Before you even start Googling for the best accountant Melbourne has on offer, the most important work happens right at your own desk. You need to get crystal clear on what your business actually needs. This isn't just about finding a service provider; it's about finding a genuine financial partner.

Are you a sole trader just trying to get your annual tax return sorted without a headache? Or are you a growing business juggling staff payroll, quarterly BAS statements, and trying to figure out your next strategic move? The answers to these questions will shape your entire search.

Defining What Your Business Actually Needs

Diving into a search without a clear picture of your needs is like going to a hardware store without a project in mind. You might walk out with a fancy hammer when what you really needed was a specific type of screwdriver. Taking a moment to define your requirements makes your search focused and saves you from wasting time and money.

Getting this right from the start stops you from paying for complex services you’ll never use. On the flip side, it also prevents you from hiring a basic accountant that your business will outgrow in six months. For many, simply understanding why every business needs an accountant is the first step to mapping out exactly what they should be looking for.

Assess Your Business Structure and Complexity

Your business structure is the foundation of your financial and tax obligations. A sole trader's world is vastly different from that of a proprietary limited company with a team of five.

-

Sole Traders and Freelancers: For most, the big priorities are lodging an accurate income tax return (ITR) and seeking professional guidance on structuring their finances. As your turnover grows, BAS and GST registration will quickly become your next focus.

-

Partnerships: Here, the financial needs get a bit more involved. You'll need help managing how profits are distributed and making sure the financial statements and tax filings correctly reflect your partnership agreement.

-

Companies (Pty Ltd): This is where the complexity really ramps up. You're now dealing with corporate tax, payroll, superannuation compliance for your staff, and potentially ongoing ASIC lodgements.

Pinpoint Your Core Service Requirements

Think about the financial tasks—both the daily grind and the big-picture stuff—that you need help with. A busy cafe in Fitzroy will probably have robust bookkeeping and payroll management at the top of its list. In contrast, a tech startup over in Cremorne might be more focused on strategic advice for managing cash flow and understanding R&D tax incentives.

The real goal here is to find someone who does more than just tick the compliance boxes. A truly valuable accountant becomes a strategic partner. They give you insights that help you boost profitability, get a handle on your cash flow, and lay the groundwork for sustainable growth. They help you read the story behind the numbers.

This kind of proactive partnership is becoming more and more crucial. The number of accounting services in Australia climbed to 36,717 in early 2025, a steady rise driven by businesses just like yours seeking expert financial guidance. IBISWorld has tracked this industry growth, showing just how high the demand is.

The table below is a simple checklist to help you match your business needs to the specific accounting services that can help.

Matching Your Business Needs to Accounting Services

Use this checklist to identify which services your Melbourne business requires based on its current stage and complexity.

| Your Business Need | Potential Service Required | Typical Business Stage |

|---|---|---|

| Annual tax compliance | Income Tax Return (ITR) Lodgement | Sole Trader, Freelancer |

| Managing employee payments | Payroll Services & Superannuation Compliance | Any business with staff |

| GST obligations | BAS Lodgement & GST Advice | Business with >$75k turnover |

| Day-to-day transaction tracking | Bookkeeping & Software Setup (Xero, MYOB) | All stages, especially growing businesses |

| Long-term financial direction | Strategic Advice, Cash Flow Forecasting | Growth & Established Businesses |

| Applying for funding or loans | Financial Statement Preparation, Business Plans | Startups, Scale-ups |

| Government R&D claims | R&D Tax Incentive Advice | Innovative startups, Tech companies |

| Keeping the company registered | ASIC Compliance & Corporate Secretarial | Pty Ltd Companies |

This isn't an exhaustive list, but it gives you a solid starting point to figure out what to ask for.

Consider Your Future Growth and Goals

Finally, think about where you're headed. Are you planning to hire your first employee in the next year? Thinking about opening a second location? Or maybe you're looking to secure funding to scale up.

A big piece of that puzzle is navigating financial hurdles, like understanding the often-complex business loan requirements. The accountant you choose should have the skills and experience to support these ambitions, not just manage your past transactions.

When you start talking to potential accountants, bring up your five-year plan. Their response will tell you everything you need to know. Are they just a bookkeeper, or are they a true growth-oriented advisor who can scale right alongside you?

Sourcing Reputable Melbourne Accountants

Alright, you've got a clear idea of what you need. Now for the hard part: finding the right person for the job.

Just typing "accountant Melbourne" into Google will throw thousands of results at you. The trick is to look past the first few paid ads to find a firm that genuinely aligns with your business. The best financial partners are rarely found with a simple search.

Professional directories are a surprisingly powerful, and often overlooked, place to start. Think of them as curated databases of qualified professionals, letting you filter your search with real precision.

-

CPA Australia: Their "Find a CPA" tool is brilliant. You can search by location, specialisation (like tax or business advisory), and even by industry. This is perfect for zeroing in on an expert with proven experience in your specific sector.

-

Chartered Accountants ANZ (CA ANZ): This is another top-tier directory. It lets you find members who meet strict professional standards, giving you an immediate layer of quality control before you even make contact.

Going through these official bodies means you’re looking at professionals who are held to high ethical standards. It’s a great way to build a shortlist you can trust from the get-go.

Tapping Into Your Professional Network

Don’t underestimate the power of your existing connections. A referral from someone who gets the daily grind of running a business is worth its weight in gold because it’s based on actual experience.

Think about who you could ask:

- Your lawyer: They often work hand-in-glove with accountants on business structuring and compliance. They’ll know who is reliable and truly professional.

- Industry mentors or peers: A business owner in your field can point you to an accountant who already gets the specific financial hurdles you’re facing. No lengthy explanations needed.

- Your bank manager: They have a bird's-eye view of the local business scene and often know which accounting firms their other clients are happy with.

A warm referral often leads to a better fit. When someone in your network vouches for an accountant, they're not just confirming technical skill; they're endorsing that accountant's communication style, reliability, and overall approach to client relationships.

Vetting Their Digital Footprint

Before you even think about picking up the phone, do a little online detective work. A firm’s digital presence says a lot about its professionalism and how it treats its clients.

A clean, modern website is table stakes these days. But dig deeper. Look for case studies or testimonials that feature businesses similar to yours. Do they show how they’ve helped clients solve real problems, or is it all just generic marketing fluff?

Also, check if they have a blog or a resources section with genuinely helpful advice. This shows they’re committed to educating their clients, not just ticking compliance boxes. If you're still getting your head around what accountants even do, it can be useful to review a general overview of accountants and their services.

This initial digital due diligence is a simple but effective way to weed out the duds and build a strong shortlist of candidates worth talking to.

Okay, you've got a shortlist. Good stuff. Now comes the really important part: making sure these accountants aren't just names on a list, but are actually qualified and—critically—get your industry.

Not all accountants are the same. Far from it. The right qualifications paired with genuine, hands-on experience in your field can be the difference between just keeping the books and actually driving your business forward.

Here in Australia, there are a few key titles you'll see thrown around. Knowing what they mean helps you understand who you're talking to.

- Certified Practising Accountant (CPA): Think of a CPA as a great all-rounder. They cover the full spectrum from tax compliance to business strategy. For most small and medium businesses, a CPA has the practical, business-focused skills you need.

- Chartered Accountant (CA): CAs often dive into the more complex end of the pool, specialising in things like audits and intricate financial reporting. Their training is notoriously tough and recognised worldwide.

- Registered Tax Agent: This one is non-negotiable. To legally charge you a fee for lodging tax returns or your BAS, they must be a registered tax agent with the Tax Practitioners Board (TPB). Always, always check this.

Most CPAs and CAs are also registered tax agents, but you can't just assume. A quick search on the TPB register is all it takes to confirm. It’s a two-minute check for total peace of mind.

Why Industry Experience Is Non-Negotiable

Having the right letters after their name is just the ticket to the game. The real win is finding an accountant in Melbourne who already speaks your language because they know your industry inside and out.

A professional who’s worked with dozens of tradies won't need you to explain contractor payments or the headaches of project-based cash flow—they’ll be telling you about the common traps.

The same goes for e-commerce. You want someone who's already an expert in managing inventory, dealing with Stripe fees, and untangling GST on international sales. It saves you from paying them to learn the basics of your own business.

An accountant who specialises in your industry doesn’t just record what you’ve done; they understand where you’re going. They can benchmark your numbers against similar businesses, flag risks specific to your trade, and spot opportunities you might have missed.

With around 200,000 accountants across Australia, there’s more than enough talent to find someone who fits your niche perfectly. And with the industry tipped to grow by 9.2% in the coming years, even more specialists are coming onto the scene.

Questions to Uncover True Industry Fit

When you have that initial chat, don’t just ask, "Have you worked with a business like mine before?" Dig deeper to see if their knowledge is real.

- For a Cafe Owner: "What are the biggest mistakes you see cafes making with their POS data and daily cash-ups?"

- For a Tradie: "How do you help construction clients manage the lumpy cash flow between big jobs and handle things like retentions?"

- For a Creative Agency: "What's the best way you've found for tracking profitability per client, or even per project?"

Their answers will tell you everything. A true expert will offer specific insights and probably ask you a few sharp follow-up questions, showing they’re already thinking strategically about your business. Often, a firm's website will give you clues, so have a look at their small business accounting services to see if they call out your industry specifically.

Making the Most of Your Initial Consultation

You’ve checked their credentials and confirmed they know your industry. Now for the most important part: the initial consultation. This first meeting isn't about what's on their CV—it's about the human connection.

Think of it as a vibe check. This is your chance to see how they communicate, how they think on their feet, and ultimately, if this is someone you can build a real, long-term professional relationship with. A great accountant is so much more than a numbers person; they're a trusted advisor in your corner.

Questions That Reveal a True Partnership

Don't just show up. Go into that first chat armed with questions that go deeper than the standard "what are your fees?" queries. Your goal is to get a feel for their approach and understand how they actually work with clients day in, day out. Getting this clarity upfront is the key to a successful partnership.

Here are a few powerful questions to kick things off:

- Communication Style: "What's your typical communication rhythm with clients? Are you all about scheduled quarterly meetings, or are you happy to jump on a quick call when things pop up?"

- Tech Stack: "We run our business on Xero. How deep is your experience with it? Are there any integrations you'd recommend for a business like ours?"

- Their Approach: "How do you see your role? Is it mainly about year-end compliance, or do you proactively bring strategies to the table during the year to help us improve cash flow and profitability?"

Their answers will paint a very clear picture of what it's like to be their client. You're listening for alignment in how you both approach business, communication, and planning for the future.

A Tale of Two Consultations

Let's play this out. Imagine you're a growing Melbourne e-commerce business, and you're meeting two potential accountants.

Accountant A is perfectly qualified and offers a competitive fixed-fee package. When you ask about proactive advice, they mention a generic monthly newsletter with tax tips and an annual review. They're professional, but it all feels a bit by-the-book.

Accountant B listens intently as you explain your cash flow struggles. They immediately start asking about your inventory management and payment gateway fees. Then, they might discuss how a different Xero integration could streamline processes. They even talk about setting up monthly check-ins to track your performance against key business metrics.

While both accountants are competent, Accountant B showed a proactive, partner-like mindset from the get-go. They didn’t just answer your questions; they started solving your problems right there in the meeting. That’s the difference between a simple service provider and a genuine financial partner.

Finding an accountant who is that engaged is what it's all about. It reflects a real dedication to the craft. In Australia, 85% of accountants work full-time hours, showing a level of commitment that goes well beyond the standard nine-to-five. To get a better sense of the professionals in Melbourne's financial scene, you can check out the demographic insights from Jobs and Skills Australia.

If you're ready to see what this kind of proactive approach feels like, booking a free consultation is the perfect next step.

Understanding Fees and Engagement Models

Getting your head around an accountant's fee structure is one of the most important steps. It's the key to building a solid partnership and making sure you don't get any nasty surprises down the track. In Melbourne, accountants generally use a few common pricing models, and each has its pros and cons depending on your business. You've got to look past the initial price tag to see the real value.

Your goal here is to find a structure that gives you predictability and matches the level of support you actually need. A new sole trader, for instance, might just want a simple, one-off fee for their tax return. But a growing business will get far more out of a fixed monthly package that includes regular advice and check-ins.

Demystifying Common Pricing Models

The most common fee structures you'll run into when searching for an accountant in Melbourne are hourly rates, fixed-fee packages, and value-based pricing. Let's break down what they mean for you.

-

Hourly Rates: This is the old-school "pay-as-you-go" method. You're simply billed for the time your accountant spends on your work. It can be a good option for one-off questions or a messy cleanup project, but it can also lead to unpredictable bills, especially around the end of the financial year.

-

Fixed-Fee Packages: This is becoming the go-to for small businesses, and for good reason. You pay a set monthly or quarterly fee for a clearly defined bundle of services—think BAS lodgements, payroll, and your annual tax return. The massive advantage here is budget predictability, which makes managing your cash flow a whole lot easier.

-

Value-Based Pricing: With this model, the fee isn't based on time, but on the value the service brings to your business. This is more common for high-level strategic work, like advising on business structures or navigating the R&D tax incentive, where the financial payoff for your business is significant.

A Comparison of Accountant Fee Structures

To help you figure out what's best for your budget and the services you need, I've put together a quick breakdown of how these fee models stack up in the real world.

| Fee Model | How It Works | Best Suited For | Potential Downside |

|---|---|---|---|

| Hourly Rate | You pay for each hour the accountant works on your file. | One-off projects, complex problem-solving, or irregular support needs. | Unpredictable costs and potential for bills to escalate unexpectedly. |

| Fixed-Fee Package | A set monthly fee covers a pre-agreed scope of services. | Businesses needing ongoing compliance work like bookkeeping, BAS, and payroll. | You might pay for services you don't fully use in quieter months. |

| Value-Based | The price is determined by the financial outcome or value delivered. | High-stakes strategic advice, business planning, or M&A support. | Can be difficult to quantify upfront and may involve a higher initial investment. |

Choosing the right model really comes down to where your business is at and what you need from your accountant—compliance, growth advice, or a bit of both.

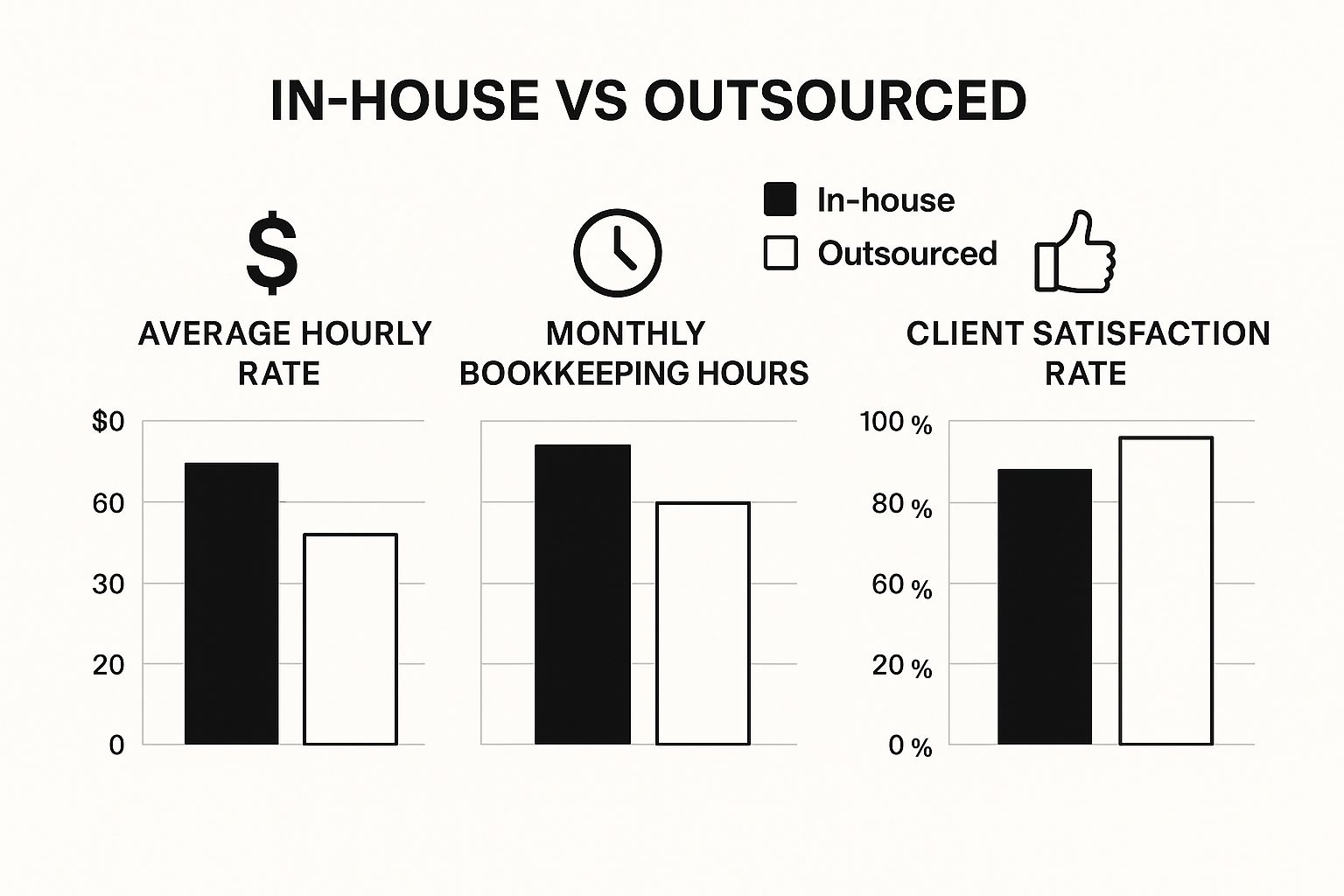

The infographic below offers a great visual on why outsourcing your accounting often makes more sense than trying to handle it all in-house.

As you can see, bringing in a professional can lead to better efficiency and satisfaction. It reinforces the idea that you're not just paying for a service; you're investing in your business's financial health.

Reading the Engagement Letter

Before any work kicks off, a professional accountant will send you an engagement letter. This is your contract, and it outlines everything you’ve agreed on. Do not just skim this document.

The engagement letter is your single source of truth. It protects both you and the accountant by creating total clarity around the scope of work, fees, timelines, and responsibilities. A vague or non-existent engagement letter is a major red flag.

Look for a precise list of what's included (e.g., "preparation and lodgement of four quarterly BAS") and what's explicitly excluded (e.g., "ASIC compliance fees"). This is also where you'll find the terms for any work that falls outside the initial scope. This is your chance to spot potential hidden costs and make sure you’re only paying for what you truly need.

Alright, you’ve done the hard yards. You’ve lined up the candidates, sat through the meetings, and crunched the numbers on their fees. Now it’s time to make the final call.

This isn't just about picking the cheapest option or the one with the most qualifications on paper. You’re choosing a financial partner, someone who’ll be in the trenches with you. Think of it less like buying a service and more like hiring a crucial member of your team.

Weighing Up What Really Matters

The perfect accountant for the café down the road might be a terrible fit for your e-commerce store. Your decision needs to balance a few key things, with a focus on what’s most important for your business right now.

-

Skills vs. Communication: What good is a technical genius if you can't understand a word they're saying? You need an accountant who can break down complex tax laws and financial reports into plain English. If you walk away from a chat more confused than when you started, that’s a red flag. Clear, responsive communication is just as vital as their credentials.

-

Real Industry Know-How: Did one of the accountants just get it? Did they talk about challenges and opportunities specific to your industry without you having to explain everything first? That kind of specialised knowledge is gold. It can help you avoid common mistakes in your field.

-

Tech-Savviness: Let’s be real, we run our businesses on cloud software now. An accountant who is fluent in tools like Xero or MYOB isn’t just a nice-to-have, it’s essential. Their ability to work seamlessly with your systems will make your life so much easier.

Doing That Final Gut Check

Before you sign anything, a couple of last-minute checks can give you complete peace of mind. The most powerful one? Speaking to their other clients.

When you get a reference on the phone, don’t settle for a simple "Yeah, they're good." Dig a little deeper with questions that reveal how they really operate:

- "Can you tell me about a time they were proactive and brought a fresh idea to the table?"

- "How quick are they to respond when you have an urgent question, especially near a BAS deadline?"

- "What's been the single biggest positive impact they've had on your business?"

The answers to these questions will paint a much clearer picture of what it’s actually like to work with them day-to-day.

A great accountant doesn’t just tally up the numbers from last quarter; they help you build a stronger business for the next one. The final decision often boils down to one simple question: Who gives you the most confidence to actually grow?

Making It Official

Once you’ve made your pick, the next step is signing the engagement letter. As we covered earlier, this document makes the partnership official and clearly lays out the rules of the game so everyone is on the same page.

From there, the onboarding begins. A professional firm will have a proper system for this—getting you set up, sorting out access to your software, and scheduling a kick-off meeting. This makes the whole transition smooth and sets you both up for a productive relationship from the get-go.

Choosing an accountant in Melbourne is a serious investment in your business’s future. By finding someone proactive and easy to talk to, you’re not just ticking a compliance box. You’re gaining a genuine ally who is committed to helping you succeed.

Ready to partner with a proactive accounting firm that makes your business performance stronger? The team at Genesis Hub offers the clarity and guidance you need. Find out more at https://www.genesishub.com.au.