That sinking feeling when you realise a receipt has gone missing is all too familiar. But don't panic—it doesn't automatically mean you've lost the opportunity to claim a tax deduction.

The short answer is yes, it can be possible to claim certain work-related expenses without a classic paper receipt, especially for small amounts where you have other ways to prove the expense. The Australian Taxation Office (ATO) has specific allowances for these minor, everyday costs.

Disclaimer: The information provided in this article is for general informational purposes only and does not constitute financial or tax advice. You should consult with a qualified professional for advice tailored to your specific circumstances.

Your Quick Guide to Claims Without Receipts

Lost paperwork is a classic headache for sole traders and employees alike. Luckily, the ATO acknowledges this happens and has put rules in place to handle it. Of course, these rules come with some pretty important limits and requirements you need to be aware of. Getting your head around them is the first step to lodging your tax return with confidence.

One of the most well-known rules relates to small expenses. In Australia, the ATO allows for a total of up to $300 for work-related expenses to be claimed without having to provide receipts. This isn't a free-for-all, though. You still need to be able to show how you worked out your claim if they ask.

This little bit of flexibility is really designed for those minor cash expenses that are genuinely for work but are just a pain to track with formal receipts. Think of it as a small buffer, not a blank cheque.

Understanding the Key Thresholds

Beyond that $300 total limit, there are a few specific claims that work on a "fixed-rate" basis, which also means you don't need a typical receipt. These are calculated using a set rate published by the ATO each year.

A couple of the most common ones include:

- Laundry expenses: A claim of up to $150 for washing and drying specific work clothing can be considered.

- Car expenses: The cents per kilometre method can be used to claim up to 5,000 business kilometres.

It's absolutely critical to remember that even without a receipt, you still need a basis for your claim. For car expenses, this means keeping a logbook or a diary of your work-related trips. For laundry, you need to be able to explain how you got to your final figure.

Trying to figure all this out can get complicated, and knowing when to call in a professional can be a smart move. If you're feeling unsure about your claims, it might be worth learning how you can find the best tax accountant close to you. We'll keep breaking down what you need to know, but this gives you the essential foundation to build on.

To make it even clearer, here's a quick rundown of the main rules in one place.

Summary of Key ATO Rules for Claims Without Receipts

| Claim Category | ATO Threshold or Limit | Required Alternative Evidence |

|---|---|---|

| Total Work-Related Expenses | Up to $300 total | You must be able to explain how you calculated your claim. |

| Laundry Expenses | Up to $150 | A reasonable basis for calculation (e.g., $1 per load for mixed items). |

| Car Expenses | Up to 5,000 business kms | A diary or logbook of work-related travel to justify the kilometres. |

| Small Expenses | Individual items under $10 | A diary entry or note detailing the expense, up to a total of $200. |

This table is a great starting point, but always remember that the golden rule is to only claim what you're genuinely entitled to. The ATO expects you to have actually incurred the expense for your work.

The Core Principles of Tax Deductions

Before we get into the nitty-gritty of what can be claimed without receipts, we need to cover the ground rules that apply to every single tax deduction. Think of it as learning the rules of the road before you get behind the wheel. Without a solid handle on these basics, it can be easy to make mistakes that attract the wrong kind of attention from the Australian Taxation Office (ATO).

At its heart, the idea is pretty straightforward: a deduction can generally be claimed for something only if you paid for it yourself, it was directly tied to earning your income, and it wasn’t for personal use. This is the bedrock of our tax system, keeping things fair for everyone.

The Direct Link to Your Income

For any expense to be acceptable to the ATO, it needs a clear and direct connection—what they call a ‘nexus’—between the cost and how you make your money. It’s not enough for something to be vaguely helpful for your job. It generally has to be a part of how you earn your income.

A classic example is a graphic designer buying a subscription to Adobe Creative Cloud. That has a direct link. But that same designer buying a new suit to look sharp for client meetings? That link is a lot weaker and generally not deductible.

It is important to be able to answer the question: "How did this specific purchase help me generate my income?"

The entire framework for tax deductions in Australia is built on a key piece of legislation. Understanding its purpose helps clarify why these rules exist and how they are applied.

This all comes from section 8-1 of the Income Tax Assessment Act 1997. In plain English, this law says you can claim deductions for costs you incur to earn your income, but it shuts the door on expenses that are capital, private, or domestic. It’s a flexible rule, but one designed to stop people from claiming their everyday living costs as business expenses. You can read a more detailed breakdown of the legislative principles of tax deductibility if you really want to get into the weeds.

The Three Golden Rules of Deductions

To make things even simpler, just think of every potential claim as having to pass three simple tests. If it fails even one, it generally can't be claimed.

- You must have spent the money yourself. You can't claim anything that your boss or someone else paid for or reimbursed you for. It has to come out of your own pocket.

- The expense must directly relate to earning your income. It needs to be a cost you had to incur to do your job, not just something that was convenient or tangentially related.

- You must have a record to prove it. This is where receipts are king, but as we’re about to explore, they aren’t the only form of proof the ATO will accept.

Getting these core ideas down is your best defence against making an unsubstantiated claim. It changes your thinking from "Can I claim this?" to "Can I justify this claim?". Once you have that foundation, it’s much easier to navigate those grey areas where you don’t have a perfect receipt for every dollar spent.

How the ATO Reviews Your Tax Claims

Ever wondered what triggers a "please explain" letter from the Australian Taxation Office? When you lodge your tax return, it doesn't just disappear into a digital black hole. The ATO uses some seriously sophisticated data-matching technology to compare your claims against industry benchmarks, as well as data from banks, employers, and other government agencies. This system is designed to spot anything that looks out of place.

Now, this process isn't meant to be scary. Think of it as a nudge to prepare a strong, defensible tax return. Knowing what the ATO looks for helps you shift your mindset from just making claims to proving them. It's all about building a clear story for your expenses, backed by solid evidence—even if that original paper receipt has vanished.

Understanding the Numbers Behind Tax Audits

The hard truth is that a lot of tax returns get adjusted after the ATO takes a closer look. This can happen for all sorts of reasons, from simple mistakes to claims that just don't have the paperwork to back them up.

ATO statistics tell a pretty clear story. Between the 2019–20 and 2020–21 tax periods, nearly 69% of reviewed income tax returns were adjusted. On average, each of those returns had about 2.6 items changed, leading to a median increase in taxable income of $955. This usually happens because deductions are either disallowed or reduced. You can dig into the latest estimates and trends from the ATO yourself.

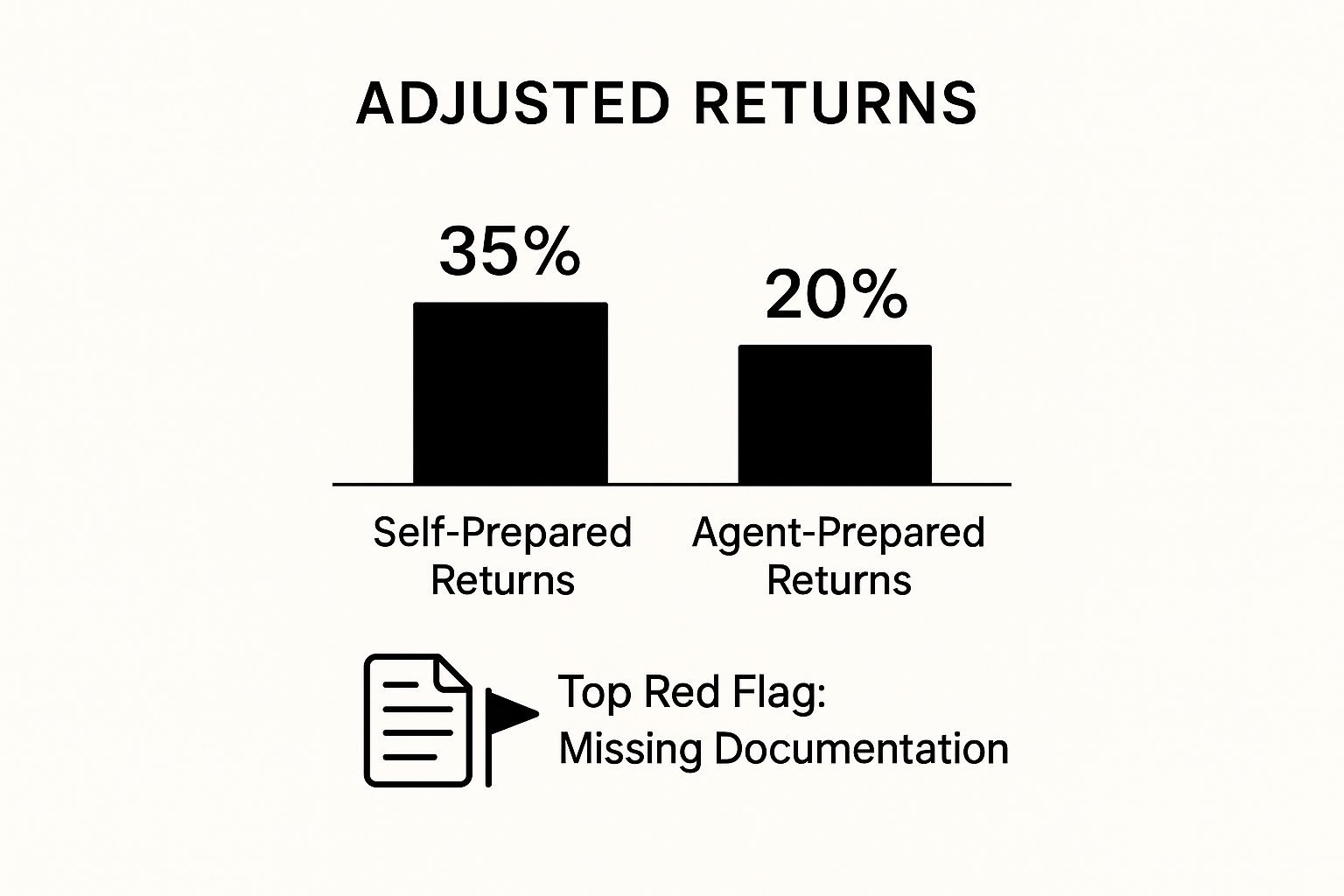

There’s also a noticeable difference between returns lodged by individuals and those prepared by tax agents. This infographic paints the picture pretty clearly.

While getting professional help appears to lower the risk, the number one culprit remains the same across the board: missing documentation.

Common Red Flags for the ATO

So, what kind of things make the ATO's system sit up and take notice? It's programmed to flag claims that seem unusual when compared to others in your line of work.

Here are a few of the most common red flags:

- Unusually high work-related expense claims: If your deductions are way above the average for someone with a similar job and income, it’s going to raise questions.

- Claims for private expenses: Trying to claim personal costs is a classic mistake. Things like your daily commute to the office or your everyday work clothes just aren't deductible.

- Lack of apportionment: This is a big one. If you use something for both work and private purposes—like your phone or internet—you have to separate the work-related portion. Failing to do this properly is a common slip-up.

The lesson here is to keep your claims consistent and reasonable. They need to tell a logical story about the costs you genuinely incurred to earn your income. A sudden, massive jump in your deductions without a good reason (like a new role or different work duties) is a magnet for scrutiny.

Getting your head around these things is key to staying on the right side of the ATO. For some more practical tips, take a look at our guide on how small business owners and individuals can navigate tax season. By understanding how the ATO reviews claims, you’re in a much better position to put together a return that’s both accurate and audit-proof.

Building a Strong Case with Alternative Evidence

Misplacing a receipt doesn't automatically mean you have to forgo that tax deduction. While a crisp paper receipt is always the best-case scenario, the Australian Taxation Office (ATO) understands that life happens. Receipts fade, get lost, or sometimes, you just don't get one.

This is why the ATO allows for other forms of proof to back up your work-related expense claims. It’s less about having one single "magic key" and more about piecing together a puzzle. Your goal is to create a complete and believable picture of the expense.

When you're trying to figure out what you can claim on tax without receipts, the trick is to build a logical case with whatever evidence you do have. You need to prove you spent the money, it was for work, and show the essentials: who you paid, how much, what you bought, and when. Often, the strongest claims come from combining a few different types of records.

Unpacking Your Alternative Evidence Toolkit

Your bank or credit card statement is usually the best place to start. It’s solid proof that a transaction happened on a certain date for a specific amount. The problem is, a statement showing a payment to "Bunnings" doesn't tell the ATO if you bought a pot plant for your home office or paint for your lounge room. That’s where you may need to layer your evidence.

Here are some of the most common and powerful forms of alternative proof:

- Bank or Credit Card Statements: Perfect for locking in the date, amount, and supplier.

- Digital Confirmations: Think email confirmations, online order summaries, or digital invoices that spell out the purchase details.

- Photographs: A quick snap of the item you bought—or even the original receipt before it disappears—can be a valid record.

- Diary or Logbook Entries: A written note made at the time of purchase is surprisingly strong, especially for small cash buys. Just make sure you detail what you bought, why it was for work, the date, and the cost.

The core idea is simple: the more evidence you have, the stronger your claim. One piece of proof might feel a bit weak on its own, but when you combine it with others, you create a solid, defensible record that ticks the ATO’s boxes.

Combining Evidence for Maximum Impact

Let's see this in action. Say a freelance photographer buys a second-hand lens for $250 in cash at a local market. No formal receipt was given. A lone diary entry might not be quite enough to convince the ATO.

A much smarter approach would be to:

- Withdraw the Cash: Your bank statement will show a $250 cash withdrawal right before the purchase.

- Make a Detailed Diary Entry: Straight after, jot down the date, the seller’s name (if you have it), the item ("Canon 50mm lens for portrait photography business"), and the price.

- Take a Photograph: Snap a quick picture of the lens itself.

Suddenly, you have three bits of evidence that work together to tell a clear, convincing story. You’ve just turned a shaky claim into a well-documented business expense.

To help you see how different records can work together, here’s a quick breakdown of acceptable alternatives.

Acceptable Alternatives to Paper Receipts

| Evidence Type | Best Used For | ATO Best Practice |

|---|---|---|

| Bank Statements | Proving a transaction occurred and its amount. | Pair it with another record (like a diary entry or photo) that clarifies the work-related purpose of the expense. |

| Diary Entries | Small cash expenses where no other record exists. | Be contemporaneous—write the entry at or very near the time of the expense, not months later at tax time. |

| Digital Confirmations | Online subscriptions, software, or e-commerce purchases. | As soon as you get it, save the email or PDF invoice to a dedicated cloud folder for easy access later. |

| Photographs | Proving the existence and nature of a purchased item. | If you can, take the photo in a work-related context. Make sure the image file has a timestamp. |

By being proactive and layering your evidence, you can confidently claim every deduction you're entitled to, even when a paper receipt is missing in action.

Putting It All Into Practice: Real-World Scenarios for Receipt-Free Claims

The ATO’s rules on what can be claimed without a receipt are one thing, but theory only gets you so far. Seeing how these rules play out in the real world is what makes it all click.

Let's walk through a few everyday situations where you might need to claim an expense without that perfect piece of paper. These examples show you how to weave together different types of proof to build a claim that the ATO will understand and accept.

The Tradie at the Weekend Market

Picture this: a carpenter spots a stall at a weekend market selling quality second-hand tools. They pick up a fantastic set of chisels for $80 and pay in cash. The seller is a small-time operator with no cash register or EFTPOS, so they walk away without a formal receipt.

On its own, an $80 cash claim could raise a red flag. But a solid case for it can be built. Here’s how:

- Follow the Money: First, showing where the cash came from is a good start. A bank statement showing an $80 withdrawal from an ATM near the market on the same day is a starting point.

- Make a Note: While it's fresh in your mind, jot down the details in a diary or a notes app on your phone. Record the date, location ("Richmond Weekend Market"), what was bought ("Set of 6 vintage chisels for detailed cabinetry work"), and how much was paid. Be specific!

- Snap a Photo: A quick picture of the chisels in the workshop proves ownership. When you pair this with a diary note, it completes the story and confirms their work-related purpose.

Together, these three bits of evidence paint a clear and believable picture for the ATO.

The Consultant with a Digital Subscription

Let's say a marketing consultant relies on a premium social media scheduling tool. The $45 monthly fee is automatically debited from their business account, but they never receive a separate PDF invoice.

In this case, the proof is entirely digital, which is perfectly fine and often even stronger.

- Bank Statements: The monthly bank statements are the main piece of evidence. Each one will clearly show a recurring $45 payment to the software company, which establishes a consistent pattern of business use.

- The Welcome Email: Think back to when they first signed up. They would have received a confirmation email outlining the subscription plan and the monthly cost. Saving that email provides the crucial context for those recurring bank debits.

A great habit to get into for recurring digital costs is to create a dedicated folder in your email or cloud storage. Just drag all those initial sign-up emails and confirmations in there. When tax time rolls around, justifying those regular bank payments becomes a breeze.

The Employee Using Their Car for Work Errands

Here’s a common one. An office administrator is asked by their boss to make a quick run to the office supply store and then drop a package at the post office. The total trip adds up to 12 kilometres.

If the employer doesn't reimburse them for these small trips, they may be able to claim the expense themselves using the cents per kilometre method. The good news is this method doesn't require fuel receipts, but you do need a record of the journey.

- Keep a Logbook or Diary: The easiest way to track this is with a simple logbook or even a calendar entry on your phone. For that day, just note the date, why the trip was made ("Urgent supply run to Officeworks and drop-off at AusPost"), and the distance travelled (12 kms).

By keeping these simple notes throughout the year, you create the proof needed to confidently claim up to 5,000 business kilometres. No fuel receipts necessary.

Developing Smart Record Keeping Habits

Let's be honest, the best way to deal with a missing receipt is to stop it from going missing in the first place. This isn't about creating some complex, time-consuming system. It’s about building a simple, consistent habit. With the tools we all have in our pockets, it's possible to create a rock-solid digital trail that will make tax time a whole lot less painful.

Think of it like this: every single business expense is a little piece of data. The job is to capture that data before it vanishes. Getting into the habit of recording an expense the moment it's made is the secret to saving a massive headache down the track. It's this small, consistent effort that can help maximise deductions.

The ATO has even made it easier with its myDeductions tool, built right into the main ATO app. It lets you snap a photo of your receipt, jot down a few details, and store it all digitally. This creates a real-time, ATO-compliant record that’s a breeze to manage.

Creating a Simple Digital Workflow

The most effective way to stay on top of your expenses is to go digital. Forget the shoebox stuffed with faded receipts; a straightforward digital process ensures you have everything you need when it’s time to lodge your return.

Here’s a simple but incredibly powerful workflow you can start today:

- Snap Immediately: The second you get a receipt for a work expense, pull out your phone and take a clear photo. Don't wait.

- Add Context: Use an app or a dedicated digital folder to add a quick note. What was it for? How does it relate to your business?

- File Digitally: Save that photo and your note in a secure cloud folder. It's helpful to organise them by financial year and then by expense type (e.g., "Fuel," "Stationery," "Client Lunches").

This entire process takes less than 30 seconds per transaction. But over a year, it builds a robust, searchable, and audit-proof record of every single one of your expenses.

By making this a reflex action, you may never miss out on a legitimate deduction again. For many business owners, this is also where a professional can make a huge difference. Understanding why every business needs an accountant can help you put these financial processes on autopilot, ensuring nothing slips through the cracks.

Frequently Asked Questions

It’s easy to get tangled up when navigating tax claims without a perfect paper trail. Here are some straightforward answers to the questions we hear most often about claiming deductions without receipts.

Is the $300 Limit Per Item or Total?

That $300 figure is a total for all small, work-related expenses claimed without receipts over the whole financial year. It's not a per-item limit, which is a common point of confusion.

If your total claims without receipts creep over $300, you’ll need to have solid evidence for every single one of those claims—not just for the amount that tipped you over the threshold.

Can I Claim Car Expenses Using Cents Per Kilometre Without Records?

Not exactly. While you don’t need a shoebox full of fuel receipts for the cents per kilometre method, you absolutely still need records to show the ATO how you got to that number.

You must be able to prove the business kilometres you’re claiming. A simple diary, logbook, or even a tracking app detailing your work-related journeys is non-negotiable here.

A classic mistake is thinking the cents per kilometre method is a "no questions asked" free pass. The ATO expects you to show your travel was for work, which makes a basic travel log absolutely crucial to back up your claim.

What if My Bank Statement Only Shows the Store Name?

A bank statement on its own can be a bit thin if the purchase isn't obviously work-related. For example, a charge from "Officeworks" is a good start, but what was bought? Was it a new pen for the office or a video game for the kids?

The best approach is to add a little more context. Scribble a note in your diary about what you bought and why it was for work, or just snap a quick photo of the item with your phone. These small steps create a much stronger record.

Keeping on top of every single deduction can feel like a full-time job. But you don’t have to go it alone. The team at Genesis Hub lives and breathes this stuff, helping sole traders and small businesses stay compliant and get back every dollar they’re entitled to.

Book a free consultation today and let’s make your next tax time the simplest one yet.