Choosing the right accountant in Melbourne CBD is a big deal. It’s not just about getting your tax return lodged on time; it's a strategic investment in your business's future. The best in the business do more than just compliance—they become genuine financial partners, offering insights that actually fuel your growth.

Why Your Accountant Is More Than a Number Cruncher

So many business owners fall into the trap of seeing their accountant as just a necessary cost, someone they only chat with once a year. This view completely misses the incredible value a proactive financial expert brings to the table.

An accountant who really gets Melbourne's dynamic business scene offers a lot more than just keeping the ATO happy. They deliver strategic advice that’s tuned into the city's unique economic pulse.

Think of them as your financial translator. They take the raw numbers and turn them into a clear story about the health of your business. That insight is gold when you're making big calls, whether you're thinking about expanding, navigating cash flow during a quiet season, or mapping out your long-term goals.

A Partner in Your Business Journey

A great accountant is like a co-pilot. They don’t just log where you’ve been; they help you chart the course for where you want to go. This means spotting financial risks before they spiral into major problems and pinpointing opportunities you might have otherwise missed.

For instance, a cafe owner in the CBD could get sharp advice on trimming supplier costs, while a tech startup might need guidance on structuring the business for a future funding round. It’s this kind of personalised, forward-thinking support that separates a simple bookkeeper from a true financial advisor. It's a key reason why every business needs an accountant on their team.

The real value of a skilled accountant isn't just in their ability to file your taxes. It's in their capacity to help you build a more profitable, resilient business. They should be a source of confidence, not just compliance.

Embracing Modern Financial Management

Today’s best accountants are also part tech consultants. They help you get the right systems in place to give you real-time clarity on your finances.

A modern accountant can help you automate financial reporting and streamline other tedious processes. This frees you up to focus on what you actually do best—running your business. In a fast-moving market like Melbourne, this kind of efficiency isn't just a nice-to-have; it's essential for staying competitive.

Pinpointing Your Business's Financial Needs

Before you even think about searching for an accountant in Melbourne CBD, the first, most critical step is to look inward. Seriously. Without a clear picture of what you actually need, every conversation you have will feel vague and unproductive. You’ve got to know your destination before you can choose the right co-pilot.

Think about it. Are you a brand-new startup needing help with the absolute basics, like choosing the right business structure? Or are you an established e-commerce store wrestling with complex inventory and trying to get a handle on cash flow forecasting?

The needs of these two businesses are worlds apart, and so is the expertise they require from an accountant. A solid self-assessment isn't just a box to tick; it's the foundation that turns your search from a guessing game into a focused mission.

From Daily Operations to Long-Term Vision

Let's break down your financial world into two buckets: the day-to-day grind and the big-picture goals.

Your immediate needs are probably all about compliance. Lodging your Business Activity Statements (BAS) on time, managing payroll, and making sure your superannuation contributions are spot on. These are the non-negotiables that keep the lights on and the ATO happy.

But don't stop there. What about your future ambitions?

- Growth Planning: Are you looking to expand, hire more staff, or invest in new equipment? An accountant can build financial models to show you if your plans are actually viable.

- Performance Analysis: Do you really know which of your services or products are most profitable? Detailed financial reports can uncover some surprising truths.

- System Efficiency: Is your bookkeeping a chaotic mess of spreadsheets and crumpled receipts? You might need help migrating to a modern cloud accounting system like Xero.

Understanding how an accountant manages their own time is also a good window into their efficiency and transparency. Many now use specialised time tracking software for accountants to ensure you’re only billed for the specific services you actually receive. It’s a fair system that benefits everyone.

Before you start reaching out to firms, it helps to get your thoughts in order. Use this simple checklist to map out what you think you need and how important each service is to your business right now.

Self-Assessment Checklist for Accounting Services

| Service Area | My Business Needs This (Yes/No/Unsure) | Priority Level (High/Medium/Low) |

|---|---|---|

| Business Structure Advice | ||

| BAS Lodgement | ||

| Payroll & Superannuation | ||

| Bookkeeping & Data Entry | ||

| Financial Reporting & Analysis | ||

| Cash Flow Forecasting | ||

| Budgeting & Goal Setting | ||

| Tax Planning & Strategy | ||

| Cloud Accounting Setup (e.g., Xero) | ||

| R&D Tax Incentive Advice |

Taking just 10 minutes to fill this out will make your first conversation with a potential accountant infinitely more productive.

Contrasting Real-World Scenarios

Let's make this practical. Picture a café owner tucked away in Degraves Street. Their priorities would likely be daily sales reconciliation, managing payments to suppliers, and analysing the cost of goods. Their ideal accountant needs to be sharp on hospitality industry benchmarks and payroll for a team of casual staff.

Now, contrast that with a tech company based in the CBD. They might need an accountant with deep experience in R&D tax incentives, handling investor relations, or structuring employee share option plans. Their financial reality is completely different.

Defining your needs isn’t just about making a list of services. It's about articulating your business's specific challenges and future ambitions so you can find an advisor who has already solved similar problems for others.

When you identify your unique requirements first, you can walk into any meeting fully prepared. You'll ask targeted questions that get right to the heart of whether an accountant has the specific skills and experience to genuinely help your business thrive. This groundwork is the difference between finding a simple service provider and finding a true strategic partner.

Decoding Credentials and Industry Expertise

When you're searching for an accountant in Melbourne CBD, you'll see acronyms like CPA (Certified Practising Accountant) and CA (Chartered Accountant) everywhere. These aren't just fancy letters after a name. They signify years of rigorous training, a strict code of ethics, and a high baseline of professional skill.

Think of these qualifications as the price of entry. They tell you an accountant has the core knowledge to navigate complex financial landscapes. But while these credentials are a must-have, they're only one part of the story.

The real difference-maker for your business is an accountant's deep-seated industry experience. A qualification proves they know the rules of the accounting game. Hands-on experience in your industry proves they know how to win your specific game.

Why Industry Knowledge Matters Most

Imagine hiring an accountant whose client list is full of construction companies to handle the finances for your new tech startup. Sure, they’ll get the compliance basics right, but will they know the ins and outs of R&D tax incentives, structuring for capital raising, or managing employee share schemes? Probably not.

This is where specialisation becomes invaluable. An accountant who lives and breathes your sector brings a level of insight that goes far beyond just crunching numbers. It translates into proactive advice that’s actually relevant to your day-to-day operations.

Here’s how this plays out in the real world:

- For a construction business: An expert understands progress payments and subcontractor obligations.

- For a hospitality venue: They're all over inventory costs, analysing daily sales data, and navigating the nightmare of staff penalty rates.

- For a creative agency: They understand project-based billing, managing client retainers, and tracking the profitability of individual campaigns.

This kind of focused experience is what elevates an accountant from a simple bookkeeper to a genuine strategic partner. The demand for these skilled professionals is high across Melbourne, reflecting a growing industry that’s constantly adapting to attract new talent, as analysis from the last Census shows. You can read more about the evolving professional landscape for Melbourne accountants.

A qualified accountant can tell you what happened with your money. An industry-specialist accountant can tell you why it happened and what you should do next. This is the critical difference that drives growth.

Probing for Real-World Experience

When you're sitting down with potential accountants, you need to dig deeper than, "Have you worked with a business like mine before?" Get specific. Frame your questions around the actual challenges you face every day.

Try asking questions like these:

- "What are the most common financial mistakes you see businesses in my industry make?" This question quickly reveals their awareness of common pitfalls and whether they think proactively.

- "Can you walk me through how you've helped a similar business improve their cash flow?" This pushes them for a concrete example of their problem-solving skills, not just theory.

- "Which accounting software, like Xero or MYOB, do you find works best for my industry, and why?" Their answer will tell you a lot about their tech-savviness and if their systems will sync up with yours.

Speaking of software, an accountant’s fluency with modern cloud platforms is non-negotiable today. Real-time data is the backbone of smart decision-making. A professional who is an expert with these tools can help you unlock their full potential, saving you time and giving you a much clearer picture of your financial health. How confidently they answer these questions will tell you everything you need to know about their real-world expertise.

How to Lead an Insightful Accountant Consultation

That first meeting with a potential accountant is your best shot at figuring out if they're the real deal. Forget just asking about their fees—this is your chance to see if they genuinely get your business and can be a real financial partner.

To find the right accountant in Melbourne CBD, you need to steer the conversation away from a simple price check and towards uncovering their strategic value. It's about gauging their proactivity, how they communicate, and whether they can think beyond basic tax compliance. Asking the right questions turns a bland interview into a deep dive.

Questions That Reveal True Value

Instead of asking what services they offer, you need to dig into how they deliver them. The way they answer will tell you everything about their process, their philosophy on client relationships, and whether their style actually fits what you need.

Here are a few powerful questions to get the ball rolling:

- "How do you prefer to communicate with clients on a regular basis?" This is a great way to find out if they're a once-a-year tax agent or a proactive advisor who keeps you in the loop.

- "Based on my type of business, what's the biggest financial challenge you see for me in the next 12 months?" This really tests their industry knowledge and whether they're thinking ahead. A solid answer shows they're already strategising for your specific situation.

- "Can you describe a time you helped a client spot a financial opportunity they'd completely missed?" This pushes them for a real-world example of the value they bring, which is far more telling than a polished list of services.

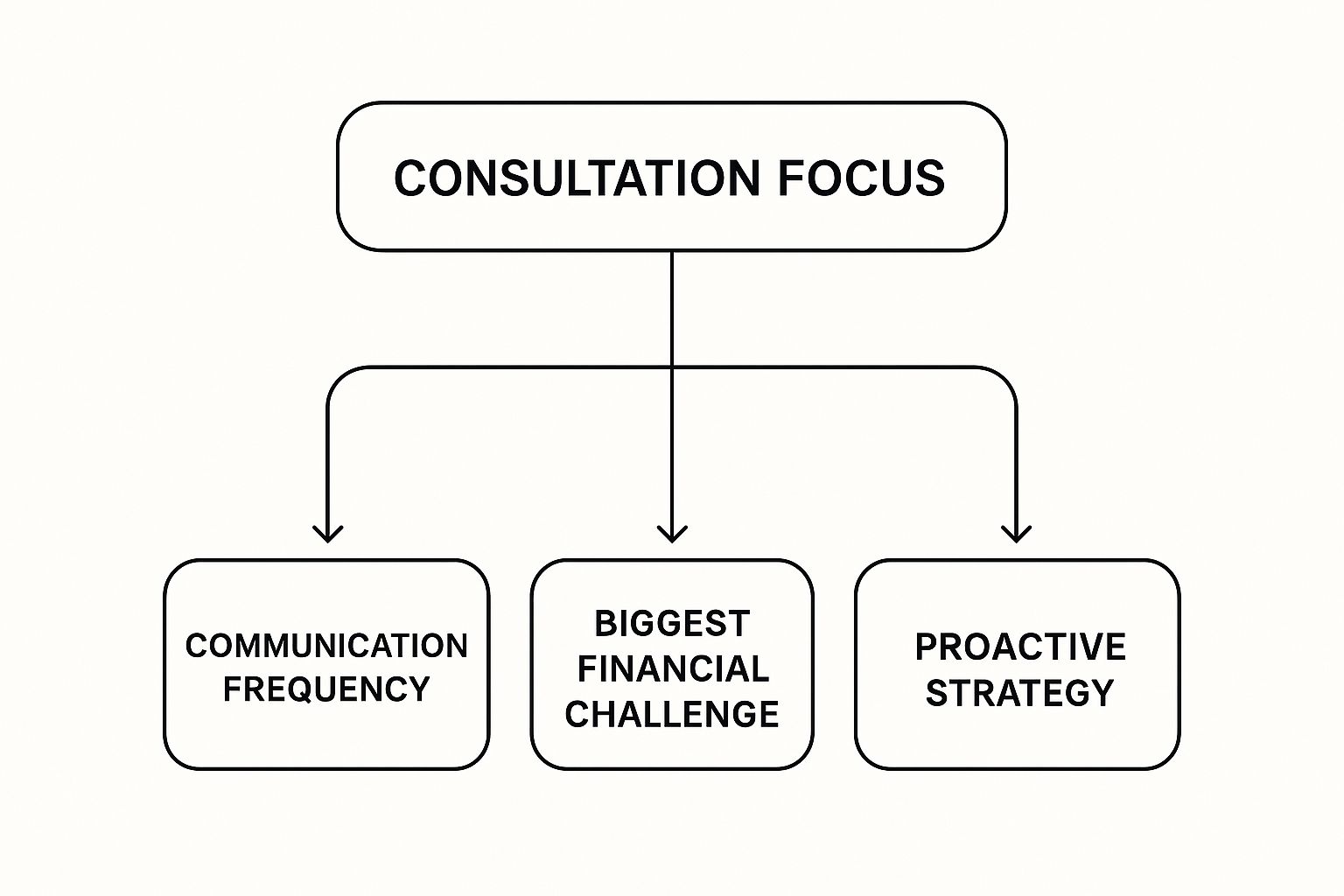

This decision tree breaks down how to focus your consultation on these three key areas to get the insights that matter most.

As the graphic shows, by probing their communication style, foresight on challenges, and strategic thinking, you can quickly size up whether they're a true long-term partner.

Understanding Their Perspective and Process

Beyond their strategic brain, you also need to get a feel for the practical side of working together. It’s worth asking about their workload and professional background to get the full picture.

Remember, skilled financial accountants are in high demand, especially in Melbourne's competitive financial sector. Salaries often reflect this, with experienced pros earning near AU$100,000 or more, depending on their specialisation. This demand highlights just how valuable their time and expertise are. You can get more insights on accountant salaries in Melbourne to see for yourself.

An effective consultation feels less like an interrogation and more like the start of a partnership. It's a two-way conversation where you both determine if there's a good fit. Your goal is to find someone who is as invested in your success as you are.

The right accountant will be eager to answer these deeper questions. It gives them a chance to show off their expertise beyond a simple fee schedule. They want to partner with clients who value strategic advice, not just the lowest price.

If you're ready for that kind of insightful discussion, you can book a free consultation with our team to experience the difference firsthand. This approach ensures you find a professional who won’t just manage your finances—they’ll actively help you build a stronger, more resilient business.

Making a Confident Final Decision

After meeting a few candidates, you've reached the final—and most important—step: choosing your long-term financial partner. It’s tempting to just look at the quotes, but this decision shouldn't come down to who's cheapest. An accountant who misses opportunities or gives cookie-cutter advice will cost you far more in the long run than you'd ever save on their fees.

This is where you need to step back and look at the whole picture. Think about the expertise they showed, the rapport you felt, their communication style, and whether their approach genuinely aligns with your business goals. It's about moving from a simple gut feeling to a confident, evidence-based choice for your accountant in Melbourne CBD.

Evaluating the Complete Package

Your final choice rests on so much more than technical skill. A great accountant is a partner you feel comfortable with, someone who can break down complex financial ideas into plain English and shows a real interest in seeing your business succeed.

Think back to your meetings. Did one accountant seem more proactive, already tossing around ideas to improve your cash flow or structure? That's a massive green flag. On the other hand, did another seem distracted or rush through your questions? That’s a potential red flag. A one-size-fits-all pitch is another warning sign. If they didn't dig into the specifics of your industry or your five-year plan, they're unlikely to provide the personalised guidance your business needs to grow.

The best financial partnerships are built on mutual respect and shared goals. You're not just hiring a service; you're bringing a key advisor onto your team who should be as invested in your business's future as you are.

Using a Simple Scoring Method

To cut through the noise and make your decision more objective, try a simple scoring system. Jot down your top priorities—things like industry experience, communication style, tech-savviness, and fee structure—and then rate each candidate from 1 to 5.

Here’s a simple framework you can adapt:

| Criteria | Candidate A (Score 1-5) | Candidate B (Score 1-5) |

|---|---|---|

| Industry-Specific Knowledge | ||

| Proactive & Strategic Ideas | ||

| Communication & Rapport | ||

| Technology Proficiency (Xero/MYOB) | ||

| Fee Structure & Value |

Tallying the scores gives you a clear, visual comparison. It helps confirm whether your gut feeling is backed by the facts you gathered during your meetings. This structured approach helps ensure you pick a partner who will actively contribute to your growth, not just tick boxes. The distinction between a local expert and a remote one can also be a factor, and it's worth exploring the nuances between a tax accountant close to you versus an online accountant to finalise your preference.

Remember, you're investing in expertise. The salary benchmarks for finance professionals in Melbourne reflect this value. For instance, recent data shows the median salary for a Financial Accountant is around AU$108,150, with top performers earning up to AU$118,125. This highlights the city’s demand for high-calibre talent—which is exactly what your business deserves. You can find more detail on Melbourne's accountant salary data on roberthalf.com.

You’ve done the research, you've shortlisted a few names, but a few nagging questions are probably still bouncing around your head before you sign on the dotted line. This is completely normal. Getting clear, straight answers to these last few queries is the final piece of the puzzle, giving you the confidence that you’re making the right call.

Let’s run through some of the most common questions we hear from business owners looking for an accountant in Melbourne CBD.

What Are Your Fees and How Do You Bill?

This is usually the first question, and for good reason. No one likes surprise bills. A good accountant will be completely transparent about their fee structure right from the start.

Many firms, like ours, offer fixed-fee packages for recurring work like BAS lodgements and annual financial statements. This is great for budgeting because you know exactly what you’re paying each month. For more complex advisory work or one-off projects, some might bill on an hourly basis. The key is to understand what’s included in any package so you can compare apples with apples. Don't be shy about asking for a detailed breakdown of the services covered.

What Does the Onboarding Process Look Like?

Switching accountants or moving from a DIY spreadsheet system can feel like a massive headache. That's why understanding the onboarding process is so important. A smooth transition is a sign of a well-organised firm.

The accountant should be able to walk you through their plan, which typically involves a few key steps:

- An initial chat: A discovery call to really dig into your specific needs and business goals.

- Getting the paperwork: They’ll send over a clear checklist of documents they need, like previous financial records or access to your accounting software.

- System setup: This is where they get you set up in their systems and handle all the necessary authorisations with the ATO.

A professional firm will make this feel seamless, not overwhelming. They should handle the heavy lifting, including the potentially awkward chat with your previous accountant if you're switching.

A great accountant doesn’t just crunch numbers; they manage the relationship from day one. How they bring a new client on board says a lot about their level of professionalism and client care.

How Will We Communicate?

Finally, it’s crucial to know how the relationship will work day-to-day. You’ll want to ask, "How often will we be in contact, and who will be my main point of contact?" This is all about setting clear expectations.

Some accountants schedule quarterly meetings to review your business performance, while others might take a more as-needed approach. Both can work, as long as it aligns with what you need.

It's also good to know who you’ll actually be dealing with. Will it be a senior partner or a dedicated client manager? Knowing exactly who to call when you have a question makes all the difference. The best accountants in Melbourne see themselves as an extension of your team, and their communication style should feel like a true partnership.

Ready to partner with a proactive accounting firm that has clear answers and a clear plan for your success? Genesis Hub offers straightforward advice to help your Melbourne business thrive. Book your free consultation today and let's get started.