When you type "accountant tax near me" into a search bar, you're not just looking for a number-cruncher. The best accountant for you is a strategic partner, someone who can tackle everything from your BAS statements to your long-term wealth creation goals.

But before you can find that person, you need to know exactly what you’re looking for.

Defining Your Needs in a Local Tax Accountant

Before diving into your search, it pays to take a moment and map out what you actually need. Having a clear idea of the job makes it infinitely easier to spot the right professional and saves you from wasting time with those who aren't a good fit. Think of it as writing a job description before you start interviewing candidates.

The Australian accounting services market is booming, expected to hit a massive USD 23.24 billion by 2030. This explosion is fuelled by a growing demand for specialised, outsourced accounting services, which is great news for you—it means more choice than ever. You can see the full breakdown in MarkNtel Advisors' research on the Australian accounting industry.

Distinguish Between Immediate and Future Goals

First things first, let's separate your urgent, must-do tasks from your bigger, long-term ambitions. Your needs will likely fall into a few key areas, and getting clear on them will focus your search.

- Tax Compliance: Are you just looking for someone to lodge your individual tax return or BAS statement on time and without any fuss? This is the baseline for most accountants.

- Business Operations: If you're running a small business, you might need help with the daily grind—things like bookkeeping, payroll, and managing cash flow. This requires a more hands-on relationship.

- Strategic Advice: Or maybe you're thinking bigger. Are you planning to buy an investment property, start a new company, or structure your finances for serious growth? For this, you need a forward-thinking advisor, not just a tax agent.

Once you're clear on what success looks like—whether that’s a stress-free tax season or a solid five-year growth plan—you can find an accountant who is actually equipped to get you there.

Consider Your Industry and Complexity

Finding an accountant with real experience in your field can be a game-changer. They bring insights that a generalist just won't have.

Someone who knows the specific tax considerations available for tradies, for example, will be far more valuable than an accountant who doesn't. The same goes for professionals who understand the unique challenges of e-commerce or property investment—their guidance will just be more relevant.

You'll also want to decide if you need someone local or if you're comfortable working with someone online. This often comes down to how you prefer to communicate and whether you value face-to-face meetings. We've got a full breakdown of this in our article on choosing between a tax accountant close to you versus an online accountant.

Once you've got a shortlist of potential accountants, it's time to do some real digging. This is the part where you separate the genuine professionals from the simple tax preparers, ensuring the person you trust with your finances is properly qualified, registered, and actually knows their stuff.

The absolute first check? Make sure they are registered. In Australia, it's a legal requirement that anyone providing tax agent services for a fee must be registered with the Tax Practitioners Board (TPB). This is not optional. A quick search on the TPB Register will confirm their status, giving you peace of mind that they meet the baseline standards for qualifications and experience.

Look Beyond the Basics

While TPB registration is the mandatory first step, you'll want to look for professional memberships to get a better sense of an accountant’s dedication to their craft. These aren't just letters after their name; they show a commitment to higher education, ongoing professional development, and sticking to a strict code of ethics.

To help you decode the jargon, here’s a quick rundown of the main credentials you’ll see in Australia.

Key Credentials and What They Mean

| Credential / Membership | What It Signifies | Why It Matters for You |

|---|---|---|

| CPA Australia | A Certified Practising Accountant has broad expertise in business, finance, and accounting principles. | Great for all-around business advice, financial planning, and strategic insights beyond just tax. |

| CA ANZ | A Chartered Accountant has completed a rigorous program, often specialising in complex accounting and financial advice. | A strong indicator of deep technical knowledge, often suited for businesses with more complex structures or investment needs. |

| IPA | A Member of the Institute of Public Accountants often has a strong focus on the needs of small and medium-sized businesses. | Ideal if you're a sole trader or small business owner looking for practical, tailored support. |

| Registered Tax Agent | This person is legally registered with the Tax Practitioners Board (TPB) to handle tax matters. | This is the non-negotiable minimum. It means they're legally allowed to prepare and lodge your tax returns. |

Seeing one of the top three professional memberships is a huge plus. It tells you the accountant has voluntarily signed up for higher standards, which is always a good sign of quality and reliability.

Dig Into Their Practical Experience

An accountant can look fantastic on paper, but do they have the right kind of experience for you? This is where you need to ask some pointed questions. You're looking for proof they've successfully helped people or businesses in a similar boat.

For instance, if you're a tradie, ask them if they're up-to-date on industry-specific tax rules for tools, vehicles, or apprentice costs. If you run an e-commerce store, quiz them on their experience with GST on international sales or integrating with inventory software. The more specific their experience, the more value they can add.

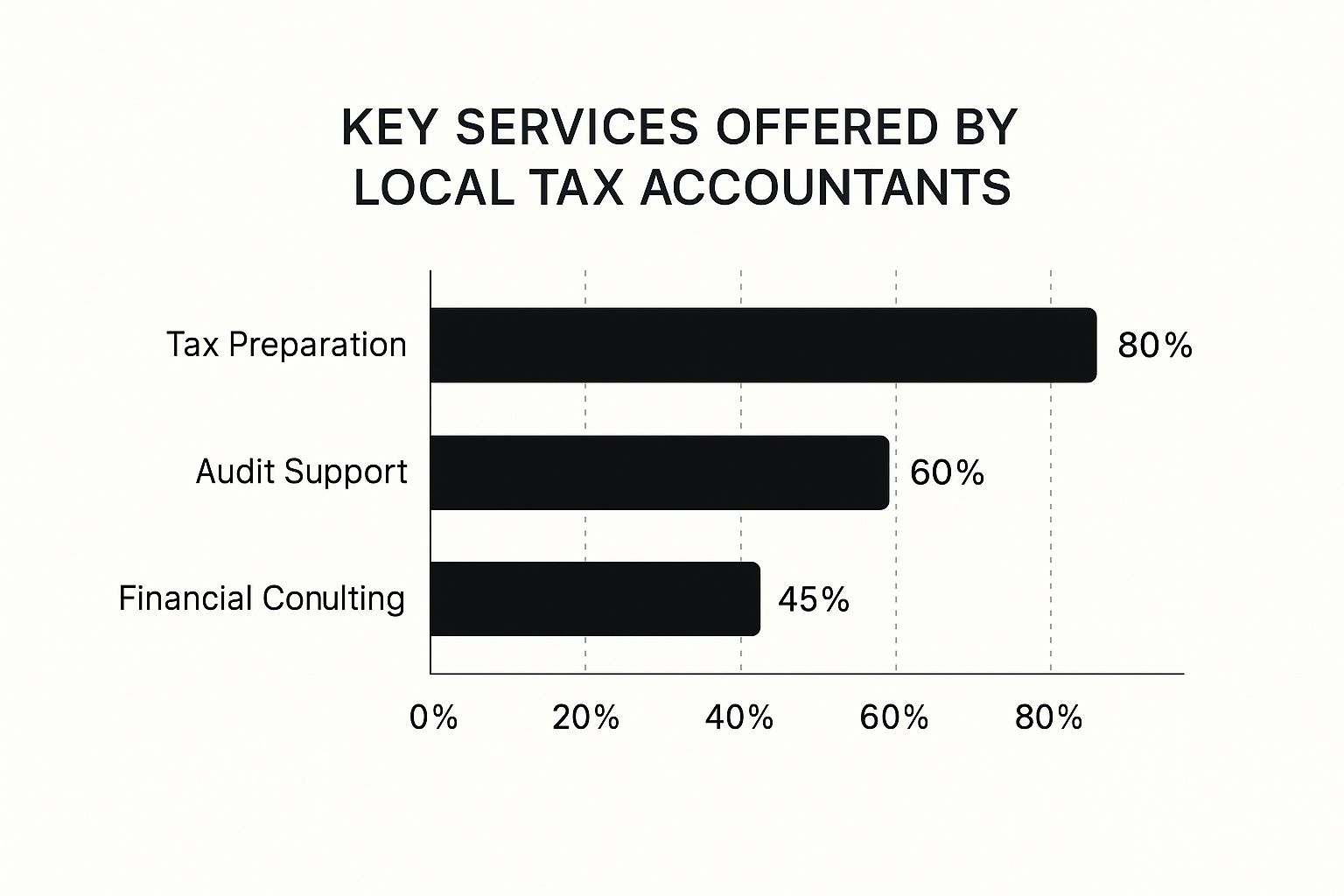

This data shows that while 80% of accountants handle tax returns, fewer offer the strategic financial consulting that can really help a business grow.

A great accountant isn't just someone who can lodge a return. They're a credentialed professional with proven experience that matches my specific world, whether that's running a cafe or managing a property portfolio.

Ultimately, you want to find a professional who offers the exact mix of services you need. Taking a look at a firm's accounting and advisory services will give you a clear idea of what they can do, from basic tax compliance to high-level growth strategies. Don't be shy about asking for case studies or examples of how they’ve helped clients with challenges just like yours.

Why Modern Accounting Technology Matters

When you're searching for a local tax accountant today, you're looking for more than just someone who knows tax law inside and out. You need a partner who's fluent in the financial technology that actually runs a modern business. Let's be honest, an accountant still clinging to old-school spreadsheets and manual data entry just can't give you the speed, accuracy, or strategic advice you need to get ahead.

Proficiency with cloud-based accounting software like Xero, MYOB, or QuickBooks isn't just a nice-to-have anymore—it's the absolute baseline. These platforms link directly to your bank accounts, automating the grunt work of data entry and giving you a live, up-to-the-minute picture of your business's financial health. This connection is the foundation for making sharp, timely decisions.

From Bookkeeper to Strategic Advisor

A truly tech-savvy accountant uses these tools to go way beyond simple compliance work. They take that real-time data and turn it into advice you can actually use, shifting the focus from just recording what happened last month to actively shaping your financial future.

This means they can offer services that were once the exclusive domain of big corporations, like:

- Live Cash Flow Forecasting: They can model different 'what-if' scenarios to predict where your cash will be in the coming months. This helps you see potential shortfalls before they happen or spot the perfect time to invest in growth.

- Custom Performance Dashboards: Forget waiting for a dense quarterly report. You can get instant, visual snapshots of the metrics that matter most to you, like profit margins, revenue growth, and key expenses.

- Data-Driven Growth Strategies: By analysing your financial patterns, they can pinpoint which services are making you the most money or flag areas where costs are quietly creeping up.

A great accountant uses technology not just to do the books, but to read the story your numbers are telling. They help you understand that story so you can write a better next chapter for your business.

This shift is changing the entire industry. Accounting firms are embracing digital tools and AI-driven automation, fundamentally altering how tax and accounting services are delivered. Cloud platforms are leading the charge, enabling instant data access and automated bookkeeping that slashes errors and sharpens financial forecasting. It's no surprise that around 80% of Australian accounting firms have seen a spike in client demand for strategic advisory services that go far beyond just lodging a tax return. You can learn more about these key accounting trends shaping Australia.

Key Questions to Ask About Technology

When you're sitting down with a potential accountant, don't just ask if they use technology. You need to dig deeper to understand how they use it to benefit you. Their answers will tell you everything you need to know about whether they're a forward-thinking partner or just ticking a box.

Here are a few specific questions to get the conversation rolling:

- Which accounting software do you specialise in? You want an expert in the platform you're already using (or plan to use), not someone who just dabbles in it.

- How do you use this software to give proactive advice? Ask them for a real-world example of how they used financial data to help a client make a better business decision.

- What other apps or tools do you integrate with? A good accountant will know about the whole ecosystem of tools for receipt tracking, payroll, or inventory management that can make your life a whole lot easier.

Choosing an accountant who truly embraces modern technology isn't an expense; it's an investment in your own efficiency and growth. It ensures you have a partner who is equipped for the future, not stuck in the past.

Decoding Fee Structures to Find the Best Value

When you're searching for a "tax accountant near me", it's easy to get fixated on the price tag. But here’s a critical point to consider: the cheapest accountant is almost never the best value. Think of a great accountant as an investment, one that should pay for itself by saving you time, stress, and, most importantly, helping you manage your tax obligations effectively.

This mindset is more important than ever, as fees are climbing. A recent survey by Ignition found that a whopping 80% of Australian accounting firms are planning to raise their prices. We're seeing a big jump in firms charging over AUD 300 for a basic individual tax return, and more than 23% are now quoting over AUD 1,000 for company returns. You can dig into the numbers in this breakdown of fee trends across Australian accounting firms.

Common Pricing Models You Will Encounter

As you start getting quotes, you’ll run into a few different ways accountants structure their fees. Each has its pros and cons, and what’s right for you really depends on what you need and how much you hate surprise bills.

- Hourly Rates: The old-school approach. You pay for the time your accountant spends on your file. This can be great for a one-off question or a quick job, but it can also become a runaway train if your situation gets complicated unexpectedly.

- Fixed-Fee Packages: This is becoming the go-to model, especially for regular work like BAS lodgements or annual tax returns. You agree on a price upfront, so you know exactly what you’re in for. It gives you budget certainty and incentivises the accountant to be efficient.

- Value-Based Pricing: This one’s a bit different. The fee isn’t tied to hours worked but to the value the service provides to you. You'll often see this for high-level strategic advice where an accountant’s insight could provide significant financial benefits.

How to Compare Proposals Effectively

When those proposals land in your inbox, resist the urge to just scan for the lowest number at the bottom. A cheaper quote might just cover the bare minimum compliance work. A slightly higher fee could include crucial advisory meetings that set you up for a better financial future.

Drill down into what’s included and, just as importantly, what’s not. Don't be shy about asking what costs extra. Will you be billed for every ten-minute phone call? Are software subscriptions included? A transparent, professional proposal will lay all this out clearly.

A cheap accountant lodges your tax return. A valuable accountant understands your situation and helps you manage your tax obligations effectively year after year.

Put it this way: an accountant who charges $500 but misses key details could end up causing issues. Another who charges $800 but provides thorough, accurate work offers fantastic long-term value. The goal isn’t to find the cheapest service, but the professional whose expertise gives you peace of mind.

Making the Final Choice and Starting the Partnership

You’ve done the hard yards. The research is complete, you've checked the credentials, and you've weighed up the proposals. Now you’re probably looking at one or two top contenders from your search for an "accountant tax near me."

This last step isn’t about crunching more numbers. It's about people. It’s about finding a professional you can build a strong, trusting relationship with for years to come.

The All-Important Initial Consultation

The initial chat is really a two-way interview. Sure, they’re sizing up your business needs, but you’re also getting a feel for whether they're the right long-term partner for you. This meeting is your golden opportunity to see if your personalities and communication styles actually click.

Think about how you like to work. Do you prefer someone who picks up the phone with proactive advice, or are you happy with a simple email check-in each quarter? A mismatch here is a recipe for frustration. A solid accountant-client relationship is built on clear, consistent communication.

Pay close attention to how they handle your questions during this meeting. Do they take the time to explain things clearly, or do they rush you with confusing jargon? The right accountant will make complex tax issues feel manageable, empowering you to make smarter financial decisions.

To help you get the most out of this chat, here are a few key questions I always suggest asking:

- Who will be my main point of contact? It’s important to know if you'll be dealing with the senior accountant you're meeting or if your file will be handed off to a junior team member.

- What’s your usual response time for calls or emails? This sets clear expectations from day one and shows how much they prioritise client service.

- How do you keep clients in the loop about tax deadlines or new legislation? A proactive accountant will have a system, like a newsletter or personal reminders.

- Can you tell me about a tricky situation you helped a similar business with? Their answer will give you real insight into their problem-solving skills and hands-on experience.

Many good firms know how important this initial meeting is for building trust. To see what this process feels like, you can always schedule a no-obligation consultation with an advisory team and experience it for yourself.

At the end of the day, trust your gut. All the qualifications on paper don’t mean a thing if you don’t feel comfortable and confident in their ability to support you. This partnership is vital for your financial health, so that sense of trust is completely non-negotiable.

Your Onboarding Checklist for a Smooth Start

Once you’ve made your choice and signed the engagement letter, it’s time for onboarding. Being prepared here makes the transition seamless and gets your new accountant up to speed in no time. A smooth start really sets the tone for an efficient and productive partnership.

To get the ball rolling, try to have these essential documents ready to go:

- Proof of Identity: Your driver’s licence or passport will do.

- Business Details: Have your ABN/ACN, business structure documents, and bank details handy.

- Past Financial Records: At least the last two years of financial statements and tax returns are ideal.

- Software Access: Login details for your accounting software, like Xero or MYOB.

- ATO Correspondence: Any recent letters or notices from the Australian Taxation Office.

Having this information ready from the get-go shows you're organised and helps your new accountant start delivering value from day one.

Got Questions? We've Got Answers

Stepping into the world of tax and finance can feel a bit confusing, and it's natural to have questions. Here are some straightforward answers to the things we get asked most often, designed to give you a bit more confidence as you look for the right accountant.

Just a heads-up, this is general info and not official tax advice.

When Is It Time to Ditch the Software and Hire an Accountant?

Tax software is great for simple, cookie-cutter returns. But the second your financial life gets a bit more interesting, the value of a real, human expert becomes crystal clear.

It's probably time to call in a professional if you're:

- Starting a new business or thinking about changing your current structure (like from sole trader to a company).

- Buying or selling an investment property.

- Trying to figure out capital gains from shares or other assets.

- Running a Self-Managed Super Fund (SMSF).

Here's the thing software can't do: strategic planning. A good accountant doesn't just fill in boxes. They look at your whole picture to structure your finances in a way that helps you manage your tax obligations and stay on the right side of the ATO. That kind of guidance can prevent a lot of stress down the line.

What's the Real Difference Between a Bookkeeper and an Accountant?

This one trips a lot of people up, but their roles are quite different, though they work hand-in-hand.

A bookkeeper is all about the day-to-day. They’re in the trenches, recording every financial transaction. Think sales, purchases, payroll, and making sure your bank accounts line up with your records. They keep your financial data clean and up-to-date.

An accountant takes that organised data and uses it for big-picture strategy. They analyse the information your bookkeeper has prepared to create financial statements, lodge tax returns, and offer high-level advice on your overall financial health and future direction.

Think of it this way: a bookkeeper is the meticulous historian of your finances, recording what happened. An accountant is the strategist who uses that history to help you build a more profitable future.

What Do I Need to Bring to My First Meeting with an Accountant?

Coming prepared to that first chat makes a world of difference. It means you can get straight into the important stuff instead of wasting time chasing down basic info.

Try to pull these things together:

- ID: Something government-issued like your driver’s licence will do the trick.

- Last Year's Tax Return: This gives the accountant a quick snapshot of your financial history.

- Income Info: Any payment summaries from jobs, Centrelink statements, or details on other money you've earned.

- Deduction Records: A collection of receipts and records for work-related costs, investment property expenses, and your private health insurance statement.

- For Business Owners: If you're running a business, you'll also want your ABN/ACN, past financial statements, and maybe access to your accounting software like Xero or MYOB.

Is a Local Accountant Really Better Than a Remote One?

Honestly, this boils down to what works for you. There’s no single right answer.

A local accountant is fantastic if you value sitting down with someone face-to-face. For many, that in-person connection is key to building trust, especially when you're talking about complex financial topics. They also tend to have a great feel for the local business scene.

But remote services offer a ton of flexibility and can be just as good, as long as you're comfortable chatting over the phone, email, or video calls.

The most important thing isn't where they are, but whether they have the right expertise, get back to you in a timely manner, and have a service style that just clicks with yours.

Ready to stop Googling "accountant tax near me" and find a partner who’s genuinely invested in your success? Genesis Hub provides clear, practical support for small businesses and individuals across Melbourne. Book your free consultation today!