To really get your head around calculating GST in Australia, it's helpful to start with the basics. At its core, it's a straightforward 10% tax tacked onto the price of most goods and services. For a business, this means adding GST to your sales invoices and, on the flip side, claiming credits for the GST you pay on your business expenses. The key is to manage this flow of tax correctly to stay on top of your obligations to the Australian Taxation Office (ATO).

Your Quick Guide to Australian GST

Before we jump into the formulas, it’s worth taking a moment to properly understand the core concepts. Getting these fundamentals right from the get-go can make the whole process a lot less painful. Think of this not as complex tax advice, but as a clear, simple overview to help you get started.

The system is built around a simple, flat rate. In Australia, the Goods and Services Tax (GST) is a 10% value-added tax applied to almost everything. Keep in mind, though, that some things are GST-free—like basic food items, health services, and education—so GST does not apply to those items.

With around 72% of Australian businesses registered for GST, knowing your way around the system is essential for staying compliant. For a deeper dive, you can find more detailed information on Australian tax calculators.

The Essentials of GST Registration

Not every business needs to register for GST from day one. The main trigger is your business turnover.

You must register for GST if:

- Your business has a GST turnover (your gross income minus any GST) of $75,000 or more.

- Your non-profit organisation has a GST turnover of $150,000 or more.

- You're a taxi or rideshare driver, regardless of your turnover.

Once you meet the relevant threshold, registration is compulsory. From that point on, you are required to charge GST on your taxable sales, but you also become eligible to claim credits for the GST you pay on business purchases.

Core Concepts You Need to Know

Getting comfortable with a few key terms is the secret to managing your GST obligations without tearing your hair out. It helps you make sense of invoices, receipts, and your Business Activity Statement (BAS).

Disclaimer: The information provided in this guide is for general informational purposes only and does not constitute professional tax advice. You should consult with a qualified accountant or tax professional for advice tailored to your specific business situation.

To help you get familiar with the lingo, I’ve put together a quick reference table breaking down the most common terms you'll see.

Key GST Terms Explained Simply

Here’s a quick reference table to help you understand the key GST terms used throughout this guide.

| Term | Simple Explanation |

|---|---|

| Taxable Sale | A sale of goods or services where GST is charged. Most sales in Australia fall into this category. |

| GST-Free Sale | A sale of specific goods or services that are exempt from GST, such as basic foods or medical services. |

| Input Tax Credit | A credit you can claim for the GST included in the price of goods or services you buy for your business. |

| Business Activity Statement (BAS) | The form used to report and pay GST (and other taxes) to the ATO, usually on a quarterly basis. |

| GST Turnover | Your gross business income, excluding any GST you've collected from your customers. |

Getting these terms down will make navigating your tax obligations a whole lot easier.

The Two Core Formulas for GST Calculation

When you strip away all the jargon, getting your Goods and Services Tax right in Australia really just comes down to two calculations you'll use day in and day out. One is for when you're pricing something for a customer (adding the GST on top), and the other is for when you're looking at a receipt for something you've bought (finding the GST hidden inside).

If you can get your head around these two simple formulas, you're well on your way to accurate invoices and making sure you claim back every GST credit you're entitled to.

Formula 1: Adding GST to a Price

This is the one you’ll use constantly when you're sending out invoices. You know your pre-tax price for a product or service, and you just need to add the correct amount of GST to get the final total your customer will pay.

The method is simple: you just multiply your pre-tax price by 10% (or 0.1) to work out the GST. Then, you tack that amount onto your original price.

The Formula:

Pre-Tax Price x 0.1 = GST Amount

Pre-Tax Price + GST Amount = Final Price (Inclusive of GST)

For a quicker way to the finish line, you can just multiply your pre-tax price by 1.1. This does both steps at once, calculating the GST and adding it to the original price in a single move.

A Practical Example: A Freelance Designer's Quote

Let's say you're a web designer in Melbourne quoting $2,000 for a new small business website. That's your price before tax. To send out a proper tax invoice, you'll need to calculate and add the GST.

Here's how it breaks down:

- Calculate the GST:

$2,000 (Pre-Tax Price) x 0.10 = $200 (GST Amount) - Calculate the Final Price:

$2,000 (Pre-Tax Price) + $200 (GST Amount) = $2,200 (Final Price)

On the invoice you send to the client, you'll clearly show the $2,000 base price, the $200 GST, and the final total of $2,200. Being this transparent is just good practice for everyone's records.

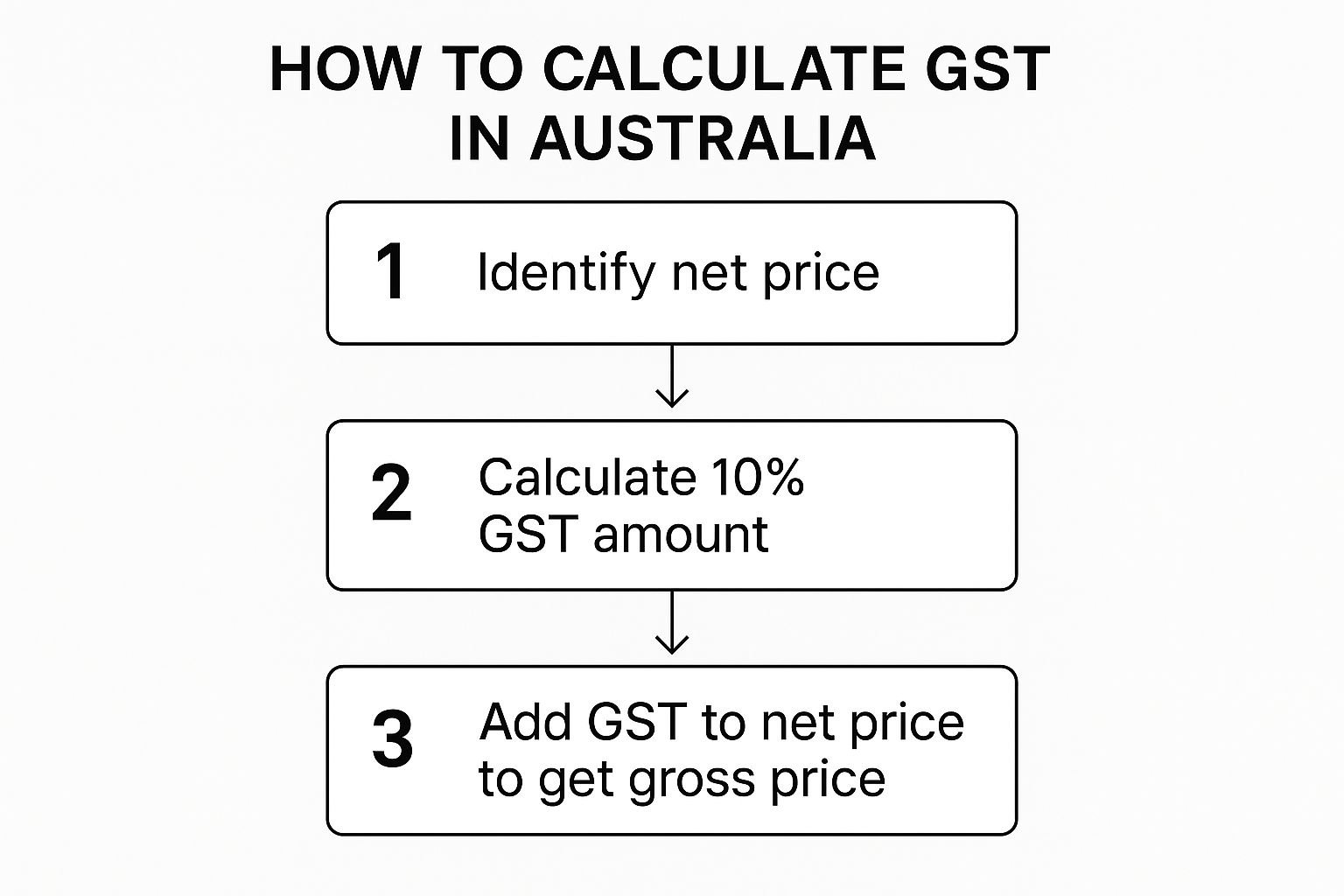

This simple infographic shows you exactly how that works.

As you can see, it’s a straightforward three-step process: start with your base price, figure out the tax, and add them together for the total.

Formula 2: Finding the GST in a Total Price

The second key formula is just the reverse. This is what you'll use when you're looking at a receipt for a business expense and need to figure out how much GST was baked into the price you paid. This is the amount you can potentially claim back as a credit on your Business Activity Statement (BAS).

To find the GST component of a total price, you simply divide the total amount by 11.

The Formula:

Total Price (Inclusive of GST) / 11 = GST Amount

Why divide by 11? It’s because the total price you paid represents 110% of the original cost (100% for the item itself, plus the 10% GST). Dividing the total by 11 correctly isolates that 10% GST portion.

Key Takeaway: A common mistake is to try to find the included GST by multiplying the total price by 10%. This will give you the wrong figures every time. The correct method is to always divide the total GST-inclusive price by 11.

A Practical Example: A Cafe Owner's Supply Run

Imagine you run a cafe and you’ve just purchased a new commercial coffee grinder for $1,650. The receipt shows this as the final price, and you know GST is included. To claim your input tax credit, you need to pull out the exact GST amount.

Here's how you'd apply the formula:

- Calculate the GST:

$1,650 (Total Price) / 11 = $150 (GST Amount)

So, of the $1,650 you paid, $150 of it was GST. That $150 is the magic number you'll use when lodging your BAS to claim a credit against the GST you've collected from customers. The actual pre-tax cost of that grinder was $1,500.

Knowing how to do this simple calculation is absolutely vital for managing your cash flow. It directly impacts how much GST you either pay to the ATO or get back as a refund, ensuring you claim every dollar you're entitled to. Over a year, that can make a real difference to your bottom line.

Integrating GST into Your Business Accounting

Knowing the formulas for a single sale is one thing, but plugging GST into your entire financial system is where you really take control. It’s about making GST a natural part of your business's financial rhythm, not just a frantic task you tackle every quarter.

Good GST management connects your day-to-day sales with your ATO reporting. Think of it as a constant process of tracking, recording, and balancing the tax you collect against the tax you pay on expenses.

This screenshot from the ATO's website is the main portal for businesses dealing with their GST obligations. It's the central hub for registration, reporting, and lodging your BAS, which highlights just how important it is to have your books in order before you start interacting with them.

Choosing Your GST Accounting Method

When it comes to tracking GST, the ATO allows businesses to use one of two main methods. The method you choose can have a real impact on when you report GST and how you manage your cash flow, so it’s a decision worth understanding.

The two methods are cash accounting and accrual accounting. With cash accounting, you only account for GST on your BAS once the money has actually hit your bank account. The accrual method, on the other hand, requires you to report GST the moment an invoice is sent out, whether you've been paid or not.

Most small businesses with a turnover under $10 million are eligible to use the cash method. It can be beneficial from a cash flow perspective, as you aren't paying GST to the ATO on income you haven't even received yet.

The Power of GST Credits

One of the most crucial parts of handling GST is understanding and claiming GST credits (often called input tax credits). This is how you get back the GST you've spent and reduce the amount you owe the ATO.

A GST credit is simply a claim for the GST included in the price of things you buy for your business. For every dollar of GST you pay on legitimate business expenses—from office supplies and software to fuel for the ute—you can claim that dollar back.

Important Reminder: To claim a GST credit on any purchase over $82.50 (including GST), you must have a valid tax invoice from your supplier. This is a key ATO requirement and a perfect example of why sharp record-keeping is so vital.

This system is designed so that the final tax is paid by the end consumer, not by the businesses in the supply chain. Your role is to collect the tax for the government and then use the credits from your own expenses to offset what you've collected.

Putting It All Together for Your BAS

Your Business Activity Statement (BAS) is where it all comes together. This is the form you use to report and pay the net GST to the ATO. The core calculation is pretty straightforward:

- Total GST Collected on Sales (from your customer invoices)

- Minus Total GST Credits Claimed (from your business expense receipts)

- Equals Net GST Payable or Refundable

If you collected more GST than you paid, you owe the difference to the ATO. If you paid more GST on your expenses than you collected from sales, the ATO will give you a refund. Simple as that.

This reporting cycle, which is usually quarterly for most small businesses, is exactly why consistent bookkeeping is a must. Trying to sort through a shoebox of faded receipts at the end of the quarter is a recipe for stress and, worse, missed claims.

Using accounting software makes this whole process much smoother. But while software is a massive help, understanding the principles behind it is key. This is why every business needs an accountant—they can provide clarity and help ensure your systems are set up correctly from day one.

Navigating Real-World GST Scenarios

Knowing the basic formulas is a solid start, but business is rarely that simple. The real test comes when you have to apply those rules to the day-to-day situations that land on your desk. Running a business isn't a textbook problem; it’s about juggling complex transactions, mixed sales, and big-ticket purchases.

This is where we get practical. Let’s walk through a few common scenarios you’re likely to face. Getting a grip on these will help you manage your GST obligations with confidence.

Creating a Compliant Tax Invoice

One of the first things to master is issuing a valid tax invoice. This document is far more than just a bill—it's a legal record the ATO requires from both you and your customer to account for GST correctly. It's important to get it right.

A compliant tax invoice needs to clearly show the GST amount as a separate figure or include a statement like "Total price includes GST." Let’s say you’re a marketing consultant wrapping up a project.

Scenario: A Marketing Consultant's Invoice

- Service Fee (Pre-Tax): $3,000

- GST Calculation: $3,000 x 0.10 = $300

- Total Amount Due: $3,000 + $300 = $3,300

Your invoice must spell this out. It should show the base price of $3,000, a separate line for GST of $300, and the final total of $3,300. This makes it crystal clear for your client (assuming they're a GST-registered business) that they can claim that $300 back as a GST credit.

Handling a Mixed Sale with Taxable and GST-Free Items

Now, things get a bit more interesting. What happens when you sell a mix of taxable and GST-free items? This is a daily reality for businesses like cafes, grocery stores, or gift basket companies. You can't just slap 10% on the total sale; you have to break it down.

Imagine you run a gourmet food store putting together a hamper.

Scenario: A Gourmet Hamper Sale

Inside the hamper, you have:

- A bottle of local wine (taxable): $30

- A box of luxury chocolates (taxable): $20

- A loaf of artisan bread (GST-free): $8

- A jar of local honey (GST-free): $12

To work out the GST, you first need to split the items into their respective groups.

- Total Taxable Items: $30 (wine) + $20 (chocolates) = $50.00

- Total GST-Free Items: $8 (bread) + $12 (honey) = $20.00

- Calculate GST on Taxable Items: $50.00 x 0.10 = $5.00

- Final Hamper Price: $50.00 (taxable) + $20.00 (GST-free) + $5.00 (GST) = $75.00

The customer pays $75.00, but your records need to show that only $5.00 of that is GST you owe the ATO.

A Quick Tip: Good accounting software can be your best friend here. Platforms like Xero or MYOB let you set a tax code for each product ('GST' or 'GST-Free'). The system can then do these split calculations automatically, saving you a massive headache and preventing simple errors.

Claiming Credits on a Large Asset Purchase

When your business buys a major asset—like a vehicle, machinery, or new computer equipment—the GST credit you can claim is often significant. This is a perfect example of why knowing how to pull the GST out of a total price is so crucial for your cash flow.

Let's say your construction company buys a new ute purely for business use.

Scenario: Buying a Ute for the Business

The drive-away price is $55,000, GST-inclusive. To figure out the GST credit for your next BAS, you just need to use the 'divide by 11' rule.

- Total Price Paid (GST inclusive): $55,000

- GST Credit Calculation: $55,000 / 11 = $5,000

- Actual Cost of Ute (Pre-Tax): $55,000 – $5,000 = $50,000

Just like that, you've found a $5,000 GST credit. That amount directly reduces the GST you owe from your sales in that period. Missing a large credit like this can seriously hurt your cash position for the quarter.

Understanding the ATO's Rounding Rules

Finally, what do you do when your GST calculation ends up with fractions of a cent? The ATO won’t accept half-cents, so there are specific rounding rules to follow.

The rule applies to the total GST amount on an invoice, not each individual line item. It’s pretty straightforward:

- If the fraction of a cent is less than 0.5, you round down.

- If the fraction of a cent is 0.5 or more, you round up.

For instance, if the total GST on an invoice comes to $14.575, it would be rounded up to $14.58. If it was $14.574, you’d round down to $14.57. This keeps your figures neat, compliant, and in whole cents.

Tools and Tips for Stress-Free GST Management

Managing your GST doesn't have to be a mad scramble every quarter. The secret is to build the right habits and use the right tools, turning GST from a last-minute chore into a simple, ongoing part of your business rhythm.

Getting proactive saves you a mountain of time. More importantly, it helps ensure you're lodging accurate figures with the ATO, helping you steer clear of costly mistakes down the track. It's all about moving from reactive panic to confident control over your tax obligations.

Choosing Your Weapon: Accounting Software

The days of manual ledgers and shoeboxes stuffed with receipts are, for most of us, well and truly over. Modern accounting software is hands down the most powerful tool you can have for simplifying how you calculate GST in Australia.

Platforms like Xero, MYOB, and QuickBooks are built to do the heavy lifting for you. They can:

- Automatically calculate GST on every sale and purchase you put through the books.

- Generate real-time reports showing exactly how much GST you've collected versus how much you've paid out.

- Pre-fill parts of your BAS, which makes lodging it significantly faster and way more accurate.

These systems hook directly into your business bank accounts, pulling in transaction data as it happens. This slashes the risk of human error and makes sure nothing gets missed.

Key Insight: The true magic of accounting software isn't just the number-crunching; it's the clarity it gives you. Being able to see a live dashboard of your GST position at any moment means you can plan your cash flow and avoid those nasty surprises when it's time to pay the ATO.

The Importance of Meticulous Record-Keeping

While your software can automate the maths, it's only ever as good as the information you feed it. This is where disciplined record-keeping becomes absolutely non-negotiable. Clean, organised records are the bedrock of stress-free GST management.

The single most important habit to build is to hold onto every single tax invoice for your business purchases. You can't legally claim a GST credit on any purchase over $82.50 without a valid tax invoice. Over a full year, missed credits from sloppy record-keeping can add up to a serious amount of money left on the table.

Smart Habits for Effortless GST Management

A truly efficient system is about more than just software—it’s about smart habits. Regularly reconciling your accounts is crucial. This just means checking that what's in your software matches your bank statements. Doing it weekly or fortnightly can prevent a massive clean-up job at the end of the quarter.

Another common practice is to set up a separate bank account just for your GST. Every time a customer pays you, transfer the GST portion straight into this account. When your BAS is due, the money is already sitting there, ready to go, protecting your day-to-day operational cash flow.

Ultimately, an effective approach is often the right mix of tools and professional advice. Software is a fantastic ally, but navigating the finer points often requires an expert eye. Figuring out whether a local or an online tax accountant is the right fit for you can help you build a solid system that supports your business as it grows, keeping you compliant and financially healthy.

Common Questions About Calculating GST

Even with the formulas laid out, it’s completely normal to have a few questions rattling around. When it comes to tax, clarity is everything. Think of this section as a quick-fire round to tackle some of the most common queries we hear from business owners wrapping their heads around GST in Australia.

Getting these final details right can make a huge difference to your confidence and, more importantly, your compliance.

When Do I Actually Need to Start Charging GST?

You are required to register for and start charging GST as soon as your business's GST turnover hits $75,000 within any 12-month period. A common misunderstanding is thinking this is based on the financial year, but it’s actually any rolling 12 months.

A mistake some business owners make is waiting until they’ve already crossed that line. It's important to get registered as soon as you can reasonably predict you're going to hit the threshold. Taking that proactive step can save you from the administrative nightmare of backdating GST on past sales.

Can I Claim GST on Something I Bought Second-Hand?

Yes, it is often possible, but it all comes down to who you bought it from. If you purchase a second-hand item for your business from another GST-registered business (like a used-car dealership), their tax invoice will clearly show the GST component. You can then claim that amount back as a credit.

However, if you buy from a private seller who isn't registered for GST, there’s no GST in the price to begin with. That means there's nothing for you to claim. Always check the invoice for a specific GST amount.

Important Note: A valid tax invoice is non-negotiable for claiming any GST credit on purchases over $82.50. If you don't have one, you can't claim the credit—even if you know for a fact that GST was included in the price you paid.

What if I Forget to Include GST on an Invoice?

It happens. If you've sent an invoice and then realise you forgot to add GST, the best thing to do is contact your client straight away. Explain the error honestly and issue a corrected, compliant tax invoice showing the base price, the GST amount, and the new total.

Clear communication is key to keeping your client relationship strong. Acting fast also ensures your own records are accurate for your next Business Activity Statement (BAS) lodgement. Getting these details right is a fundamental part of good business practice, and for a broader look at your obligations, our articles on tax and compliance offer more valuable insights.

At Genesis Hub, we know that managing GST is just one piece of the puzzle. Our team offers expert BAS and GST lodgement services to keep your Melbourne business compliant and your cash flow healthy. If you're ready for clear, proactive accounting support, book your free consultation with Genesis Hub today.

Article created using Outrank