask for it. This might be a doctor’s note, official reports, or other documents that back up your claim.

Now, here’s a critical point that trips a lot of people up.

An extension to lodge is not an extension to pay. If you owe tax, the original payment due date still stands. Interest charges will start racking up on any unpaid amount from that date, no matter when you end up lodging your return.

What An Extension Means For You

If the ATO approves your request, they’ll give you a new, later date to get your return in. This can provide some much-needed breathing room to sort out your personal situation without the added stress of a looming tax deadline.

But if things are complicated or you just feel overwhelmed, bringing in a tax agent is often your best move. Even if you've missed the 31 October deadline to get on their client list, an agent can still talk to the ATO for you and help navigate the whole extension process. Just remember, this is general information, not specific advice for your personal situation.

Your Checklist For An On-Time Tax Return

Turning tax-time stress into a feeling of control is easier than you might think. By getting organised well ahead of time, you can tackle your obligations with confidence, long before the tax return deadline in Australia is even on your radar. This simple checklist is your game plan for a smooth, on-time lodgement.

Think of the entire financial year, from 1 July to 30 June, as your preparation window. The more you organise during this period, the simpler your tax return will be when the time comes to lodge.

Step 1: Gather Your Income Details

First things first, let's pull together all the information about the money you’ve earned. For most people, this is pretty straightforward. Employers report this info directly to the ATO, and you’ll often find it pre-filled in your tax return.

You’re going to need:

- Income Statements: These used to be called group certificates. They give you a summary of your salary or wages and show how much tax your employer has already withheld.

- Bank Interest: Grab any statements that show the interest you’ve earned on your savings accounts throughout the financial year.

- Other Income: This is a catch-all for any other earnings. Think government payments, investment dividends, rental property income, or even money from a side hustle. If you're a sole trader, knowing how to handle these earnings is critical. You can learn more about this by reading our small business guide on owners drawings.

Step 2: Collect All Your Deductions

This is where your good record-keeping really pays off. Deductions can reduce your taxable income, which can mean a smaller tax bill or a larger refund. It’s all about claiming what you’re genuinely entitled to.

Remember the three golden rules for claiming any deduction: you must have spent the money yourself (and not been paid back), the expense must be directly related to earning your income, and you need a record to prove it.

Your deduction checklist could include things like:

- Work-Related Expenses: Keep receipts for things like work uniforms, self-education courses, or any tools and equipment you had to buy for your job.

- Home Office Expenses: If you've been working from home, track your hours. This lets you calculate your claim using either the ATO’s set rate or the more detailed actual cost method.

- Donations: Got receipts for any donations you made to registered charities? Get them ready.

- Cost of Managing Tax Affairs: Yep, you can even claim the fee you paid your tax agent for preparing last year’s return.

Step 3: Finalise Your Details

Before you hit that lodge button, do one last check to make sure all your personal information is spot-on. Something as simple as an out-of-date address or old bank account details can cause major delays, which is especially frustrating if you’re waiting on a refund.

Double-check that your Tax File Number (TFN), name, address, and bank account details on file with the ATO are all current. This one simple step helps ensure a completely smooth process from start to finish.

A Few Common Questions About Tax Deadlines

Trying to get your head around the rules for the tax return deadline in Australia can definitely throw up a few questions. Let's run through some of the most common ones we hear, giving you quick, clear answers to clear up any confusion.

Just remember, this is general information. Your own situation will always dictate the right move, so it's not a substitute for proper tax advice.

Do I Need To Lodge If I Earn Below The Tax-Free Threshold?

This is a great question. Even if you've earned less than the $18,200 tax-free threshold, you might still need to lodge a return. A classic example is when your employer has withheld tax from your pay throughout the year. If that's happened, lodging is the only way to get that money back in your pocket as a refund.

You might also have to lodge to be eligible for certain government benefits or to report income from other sources. The ATO has a handy online tool to help you figure out if you need to lodge.

What Is The Deadline For First-Time Lodgers?

The deadline is the same for everyone, whether it’s your first tax return or you’re a seasoned pro. If you’re lodging it yourself, that deadline is locked in at 31 October.

Being new to the tax game doesn't get you a free pass or an automatic extension. If you want a later deadline, you need to get on board with a registered tax agent before the 31 October cut-off, just like everybody else.

Does The Deadline Change If I Am Overseas?

No, your tax obligations don't take a holiday just because you do. The tax return deadline in Australia stays put even if you're out of the country. The ATO generally won't consider a vacation as a valid reason for an extension.

The best thing to do is plan ahead. You can either get your return lodged early before you jet off, or you can sign up with a tax agent who can handle the lodgement for you while you're away.

Navigating tax deadlines can feel like a maze, but you don't have to do it alone. The team at Genesis Hub specialises in making tax simple for small businesses and individuals across Melbourne. We make sure you meet every deadline and claim every deduction you're entitled to. Contact us for a free consultation today.

Article created using Outrank